Money Center Banks Meaning Overview Role in Economy

Money Center Banks: Meaning, Overview, Role in Economy

What Are Money Center Banks?

A money center bank is similar in structure to a standard bank; however, its borrowing and lending activities are with governments, large corporations, and regular banks. These financial institutions generally do not borrow from or lend to consumers.

Key Takeaways:

1. A money center bank is similar in structure to a standard bank; however, its borrowing and lending activities are with governments, large corporations, and regular banks.

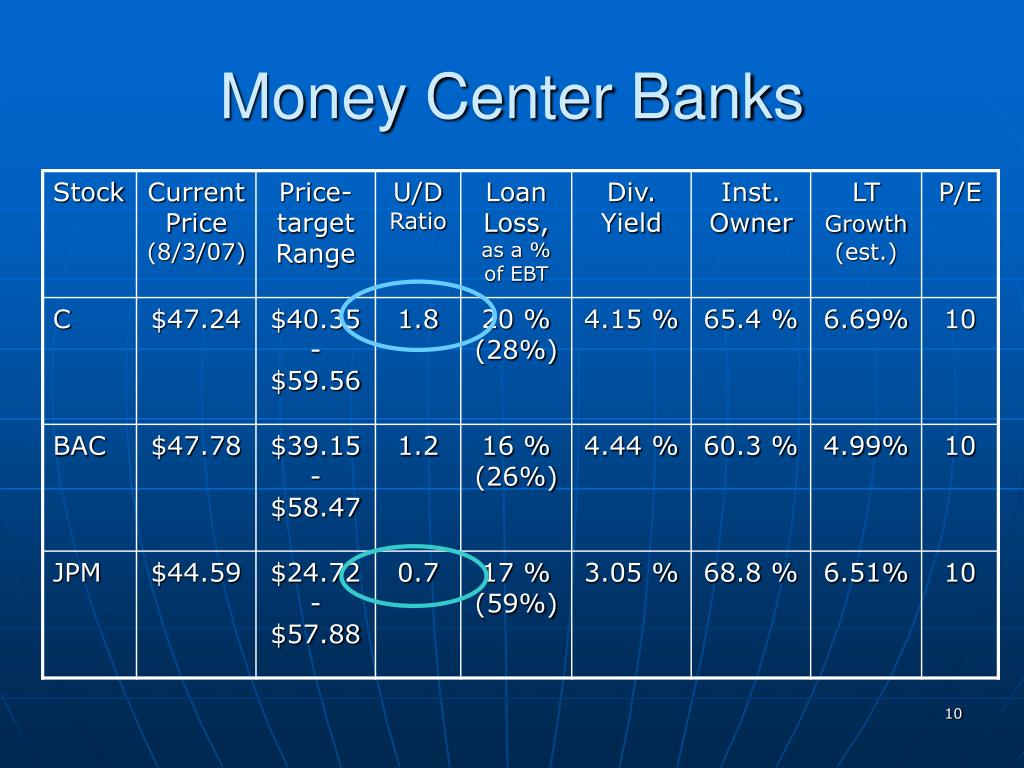

2. Examples of large money center banks in the United States include Bank of America, Citi, JP Morgan, and Wells Fargo.

3. Most money center banks raise funds from domestic and international money markets.

Understanding Money Center Banks

Money center banks are usually located in major economic centers such as London, Hong Kong, Tokyo, and New York. With their large balance sheets, these banks are involved in national and international financial systems.

Money Center Banks and the 2008 Financial Crisis

During the 2008 financial crisis, banks like Bank of America, Citi, JP Morgan, and Wells Fargo struggled financially. The U.S. Federal Reserve stepped in with three phases of quantitative easing (QE) and bought back mortgages.

In 2004, U.S. homeownership peaked at 70%; during the last quarter of 2005, home prices started to fall, leading to a 40% decline in the U.S. Home Construction Index during 2006. Subprime borrowers were not able to withstand the higher interest rates and began defaulting on their loans. In 2007, multiple subprime lenders filed for bankruptcy, causing a ripple effect throughout the entire U.S. financial services industry and hitting many money center banks hard.

During the period of QE, these financial institutions had a steady stream of cash, which allowed them to originate new mortgages and loans, supporting overall economic recovery.

Once the QE programs ceased, there were concerns about whether money center banks could grow organically without support. However, U.S. interest rates began to rise, and with them, money center banks’ net interest income also rose.

Money Center Banks and Dividend Income

Most money center banks raise funds from domestic and international money markets. The dividend yields of these institutions are enviable for some, who like to collect such securities for income.

The formula for calculating dividend yield is as follows:

Dividend Yield = Annual Dividends Per Share / Price Per Share

Estimated current year yields often use the previous year’s dividend yield or take the latest quarterly yield, multiply it by four (adjusting for seasonality), and divide it by the current share price.

Quarterly rates of return are often annualized for comparative purposes. A stock or bond might return 5% in Q1. We could annualize the return by multiplying 5% by the number of periods or quarters in a year. The investment would have an annualized return of 20% because there are four quarters in one year (5% * 4 = 20%).