Understanding a Rollover in Retirement Accounts and Forex

Contents

Understanding Rollovers in Retirement Accounts and Forex

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling, and both the Retirement Income Certified Professional® and Certified Retirement Counselor designations for advance retirement planning.

What Is a Rollover?

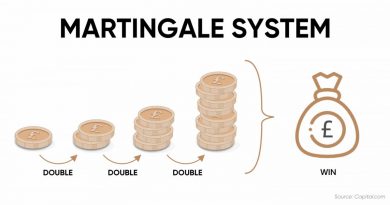

A rollover entails transferring the holdings of one retirement plan to another without creating a taxable event. It can also involve reinvesting funds from a mature security into a new issue of the same or similar security, or moving a FOREX (FX) position to the following delivery date, incurring a charge in the latter case.

In the context of retirement assets, the distribution from a retirement plan is reported on IRS Form 1099-R and may be limited to one per annum for each individual retirement account (IRA). The forex rollover fee due to the difference in interest rates between the two currencies underlying a transaction is paid to the broker.

Understanding Rollovers

Rollovers often occur to generate income for specific purposes, such as day trading or tax savings with retirement plans. A rollover IRA or IRA rollover is a transfer of funds from a retirement account into a traditional IRA or a Roth IRA. The benefits of rollovers vary among different types of investments, as shown in the following examples.

Key Takeaways

- A rollover can involve transferring the holdings of one retirement plan to another without taxes.

- A rollover may mean reinvesting funds from a mature security into a new issue of the same or similar security.

- A direct rollover in a retirement plan may involve sending the funds directly to the new investment vehicle.

Rollovers in Retirement Accounts

With a direct rollover, the retirement plan administrator may pay the plan’s proceeds directly to another plan or an IRA. The distribution may be issued as a check payable to the new account. When receiving a distribution from an IRA through a trustee-to-trustee transfer, the institution holding the IRA may distribute the funds to the other IRA or a retirement plan.

In a 60-day rollover, funds from a retirement plan or IRA are paid directly to the investor, who deposits some or all of the funds in another retirement plan or IRA within 60 days.

Taxes are typically not paid when performing a direct rollover or trustee-to-trustee transfer. However, distributions from a 60-day rollover and funds not rolled over are typically taxable.

Another type of retirement account rollover has emerged as a financing alternative for those starting a business. When executed properly, a rollover for business startups (ROBS) allows entrepreneurs to invest their retirement savings into a new business venture without incurring taxes, early withdrawal penalties, or loan costs. However, a ROBS transaction can be complicated to execute, so it’s important to work with a competent provider.

Rollovers in Forex Positions

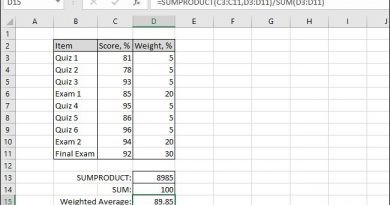

Long-term forex day traders can profit by trading from the positive side of the rollover equation. Traders calculate swap points, which is the difference between the forward rate and spot rate of a specific currency pair expressed in pips. They base their calculations on interest rate parity, which implies that investing in different currencies should result in hedged returns that are equal, regardless of the currencies’ interest rates.

Traders calculate swap points for a specific delivery date by considering the net benefit or cost of lending one currency and borrowing another against it during the time between the spot value date and the forward delivery date. Traders make money when they are on the positive side of the interest rollover payment.