What Is a Bank Stress Test How It Works Benefits and Criticism

Anthony Battle, a CERTIFIED FINANCIAL PLANNER™ professional, holds designations for advanced financial planning, insurance specialization, financial counseling, and retirement planning.

A bank stress test determines a bank’s ability to withstand economic shocks. Scenarios include recessions and market crashes. US banks with $50 billion or more in assets must undergo stress tests conducted by their risk management teams and the Federal Reserve.

Bank stress tests were established after the 2008 financial crisis to address undercapitalization. Authorities expanded reporting regulations to focus on capital reserves and internal strategies. Banks must regularly assess and document their solvency.

Key takeaways:

– Bank stress tests evaluate a bank’s capital during crises

– Stress tests are required for banks of a certain size

– Failing a stress test requires banks to preserve or increase capital reserves

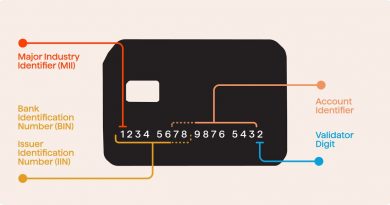

Stress tests measure credit, market, and liquidity risks. Using computer simulations, various criteria are applied from the Federal Reserve, IMF, and ECB. Standard scenarios and historical events are used to test a bank’s capital adequacy.

The purpose of stress tests is to ensure that banks can manage during tough times. Results are published to show how banks would handle economic or financial disasters. Regulations require companies that fail stress tests to cut dividends and buybacks to build reserves.

Critics argue that stress tests demand too much from banks and hinder credit provisioning. They also claim that stress tests lack transparency, leading banks to retain excessive capital. Timing and disclosure concerns can affect lending and artificially inflate reserves.

Some banks, including Santander and Deutsche Bank, have failed stress tests multiple times.