Understanding Value at Risk VaR and How It s Computed

Value at Risk (VaR) quantifies potential financial losses within a firm or portfolio over a specific time frame. Investment and commercial banks commonly use VaR to determine the extent and probabilities of potential losses in their portfolios.

VaR allows risk managers to measure and control risk exposure. It can be applied to specific positions or entire portfolios to assess firm-wide risk exposure.

Key Takeaways:

– VaR quantifies potential losses for a firm or investment.

– VaR can be computed using historical, variance-covariance, or Monte Carlo methods.

– Investment banks use VaR modeling to assess firm-wide risk.

VaR modeling assesses potential loss, the probability of occurrence, and the time frame. For example, a financial firm may determine that an asset has a 3% one-month VaR of 2%, meaning there’s a 3% chance of a 2% decline in value during that month. By converting the chance of occurrence to a daily ratio, the odds of a 2% loss are one day per month.

Using firm-wide VaR assessment allows institutions to determine cumulative risks from different trading desks and departments. It helps them assess capital reserves and the need to reduce concentrated holdings.

There are three main ways to compute VaR: historical, variance-covariance, and Monte Carlo methods.

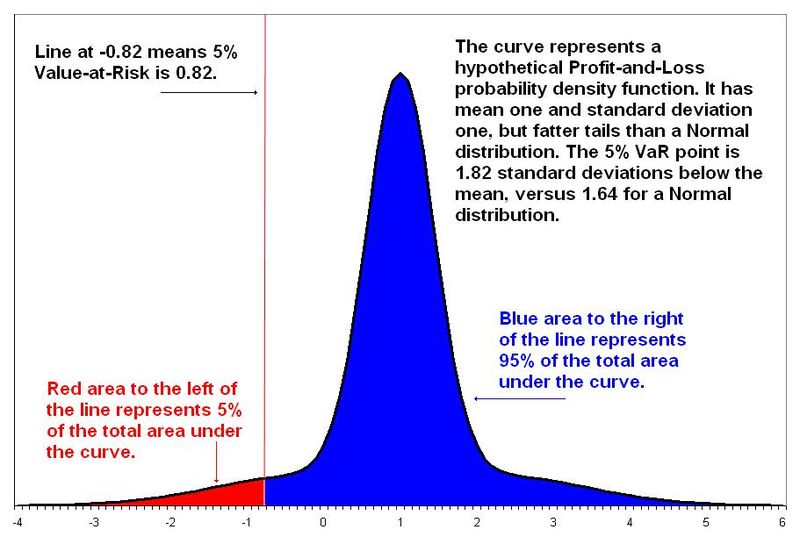

The historical method relies on past returns to inform future outcomes. The variance-covariance method assumes normal distribution of gains and losses. The Monte Carlo method uses computational models to simulate returns over possible iterations.

Advantages of VaR include its simplicity, comparability across different assets or portfolios, and its integration into financial software tools.

Disadvantages include the absence of a standard protocol for determining risk, potential understatement of risk, and the lowest assessment of potential loss in a range of outcomes.

Overall, VaR is a widely used risk assessment technique. Although it has limitations, it provides valuable data for making investment decisions.