Valued Policy State What it is How it Works Controversy

Contents

Valued Policy State: What it is, How it Works, Controversy

What Is Valued Policy Law?

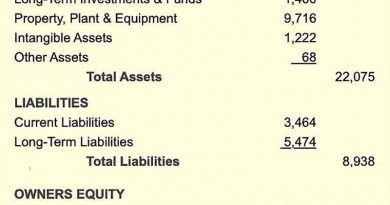

Valued policy law (VPL) is a legal statute that requires insurance companies to pay the full value of a policy to the insured in the event of a total loss. Valued policy law does not consider the actual cash value of the insured property at the time of the loss; instead, the law mandates total payment.

A valued policy differs from an unvalued, or open, insurance policy, in which the value of the property would need to be proven subsequent to a loss through the production of invoices, estimates, claims adjusters, or other evidence.

Key Takeaways

- Valued policy law (VPL) is a legal mandate that insurers cover the full value of a property if the damage is deemed a total loss.

- The value to be repaid under VPL can be arrived at using either the actual cash value or replacement cost method.

- In the U.S., only certain states have valued property law on the books, whereas in other states losses subject to insurance must be proven.

Understanding Valued Policy Law

A total loss occurs when an insured property is destroyed or damaged to such an extent that it can be neither recovered nor repaired for further use. Often, a total loss triggers the maximum settlement according to the terms of the insurance policy.

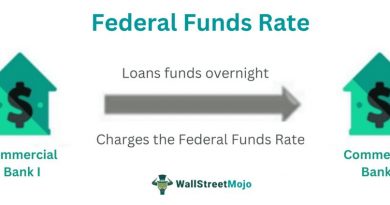

Insurance policies generally use one of two methods to determine the value of a loss: actual cash value or replacement cost.

- Actual cash value is the most common standard for determining the amount of insurance needed, the amount of loss to be paid, and the amount upon which any coinsurance or similar requirement will be based. It is defined as replacement cost at the time of loss, less depreciation. However, this definition is being rewritten through case law and state legislation by the broad evidence rule, which states that the determination of the actual cash value of a loss should include all relevant evidence an expert would use to set the value of the property, including replacement cost less depreciation and fair market value.

- Replacement cost means that the company will pay the cost to repair or replace, after application of the deductible and without any depreciation.

In general, valued policy laws require that the amount stated in policy declarations shall be the dollar amount paid to the insured at the time of loss. If the value of an insured item at the time of loss is less than the amount of insurance, the insurer has no recourse to contest payment in full. Moreover, in most valued policy states, any policy provision inconsistent with the valued policy law is considered void.

Not all states within the United States have these laws. States that do have valued policy laws include Arkansas, California, Florida, Georgia, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Dakota, Ohio, South Carolina, South Dakota, Tennessee, Texas, West Virginia, and Wisconsin.

1874

Wisconsin was the first state to pass a Valued Policy Law in 1874.