Monoline Insurance Company Meaning 2008 Financial Crisis

Monoline Insurance Company: Meaning, 2008 Financial Crisis

What Is a Monoline Insurance Company?

A monoline insurance company provides guarantees to debt issuers, usually in the form of credit wraps that enhance the credit of the issuer.

These insurance companies started by providing wraps for municipal bond issues, but they now provide credit enhancement for other types of bonds, such as mortgage-backed securities and collateralized debt obligations.

Key Takeaways

– A monoline insurance company focuses on providing only one specific type of insurance product.

– Monoline insurance companies are typically associated with insurance on bonds.

– Insurance on bonds and other debt securities is provided by guarantees in the form of credit wraps.

– Credit wraps improve the credit rating of a debt issuance or prevent a downgrade.

– Monoline insurance companies were heavily involved in the 2008 financial crisis as they insured and invested in many residential mortgages that eventually defaulted.

Understanding a Monoline Insurance Company

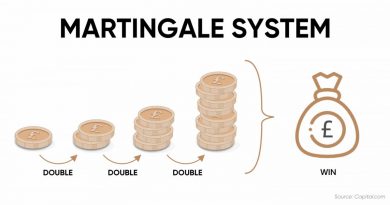

Debt securities issuers often turn to monoline insurance companies to boost the rating of their debt issues or prevent downgrades. This is done through a credit wrap.

A credit wrap protects investors against losses by guaranteeing repayment of a portion of the interest or principal on the loan or repurchasing defaulted loans in a portfolio. It is essentially insurance on a debt security.

The ratings of debt issues protected by credit wraps often reflect the rating of the wrap provider. Monoline insurance companies also provide bonds that protect against default in transactions involving physical goods.

As monoline suggests, these insurance companies specialize in one type of service. They do not offer multiple insurance products, such as auto insurance, home insurance, and bond insurance. Focusing on one area allows for expertise in that specific market.

Therefore, a monoline insurance company is any company that focuses on providing one type of insurance product, though the term is commonly used for companies that protect debt securities.

Monoline Insurance Companies and the 2008 Financial Crisis

Monoline insurance companies were heavily involved in the 2008 financial crisis due to certain business decisions.

Insurance Activities and Investments

Monoline insurers provided bond insurance for collateralized debt obligations, particularly those backed by residential mortgages. They also acted as counterparties in credit default swaps, offering assurance of payment if the credit quality of a collateralized debt obligation deteriorated.

Additionally, monoline insurance companies sold guaranteed investment contracts to issuers who did not initially require all the proceeds. They also invested in municipal bonds and structured finance debt securities, including collateralized debt obligations backed by residential mortgages.

These decisions significantly increased the risks for insurers due to adverse selection, moral hazard, and inadequate regulations to monitor their operations, capital adequacy, and risk.

Risk Impact

Monoline insurers operated in relative anonymity until the 2008 financial crisis, which exposed the increased risk they took on by expanding into correlated product lines. The crisis also revealed their dependency on credit ratings.

The crisis nearly drove the entire monoline insurance industry to extinction. The primary monoline firms at the time were MBIA, Ambac, FSA, FGIC, SCA (XL Capital Assurance), Assured Guarantee, Radian Asset Assurance, ACA Financial Guarantee Corporation, and CIFG.

Most of these companies were based in New York or Wisconsin, with subsidiaries in several European countries. They conducted international business, and their guaranteed securities were held in portfolios worldwide.

During and after the financial crisis, all monoline insurance companies experienced downgrades in their credit ratings and negative financial impacts on their balance sheets.