Variable Survivorship Life Insurance What It Is How It Works

Variable Survivorship Life Insurance: What It Is, How It Works

What Is Variable Survivorship Life Insurance?

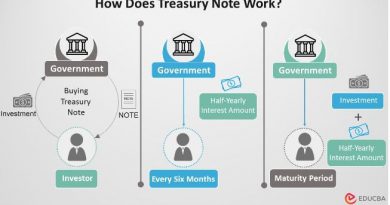

Variable survivorship life insurance is a type of policy that covers two individuals and pays a death benefit only after both people have died. It may pay out a benefit before the first policyholder’s death if the policy has a living benefit rider. The living benefit rider is often included in life insurance policies at no cost, and it allows access to a certain amount of policy death benefit in the case of terminal illness.

Understanding Variable Survivorship Life Insurance

Like any variable life policy, variable survivorship life insurance has a cash value component where a portion of each premium payment is invested by the policyholder, who bears all investment risk. The insurer offers a range of investment options to choose from. The other portion of the premium goes toward administrative expenses and the policy’s death benefit. This type of policy is considered a security and is subject to regulation by the Securities and Exchange Commission.

A more flexible version of variable survivorship life insurance, called "variable universal survivorship life insurance," allows the policyholder to adjust the policy’s premiums and death benefit during the policy’s life.

Benefits of Variable Survivorship Life Insurance

Policies allow you to invest premiums

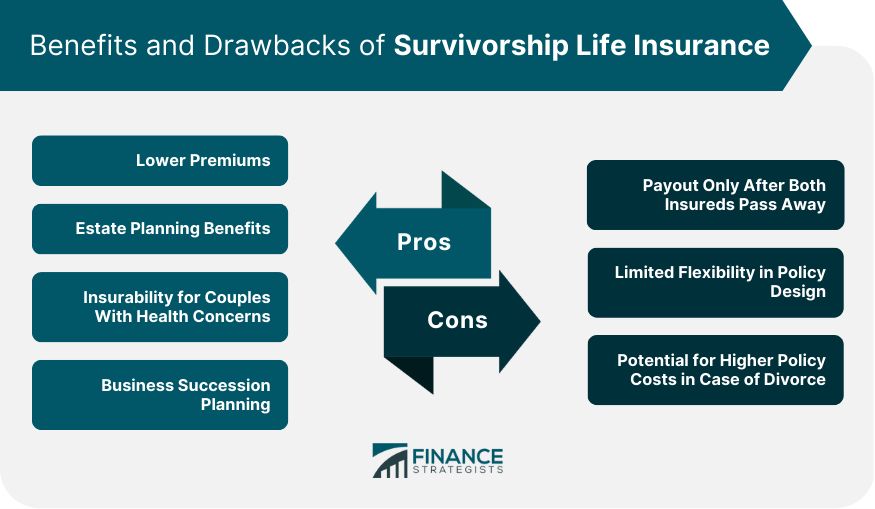

Variable survivorship life insurance policies let policyholders invest premiums in a separate account that fluctuates based on market performance.

Policies are cheaper

Variable survivorship life insurance is typically cheaper than regular single-insured life insurance because premiums are determined by the joint life expectancy of the insured parties. As such, premiums are cheaper than purchasing individual policies for both individuals.

They’re easier to buy

It is significantly easier to qualify for a survivorship life policy than for single-insured life insurance. Variable survivorship life insurance companies are less concerned about the health statuses of the individual policyholders since both must die before the benefit is paid.

They build estates

Survivorship life insurance can grow an estate and provide beneficiaries with a moderate payout, even if the policyholder exhausts their entire estate during the beneficiary’s lifetime.

They preserve estates

Individuals interested in leaving their assets to loved ones often prefer survivorship life insurance policies because they provide liquidity to cover various taxes.