What Is a Central Bank and Does the U S Have One

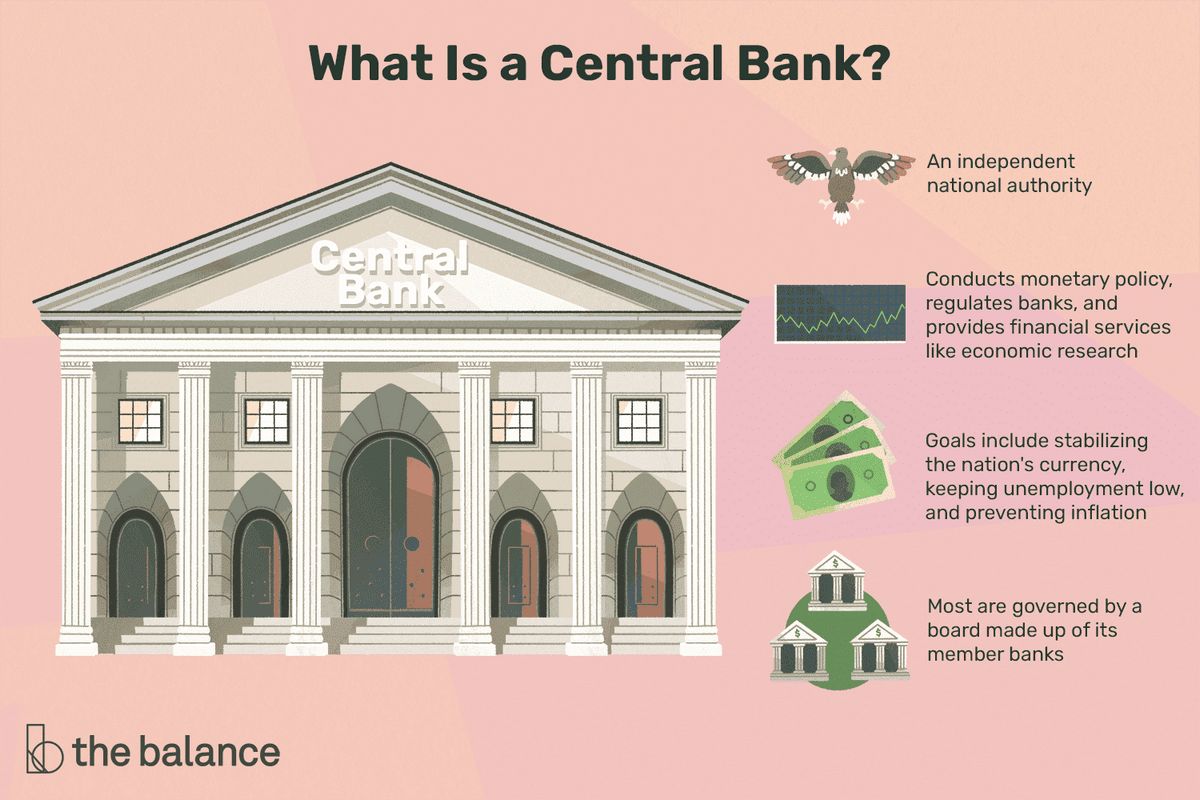

A central bank is a financial institution that has privileged control over money and credit for a nation or group of nations. It is responsible for formulating monetary policy and regulating member banks. Central banks are non-market-based institutions, and while some are nationalized, many are not government agencies and are considered politically independent. What sets central banks apart from other banks is their legal monopoly status, which allows them to issue banknotes and cash. Commercial banks, on the other hand, can only issue demand liabilities like checking deposits.

Key Takeaways:

-A central bank oversees a nation’s monetary system and policy, regulating the money supply and setting interest rates.

-Central banks enact monetary policy to maintain a stable economy.

-A central bank imposes requirements on the banking industry and can act as a lender of last resort.

-The Federal Reserve is an example of a central bank in the United States.

Central banks also regulate member banks through capital requirements, reserve requirements (dictating how much banks can lend and how much cash they must keep), and deposit guarantees. They offer loans and services for banks and the government, and manage foreign exchange reserves. In times of crisis, central banks can act as lenders of last resort to distressed banks and governments. They provide an alternative to taxation by purchasing government debt obligations, which helps the government raise revenue.

The Federal Reserve, or "the Fed," is the central bank in the United States. It controls the national money supply by changing reserve requirements. Lowering requirement minimums allows banks to lend more, increasing the money supply. Raising requirements decreases the money supply. The Fed’s role also includes setting interest rates. Lowering the discount rate that banks pay on short-term loans increases liquidity and stimulates economic activity. However, decreasing interest rates can lead to inflation, so the Fed must exercise caution.

The Fed can conduct open market operations to change the federal funds rate. It buys government securities, injecting cash into the system and increasing the money supply. The Fed can also sell securities, removing cash from the system.

The Bank of England and the Swedish Riksbank were the first prototypes for modern central banks in the 17th century. The National Banking Act of 1863 established a network of national banks and a single U.S. currency. The United States experienced several bank panics in the late 1800s and early 1900s, leading to the establishment of the Federal Reserve System in 1913. Central banks were primarily responsible for maintaining the convertibility of gold into currency during the gold standard era.

During World War I, governments abandoned the gold standard, leading to inflation as they printed more money. After the war, many countries returned to the gold standard to stabilize their economies. This highlighted the importance of central bank independence from political parties or administrations.

The Great Depression and its aftermath prompted a return to central banks dependent on political decision-making in many countries. However, the independence of central banks from the government regained popularity in Western economies as the optimal way to achieve a stable economic regime.

Deflation concerns have increased after major financial crises. Japan’s experience in the 1990s, known as the Lost Decade, showed the negative consequences of deflation. The Great Recession of 2008-09 also raised fears of prolonged deflation. Central banks such as the Federal Reserve and the European Central Bank implemented unconventional monetary policy tools like quantitative easing (QE) to combat deflation. QE involves creating new money and buying securities from banks to increase liquidity and lower long-term interest rates.

These deflation-fighting measures have had unintended consequences. QE programs have led to currency depreciation and negative yields on European government debt. Central bank balance sheets have also swelled to record levels, which may have negative consequences in the future.

Today, major central banks face pressure to reduce their balance sheets. Unwinding or tapering these positions could disrupt the market and potentially lead to a collapse in asset prices. Central banks may choose to let bonds mature rather than selling them outright, but the resilience of markets is uncertain without consistent central bank buying.

In conclusion, central banks play a vital role in a nation’s economy by controlling and manipulating the money supply, regulating member banks, and acting as lenders of last resort. They have evolved over time and continue to face challenges in maintaining financial stability.