Trickle-Down Economics Theory Policies Critique

Trickle-Down Economics: Theory, Policies, Critique

What Is Trickle-Down Economics?

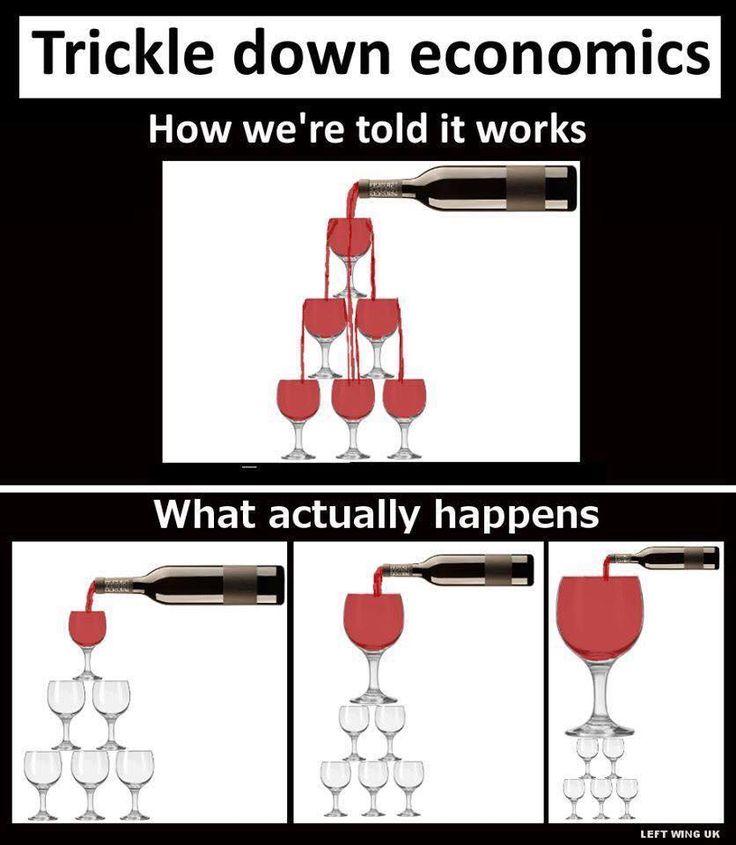

Trickle-down economics and its policies employ the theory that tax breaks and benefits for corporations and the wealthy will eventually benefit everyone.

Reduced income tax and capital gains tax breaks are offered to large businesses, investors, and entrepreneurs to stimulate economic growth.

Key Takeaways:

-The trickle-down theory states that tax breaks and benefits for corporations and the wealthy will benefit everyone else.

-Trickle-down economics involves less regulation and tax cuts for those in high-income tax brackets as well as corporations.

-Critics argue that the benefits the wealthy receive add to income inequality.

Understanding Trickle-Down Economics:

Trickle-down economics is a common political debate associated with supply-side economics. While there is no single comprehensive economic policy identified as trickle-down economics, a policy is considered “trickle-down” if it disproportionately benefits wealthy businesses and individuals in the short run but is designed to boost standards of living for all individuals in the long run.

President Herbert Hoover’s stimulus efforts during the Great Depression and President Ronald Reagan’s use of income tax cuts were described as "trickle-down."

Supply-side economics theorists believe that less regulation and tax cuts for corporations and high-income earners trigger company investment and stimulate employment.

Trickle-Down Economic Policies:

Corporate income tax reduction, tax cuts for the wealthy, and deregulation are the initial steps of a trickle-down policy. More money remaining in the corporate sector can trigger business investment with new factories, upgraded technology, equipment, and increased employment.

Wealthy individuals may spend more, creating more demand for goods in the economy. The increase in the labor market leads to more spending and investing, creating growth in industries such as housing, automobiles, consumer goods, and retail.

The boost in the economy leads to tax revenue increases, and according to the trickle-down economic theory, the additional revenue will pay for the original tax cuts for the wealthy and corporations.

Trickle-Down Economics and the Laffer Curve:

American economist Arthur Laffer, a member of the Reagan administration, developed a bell-curve style analysis that plotted the relationship between changes in the official government tax rate and actual tax receipts, known as the Laffer Curve.

The nonlinear shape of the Laffer Curve suggests taxes could be too light or too onerous to produce maximum revenue. A 0% income tax rate and a 100% income tax rate each produce $0 in receipts to the government.

At 0%, no tax can be collected, but at 100%, there is no incentive to generate income, suggesting that specific cuts in tax rates would boost total receipts by encouraging more taxable income.

Laffer’s idea that tax cuts could boost growth and tax revenue was quickly labeled “trickle-down.” Under President Reagan, between 1980 and 1988, the top marginal tax rate in the United States fell from 70% to 28%, and total federal receipts increased from $599 billion to $991 billion.

The results empirically supported one of the assumptions of the Laffer Curve but could not prove a correlation between a reduction in top tax rates and economic benefits to low- and medium-income earners.

Criticism of Trickle Down Economics:

Trickle-down theorists argue that more money in the hands of the wealthy and corporations promotes spending and free-market capitalism, but it does so only with government intervention.

Critics argue that the added benefits the wealthy receive can distort the economic structure and add to income inequality. Many economists counter that cutting taxes for the poor and working families boosts the economy by increasing spending on goods and services, whereas a tax cut for a corporation may go to stock buybacks or increased savings for the wealthy.

Many factors drive growth, including Federal Reserve monetary policy and lowering interest rates. Trade and exports, sales from U.S. companies to foreign companies, as well as foreign direct investment, contribute to the economy.

In December 2020, a London School of Economics report by David Hope and Julian Limberg was released, examining five decades of tax cuts in 18 wealthy nations. It found that tax cuts consistently benefited the wealthy but had no meaningful effect on unemployment or economic growth.

What Is the Tax Cuts and Jobs Act?

Trickle-down policies are common with Republican leaders. President Donald Trump signed into law the Tax Cuts and Jobs Act on Dec. 22., 2017. It cut personal tax rates and personal exemptions, which expire in 2025 and revert to the old, higher rates. However, corporations received a permanent tax cut to 21%. Critics of the plan say the top 1% get a larger tax cut compared to those in lower income brackets.

How Did President Hoover Use Trickle-Down Economics?

President Hoover believed that incentivizing business prosperity would trickle down to the average person and that economic assistance to citizens would stifle the workforce. However, this philosophy was not effective against the Depression, and his failure to end it led to his defeat in the 1932 presidential election against Franklin D. Roosevelt and the New Deal.

What Is Reaganomics?

Reaganomics is the economic policy instituted by President Ronald Reagan, which included tax cuts, decreased social spending, increased military spending, and market deregulation, all influenced by the trickle-down theory and supply-side economics.

The Bottom Line:

The trickle-down theory includes commonly debated policies associated with supply-side economics. A policy is considered a “trickle-down” if it benefits wealthy businesses and individuals in the short run to boost standards of living for all individuals and the economy in the long run. Presidents Hoover, Reagan, and Trump have all employed methods of trickle-down economic policies.