Market Neutral Fund What it is How it Works Examples

Market Neutral Fund: What it is, How it Works, Examples

What Is a Market-Neutral Fund?

A market-neutral fund is a hedge fund that seeks a profit regardless of market conditions, often through paired positions or derivatives. These funds aim to mitigate risk and generate positive returns in all market environments.

Key Takeaways

- A market-neutral fund is a hedge fund strategy that seeks above-average returns in any market conditions.

- These funds take offsetting long and short positions to maintain a zero delta or zero beta position.

- Market-neutral funds can generate alpha but are complex and highly leveraged, increasing risk and costs.

Understanding Market-Neutral Funds

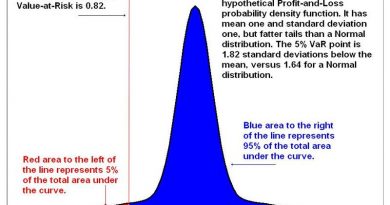

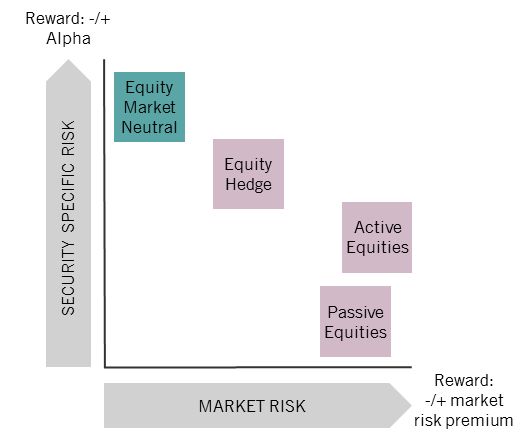

Market-neutral funds aim to provide returns unrelated to the overall stock market. They seek significant alpha and little or no beta. However, adding these funds to a portfolio does not guarantee beating the market or better results. They are more complex and costly than traditional mutual funds.

Market-neutral funds are high-risk due to their reliance on leverage, short selling, and arbitrage. Expected returns vary widely based on strategies employed. They can mitigate risk in downward trending markets but may not outperform benchmark indexes like the S&P 500.

Market-Neutral Fund Strategies

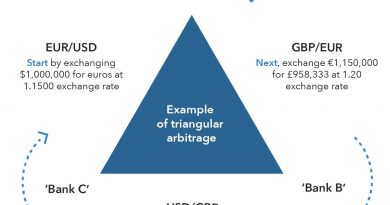

Market-neutral funds use simultaneous long and short positions while employing arbitrage strategies. They can use a qualitative or statistical correlation approach, focusing on equities for transactional opportunities.

Profit in market-neutral strategies comes from uncorrelated stock price movements. Variations include equity market-neutral (EMN), which specializes in trading stocks only.

Qualitative strategies involve paired trades between two securities with arbitrage convergence opportunities. Statistical correlation strategies exploit deviations from high historical correlation for convergence arbitrage. Pairs trading requires technical analysis to identify potential profit opportunities.

In statistical correlation pairs trading, highly correlated stocks are identified. After tracking their correlations through technical analysis, a long position is taken on underperforming stocks and a short position on overperforming stocks when deviations occur. Profit is achieved through price convergence.

Investing in Market-Neutral Funds

Market-neutral strategies are usually offered by hedge fund managers in hedge fund or registered product structures. Due to their complexity and high risks, they are not suitable for all investors and are not typically used as core holdings. These funds also have high fees and turnover, which should be considered by investors.

Example: AQR Equity Market-Neutral Fund

Example: Vanguard Market Neutral Investor Fund

The Vanguard Market Neutral Fund Investor Shares uses long and short-selling strategies to minimize the market’s impact on returns. It differs from other Vanguard mutual funds, which only buy and sell long positions. The fund selects short positions based on evaluation in growth, quality, management decisions, sentiment, and valuation. It publishes its shorts, unlike many funds that short stocks.