Merchant Agreement Meaning Bank Relationships Regulations

Contents

Merchant Agreement: Meaning, Bank Relationships, Regulations

What Is a Merchant Agreement?

A merchant agreement is a contract that governs the relationship between a business and the merchant acquiring bank it partners with. This document details the electronic payment services that the merchant acquiring bank agrees to provide.

In most cases, such banks are responsible for facilitating the electronic transaction process. Merchant banks also serve as credit card providers for both open loop and closed loop merchant cards.

Key Takeaways

- A merchant agreement is a contract establishing the parameters of the relationship between a merchant acquiring bank and the business it serves.

- Merchant banks facilitate electronic transaction processing and provide credit cards.

- The fees merchants pay merchant acquiring banks depend on the number of transactions conducted.

Acquiring Bank Relationships

Acquiring bank relationships enable merchants to conduct sales using electronic payment methods. This partnership entails obtaining information from the merchant’s payment gateway technology, communicating with card issuers through the acquirer’s network, receiving authorization, and settling the transaction in the merchant’s account.

The fees merchants pay for electronic payment processing services vary based on online and brick-and-mortar transactions. Merchants are required to pay fees to the acquirer for each electronic transaction, which covers both the acquirer’s fees and the processor’s fees. Acquirers also charge a monthly fee for settlement and bank account services.

In cases where merchants only accept cash, they will set up a standard bank account with its own requirements and contractual provisions.

Merchant agreements typically apply to vendors, as well as foundations and charitable institutions.

Rules and Requirements

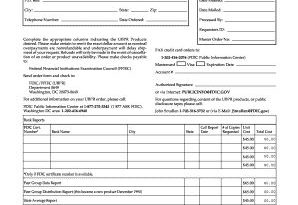

Merchant agreements highlight various rules, including the following requirements:

- The merchant must accept all valid cards issued by the payment network.

- The merchant must prominently display the logos of the payment cards it accepts.

- The merchant may not require customers to pay a surcharge on payment card transactions, except where permitted by law.

- The merchant may establish a minimum transaction amount for payment cards.

- The merchant cannot accept the card to pay for illegal purchases, such as the sale of alcohol or tobacco to minors.

- The merchant must charge sales tax to the payment card along with the purchase amount.

- The merchant cannot authorize the transaction to include an estimated tip for transactions where a tip might apply, such as restaurant purchases and taxicab fares.

- Merchants must issue refunds back to the payment card used, instead of refunding in cash.

- The merchant must not print the cardholder’s full account number or expiration date on the receipt.

- The merchant must safeguard the cardholder’s personal information.

- The merchant must train employees to recognize potentially fraudulent transactions and phony cards.

- Merchants must provide clear refund and return policies to customers.