Valued Marine Policy What It Is How It Works

Valued Marine Policy: What It Is, How It Works

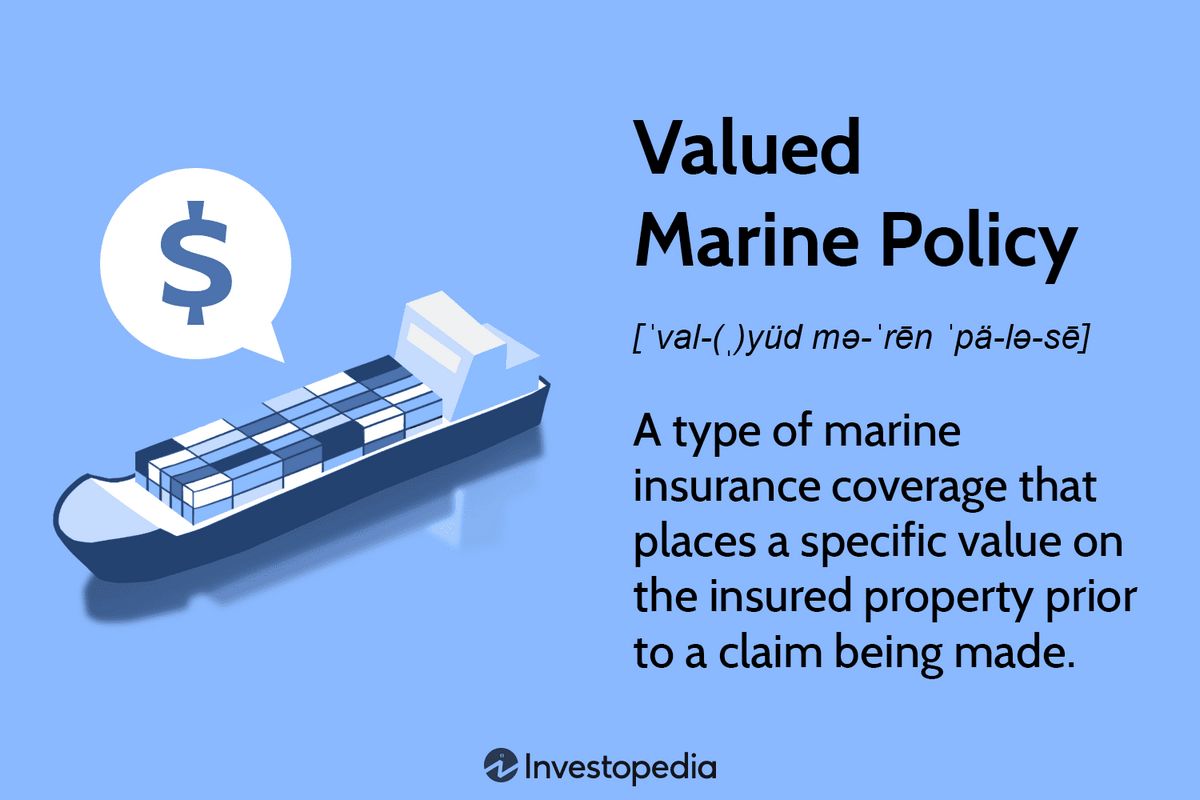

What Is a Valued Marine Policy?

A valued marine policy is marine insurance coverage that assigns a specific value to insured property, such as the hull or cargo of a shipping vessel, before a claim is made. If there is a loss, the policy will pay a predetermined amount, provided there is no fraud.

A valued marine policy differs from an unvalued (or open) marine policy, which requires proving the value of the property after a loss with invoices, estimates, and other evidence.

Key Takeaways:

– A valued marine policy assigns a specific value to marine property before a claim is made.

– If there is a loss, a valued marine policy will pay a predetermined amount.

– The value assigned to the insured item remains unchanged, regardless of its depreciation or appreciation.

– Valued marine policies differ from unvalued marine policies, which assess property value and damages after a claim is filed.

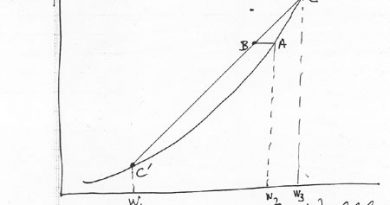

How a Valued Marine Policy Works

Insurance provides financial protection against specific types of loss in exchange for a premium. Almost anything, including ships and cargo, can be insured.

All marine insurance policies are either valued or unvalued. In valued policies, the monetary value is predetermined and stated in the policy, eliminating disputes over the value of the insured property. When the policy includes the terms "valued at" or "so valued," no reassessment is necessary in case of a loss.

Important:

A marine insurance policy should be classified as valued if it includes the terms "valued at" or "so valued."

A valued marine policy pays a fixed amount, regardless of the extent of the damages. For example, a policy may pay $1,000 per box of lost cargo, irrespective of its actual value.

Special Considerations

It is important to note that the depreciation or appreciation of the insured item does not affect the claimable amount in case of a total loss. This distinction is established in the United Kingdom’s Marine Insurance Act of 1906, which serves as the basis for maritime insurance policies and laws worldwide.

The Marine Insurance Act of 1906 states that for an unvalued policy, the measure of indemnity is the insurable value of the subject matter insured. Shipowners with valued policies may be at an advantage when claiming during periods of falling market rates, as recovery for those with unvalued policies may be a fraction of the ship’s initial worth.

Therefore, it is crucial for ship insurers to obtain policies with the proper wording, as the distinction between valued and unvalued marine policies has sparked legal disputes in many countries.

Policies will also include language incorporating the York Antwerp Rules, which establish costs and liability for the maritime industry.