Richmond Manufacturing Index What It is How It Works

Ali Hussain has a background in finance with large financial institutions and journalism covering business.

The Richmond Manufacturing Index is a gauge of manufacturing activity in the Fifth Federal Reserve District published by the Federal Reserve Bank of Richmond.

Key Takeaways:

– The Richmond Manufacturing Index covers Maryland, North Carolina, the District of Columbia, Virginia, most of West Virginia, and South Carolina.

– The index focuses on new orders, employment, shipments, and other areas.

– Information is received from hundreds of respondents in the manufacturing sector, indicating the outlook for their business for the following month and the next six months.

Understanding the Richmond Manufacturing Index:

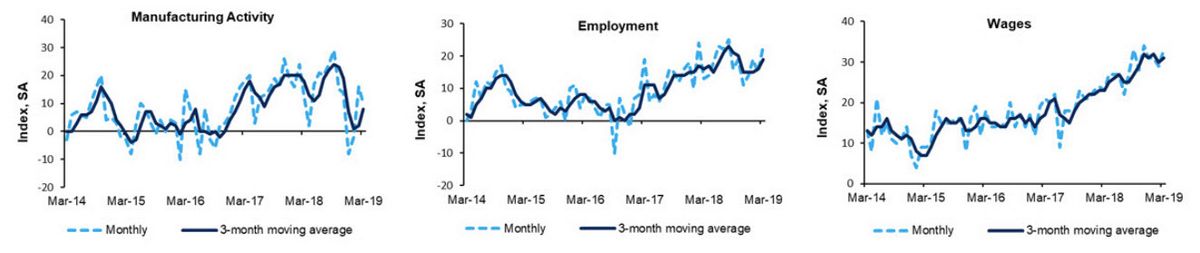

– The index represents a weighted average of business conditions for manufacturing companies in the region, focusing on shipments, new orders, order backlogs, capacity utilization, supplier lead times, number of employees, average work week, wages, inventories, and capital expenditures.

– A rise signifies improvement and growth, while a decrease signifies contraction.

– It is a diffusion index, equal to the percentage of firms reporting increases minus the percentage reporting decreases in key business areas.

The report is important to traders, economists, investors, and businesses as it indicates the financial health of the manufacturing sector. It provides expectations for future performance and affects the stock and bond markets. The price trends data also helps give an early read on potential inflation.

Richmond Manufacturing Index Survey:

– Since November 1993, the Federal Reserve Bank of Richmond has conducted the monthly Survey of Manufacturing Activity. Select manufacturing firms are sent the survey based on their business type, location, and size.

– Respondents report on shipments, new orders, backlogs, inventories, wages, and capital expenditures from the previous month. They also provide business expectations for the next six months.

– Separate surveys are conducted for service sector firms and retailers.

– The respondents report on whether activity increased, decreased, or remained unchanged. These responses are then converted into diffusion indexes.

– The report includes business activity from Maryland, North Carolina, the District of Columbia, Virginia, most of West Virginia, and South Carolina. Results are released on the fourth Tuesday of every month.

Example of the Richmond Manufacturing Index:

– For simplicity, let’s look at just the employment metric.

– In April, 120 contacts responded to the survey. 78 indicated that employment increased (65%), 24 reported a decrease (20%), and 18 reported no change (15%).

– The diffusion index for employment would be 65 minus 20, or an index reading of +45.

– If the index reading in March was +30, there has been an improvement in the manufacturing sector from month to month. This would indicate that employment, new business orders, or shipments have increased, or all three. The increase signifies growth and a bullish outlook.