Long-Short Equity What It Is How It Works in Investing Strategy

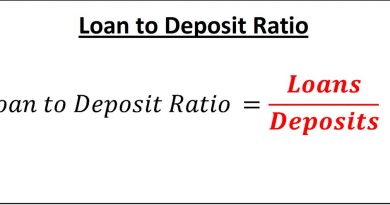

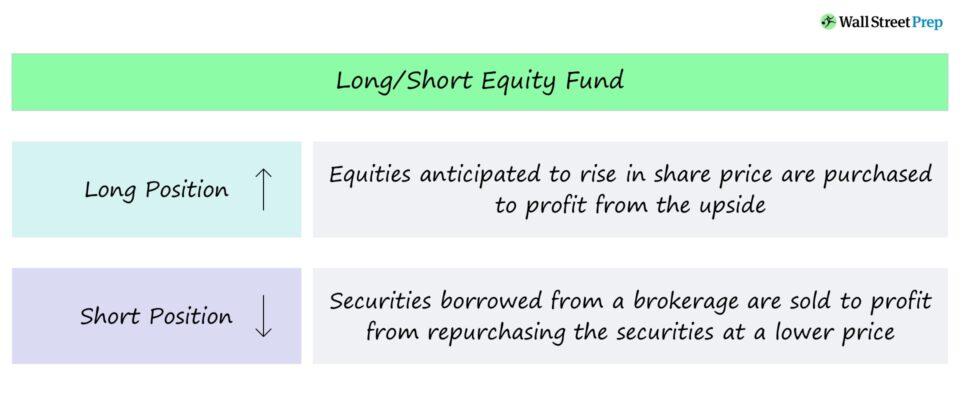

Long-short equity is an investing strategy that takes long positions in stocks expected to appreciate and short positions in stocks expected to decline. This strategy seeks to minimize market exposure and profit from stock gains in long positions and price declines in short positions. Hedge funds commonly use this strategy and often employ a market-neutral approach, where long and short positions are equal in dollar amounts.

Long-short equity works by exploiting profit opportunities in both expected upside and downside price moves. It identifies relatively underpriced stocks for long positions and overpriced stocks to sell short. While many hedge funds have a long bias in their long-short equity strategy, finding profitable short ideas is historically more difficult than finding long ideas.

Long-short equity strategies can differ in terms of market geography, sector, investment philosophy, and more. For example, a long-short equity strategy can focus on a global equity growth fund or a narrow mandate like an emerging markets healthcare fund.

A long-short equity fund differs from an equity market neutral (EMN) fund in that the latter attempts to exploit differences in stock prices by being long and short in closely related stocks with similar characteristics. Equity market neutral funds rebalance their long and short holdings to maintain equivalency and reduce overall risk.

A popular variation of the long-short model is the "pair trade," which offsets a long position on one stock with a short position on another stock in the same sector. This strategy aims for the long position to appreciate and the short position to decline, resulting in overall profit. Long-short strategies often use different sectors for the long and short legs to avoid the movement of stocks within a single sector.

In conclusion, long-short equity is a strategy that aims to capitalize on the potential growth and decline in stock prices. Hedge funds commonly use this strategy, and it can be tailored to different market conditions and sectors. The pair trade is a popular variation of the long-short model, offsetting long and short positions within the same sector.