Funding Agreement What it is How it Works Example

Contents

Funding Agreement: What it is, How it Works, Example

What Is a Funding Agreement?

A funding agreement is a type of investment that institutional investors utilize because of its low-risk, fixed-income characteristics. It refers to an agreement between two parties, where an issuer offers an investor a return on a lump sum investment. The terms outline the scheduled use of capital and the expected rate of return over time.

Understanding Funding Agreements

A funding agreement requires a lump sum investment paid to the seller, who then provides the buyer with a fixed rate of return over a specified time period, often based on LIBOR.

Key Takeaways

- A funding agreement is an agreement between an issuer and an investor.

- The investor provides a lump sum of money, and the issuer guarantees a fixed rate of return over a time period.

- Funding agreements are popular with high-net-worth and institutional investors due to their low-risk, fixed-income nature.

- Portfolios focused on capital preservation are more likely to enter into funding agreements.

- The return to the investor from a funding agreement is usually modest.

Funding agreement products are similar to capital guarantee funds or guaranteed investment contracts, as they promise a fixed rate of return with little or no risk to principal. However, they typically offer only modest rates of return.

Funding agreements often have liquidity limitations and require advance notice for early redemption or termination. They are targeted to high-net-worth and institutional investors. Mutual funds and pension plans often buy funding agreements due to their safety and predictability.

Funding agreement products can be offered globally and by many types of issuers. They often have a higher rate of return than money market funds. Some products may be tied to put options allowing termination after a specified period of time. They are popular with those wishing to use them for capital preservation in an investment portfolio.

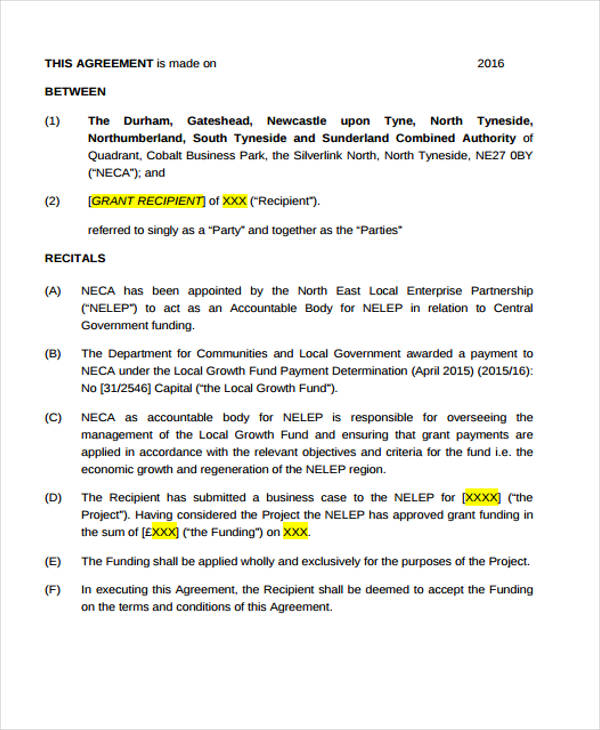

Example of a Funding Agreement

Mutual of Omaha provides one platform for funding agreement products available to institutional investors. These funding agreements are marketed as conservative interest-paying products with steady income payouts, and are offered for fixed terms with fixed or variable interest. The funds that are deposited are held as part of the United of Omaha Life Insurance Company General Asset Account.

After the lump-sum investment is made, the Mutual of Omaha funding agreement allows for termination and redemption for any reason by either the issuer or the investor, but contract terms require that 30 to 90 days notice be given prior to the last day of the interest rate period.