Free-Float Methodology and How to Calculate Market Capitalization

Free-Float Methodology and How to Calculate Market Capitalization

What Is Free-Float Methodology?

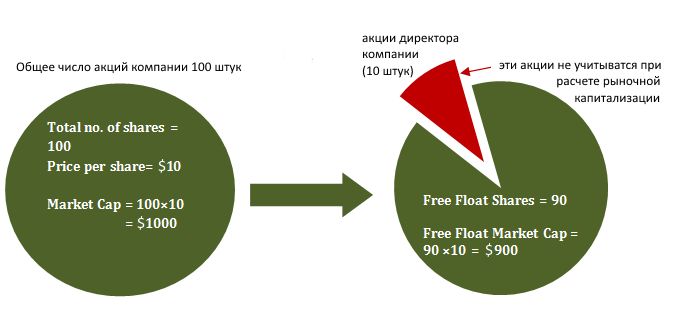

The free-float methodology calculates the market capitalization of a stock market index’s underlying companies. It multiplies the equity’s price by the number of readily available shares in the market.

Unlike the full-market capitalization method, which includes all shares (active and inactive), the free-float method excludes locked-in shares held by insiders, promoters, and governments.

Key Takeaways

- Free-float methodology calculates the market capitalization of a stock market index’s underlying companies.

- Using this methodology, a company’s market capitalization is calculated by multiplying the equity’s price by the number of readily available shares in the market.

- The free-float methodology contrasts with the full-market capitalization method, which includes both active and inactive shares.

- The free-float method excludes locked-in shares held by insiders, promoters, and governments.

Understanding Free-Float Methodology

The free-float methodology is also known as float-adjusted capitalization. It is considered a better way of calculating market capitalization compared to the full-market capitalization method.

Full-market capitalization includes all shares provided by a company through its stock issuance plan, including unexercised stock given to insiders through stock option compensation plans.

Other holders of unexercised stock may include promoters and governments. Full-market capitalization weighting for indexes is rarely used because it significantly affects the return dynamic of an index. Companies have different plans for issuing stock options and exercisable shares.

The free-float methodology provides a more accurate reflection of market movements and the actively available stocks for trading in the market. It results in a smaller market capitalization than the full-market capitalization method.

An index using the free-float methodology reflects market trends by considering only the shares available for trade. It broadens the index by reducing the concentration of a few top companies.

How to Calculate Market Capitalization Using the Free-Float Method

The free-float methodology is calculated as:

FFM = Share Price x (Number of Shares Issued – Locked-In Shares)

The free-float methodology is adopted by major indexes such as the S&P 500 Index, Morgan Stanley Capital International (MSCI) World Index, and the Financial Times Stock Exchange Group (FTSE) 100 Index.

Free-float methodology has a relationship with volatility. The fewer free-floating shares a company has, the higher its volatility. A larger free float reduces volatility because there are more traders buying and selling shares.

Institutional investors prefer companies with a larger free float since they can buy or sell a large number of shares without significantly impacting the price.

Price-Weighted vs. Market-Capitalization-Weighted

Market indexes are usually weighted by price or market capitalization. Both methodologies weigh the returns of individual stocks in the index. Market capitalization weighting is the most common methodology, as seen in the S&P 500 Index.

Price-weighted indexes calculate returns based on the price levels of individual stocks in the index. Stocks with higher prices have more influence on the index’s returns, regardless of their market capitalization. Price-weighted and capitalization-weighted indexes differ considerably in methodology.

Price-weighted indexes are rare in the trading market. The Dow Jones Industrial Average (DJIA) is an example of a price-weighted index.

Example of Free-Float Methodology

Suppose stock ABC is trading at $100 with a total of 125,000 shares. Out of these, 25,000 shares are locked-in and not available for trading. Using the free-float methodology, ABC’s market capitalization is $10 million (100 x 100,000 total available shares).

How Do You Calculate Free Float?

To calculate free float, subtract a company’s restricted shares from its outstanding shares. To calculate the company’s free-float market capitalization, multiply the free-float number by the company’s share price.

Note: This text has been edited to enhance readability and clarity while maintaining the integrity and tone of the original text.