Triangular Arbitrage Definition and Example

Contents

- 1 Triangular Arbitrage: Definition and Example

- 1.1 What Is Triangular Arbitrage?

- 1.2 Understanding Triangular Arbitrage

- 1.3 Automated Trading Platforms and Triangular Arbitrage

- 1.4 Example of Triangular Arbitrage

- 1.5 What Is the Triangular Arbitrage Algorithm?

- 1.6 Is Crypto Triangular Arbitrage Possible?

- 1.7 Is Triangular Arbitrage Illegal?

- 1.8 The Bottom Line

Triangular Arbitrage: Definition and Example

What Is Triangular Arbitrage?

Triangular arbitrage occurs when there is a discrepancy between three foreign currencies’ exchange rates. These opportunities are rare, and traders who take advantage of them usually rely on advanced computer equipment and/or programs to automate the process.

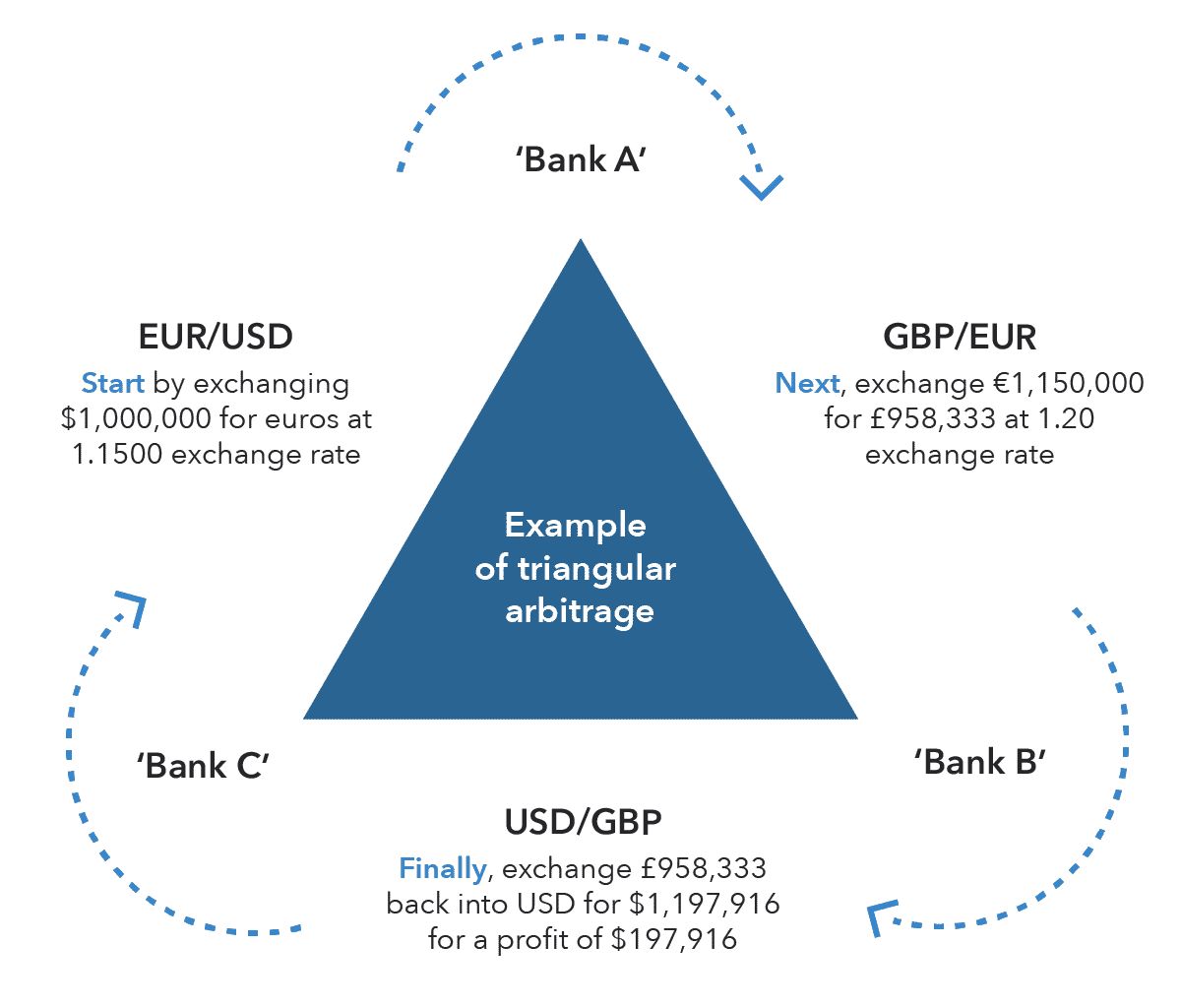

For example, a trader employing triangular arbitrage could make the following series of exchanges—USD to EUR to GBP to USD—using the EUR/USD, EUR/GBP, and USD/GDP rates, and (assuming low transaction costs) generate a profit.

Key Takeaways

- Triangular arbitrage is a low-risk profit-making strategy for currency traders that exploits exchange rate discrepancies through algorithmic trades.

- To ensure profits, these trades should be performed quickly and on a large scale.

- Triangular arbitrage opportunities are regularly exploited, leading to increased efficiency in currency markets.

Understanding Triangular Arbitrage

Triangular arbitrage can result in a "riskless" profit if quoted currency exchange rates don’t align with the market’s cross-exchange rate. In other words, if two currencies also trade against a third currency, their exchange rates should be synchronized. Otherwise, a profit opportunity exists.

International banks, who make markets in currencies, take advantage of an inefficiency where one market is overvalued and another is undervalued. Price differences between exchange rates are usually minimal, requiring traders to trade large capital amounts for profitability.

Automated Trading Platforms and Triangular Arbitrage

Automated trading platforms have streamlined trade execution by using algorithms that automatically conduct trades once specific criteria are met. These platforms allow traders to set rules for entering and exiting trades, with the computer executing them accordingly. While automated trading has many benefits, like backtesting rules on historical data, engaging in triangular arbitrage is only feasible with an automated trading platform.

Due to the speed of algorithmic trading platforms and markets, arbitrage opportunities can vanish within seconds. Automated trading platforms are designed to identify and act on opportunities before they disappear.

The speed of algorithmic trading platforms and markets can also work against traders. For example, a trader may not be able to lock in a profitable price in under a second, resulting in a loss.

Example of Triangular Arbitrage

Let’s say you have $1 million and the following exchange rates: EUR/USD = 1.1586, EUR/GBP = 1.4600, and USD/GBP = 1.6939.

To determine if there’s a triangular arbitrage opportunity, you can perform the following calculations:

- Sell dollars to buy euros: $1 million x 1.1586 = €1,158,600

- Sell euros for pounds: €1,158,600 ÷ 1.4600 = £793,561.64

- Sell pounds for dollars: £793,561.64 x 1.6939 = $1,344,214.06

- Subtract the initial investment from the final amount: $1,000,000 – $1,344,214.06 = -$344,214.06

In this case, the transactions would result in a loss of $344,214.06 (assuming no transaction costs or taxes), indicating no triangular arbitrage opportunity. A positive result would indicate an arbitrage opportunity.

Arbitrage involves buying an asset in one market and selling it in another for a profit and can be used in various markets.

Converting Pairs

Converting currencies can be confusing. A helpful rule to remember is "left to right, divide; right to left, multiply," referring to the reading direction of the exchange rate.

- €1,000,000 ÷ $1.08 = $925,925.93

- Multiply both sides of the equation by $1.08

- €1,000,000 = $925,925.93 x $1.08

So, when converting dollars to euros using the EUR/USD spot price, multiplication is required because you read the pair from right to left.

What Is the Triangular Arbitrage Algorithm?

A triangular arbitrage algorithm is an automated trading program that identifies and executes triangular arbitrage opportunities.

Is Crypto Triangular Arbitrage Possible?

Triangular arbitrage identifies price differences for trading opportunities, so it might be possible to use the strategy with three cryptocurrencies.

Is Triangular Arbitrage Illegal?

Buying and selling currency is legal. As long as transactions and information sources comply with the law, the triangular arbitrage trading strategy is not illegal.

The Bottom Line

Triangular arbitrage is a strategy where price discrepancies between three currencies are exploited for profit. Due to the constant and rapid fluctuation in exchange rates, it can be risky. Traders attempting the strategy should be well-practiced or use a proven automated trading method.