What Is a Bank Identification Number BIN and How Does It Work

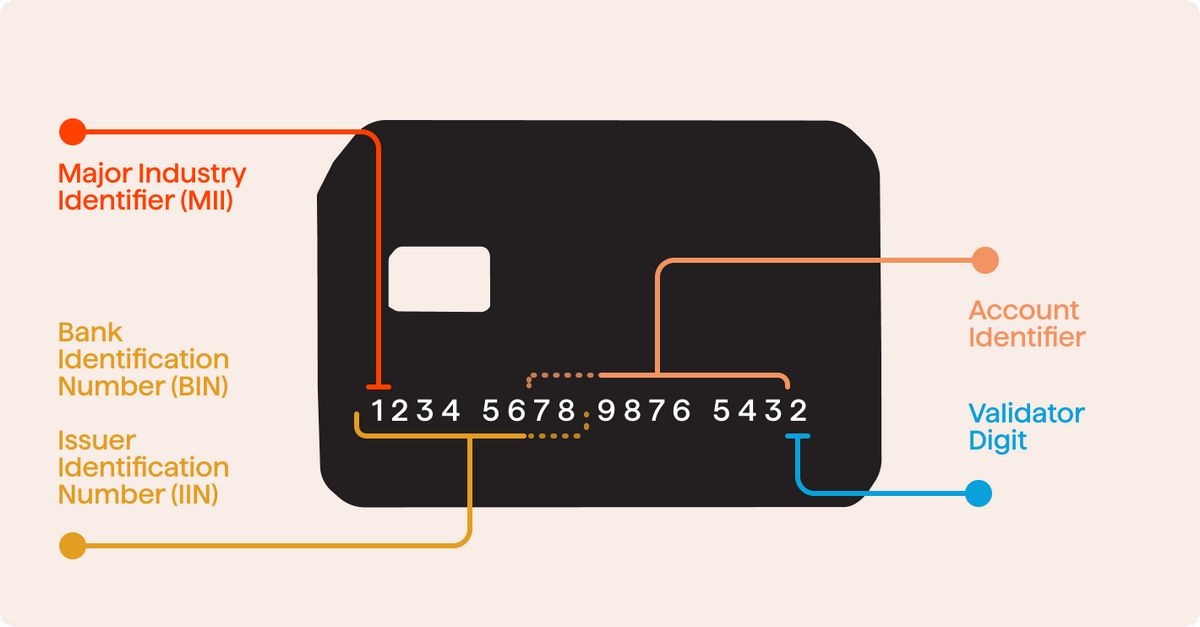

Bank Identification Number (BIN) refers to the first four to six numbers on a payment card. These numbers identify the financial institution that issues the card, allowing transactions to be matched with the issuer. BINs are found on credit cards, charge cards, and debit cards. They play a crucial role in fraud prevention and identifying stolen or fraudulent cards.

Key Takeaways:

-A BIN is the first four to six numbers on payment cards.

-BINs are found on various payment cards.

-BINs help merchants evaluate and assess payment card transactions.

-BINs allow for accepting multiple forms of payment and faster transaction processing.

-BINs assist in identifying fraudulent or stolen cards and preventing identity theft.

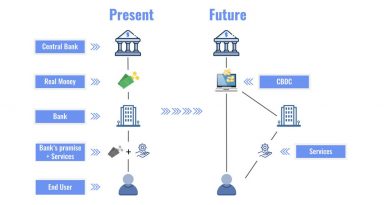

Bank Identification Numbers (BINs) were developed by the American National Standards Institute (ANSI) and the International Organization for Standardization (ISO) to identify card-issuing institutions. Payment cards have a unique BIN number, consisting of four to six digits. The first digit indicates the major industry identifier, followed by digits specifying the issuing institution. BIN numbers are crucial for online transactions, as they indicate the card brand, level, type, and issuing bank’s country. The issuer receives authorization requests when customers make transactions to verify card and account validity and whether sufficient funds are available.

BINs are useful for several purposes. Merchants can use BINs to evaluate and assess payment card transactions, identify originating banks, verify addresses, and detect potential security breaches or identity theft. BINs also facilitate faster checkout and authorization processes for debit and credit card payments. These numbers are sometimes referred to as issuer identification numbers (IINs).

A hypothetical example illustrates how BINs work. When a customer uses their bank card at a gas pump, the system scans the BIN to determine the issuing institution. An authorization request is then placed on the customer’s account, which gets approved or declined based on available funds. BINs are crucial for ensuring efficient and secure international transactions.

A bank identification code (BIC) is an international code made up of eight to 11 digits used to identify a bank or non-financial institution during international transactions. BICs can be connected or non-connected, with the former being part of the SWIFT network.

Consumers generally don’t use BINs but should understand their meaning. The first digit represents the major industry identifier, while the remaining digits specify the issuing financial institution. When making a purchase or transaction, the issuing institution receives a request for authorization to verify the account’s legitimacy and available funds. If approved, the transaction proceeds; otherwise, it is declined.

BIN scamming is a fraud scheme where fraudsters impersonate someone from a bank to obtain card information from unsuspecting individuals. BIN numbers are essential for merchants to accept multiple payments simultaneously and expedite payment processing. They also aid banks and financial institutions in identifying compromised or stolen cards, providing information about the card type, issuing bank, and cardholders.

In conclusion, bank identification numbers are crucial for identifying card-issuing financial institutions and facilitating secure financial transactions. They play a significant role in fraud prevention and protecting consumers from identity theft. It is important to keep your financial information, including your BIN, confidential. If you receive a call from a scammer claiming your account information has been compromised, hang up and notify your bank, or file a complaint with the FTC.