Variable Ratio Write

A variable ratio write is an options investing strategy where the investor holds a long position in the underlying asset while writing multiple call options at different strike prices. This strategy is commonly used to capture premiums from call options and is best suited for stocks with low expected volatility in the short term.

Key Takeaways:

– A variable ratio write is an options strategy used to generate additional income from an owned stock.

– It is used when the trader expects the stock price to remain stable.

– The strategy involves investing in multiple call options with varied strike prices.

– The potential profit comes from the premiums received from the call options.

Understanding Variable Ratio Writes:

– The word "ratio" in ratio call writing refers to the number of options sold for every 100 shares owned.

– For example, in a 2:1 variable ratio write, the trader sells 200 options while owning 100 shares.

– The strike prices of the written calls differ, with one being "out of the money" and the other being "in the money."

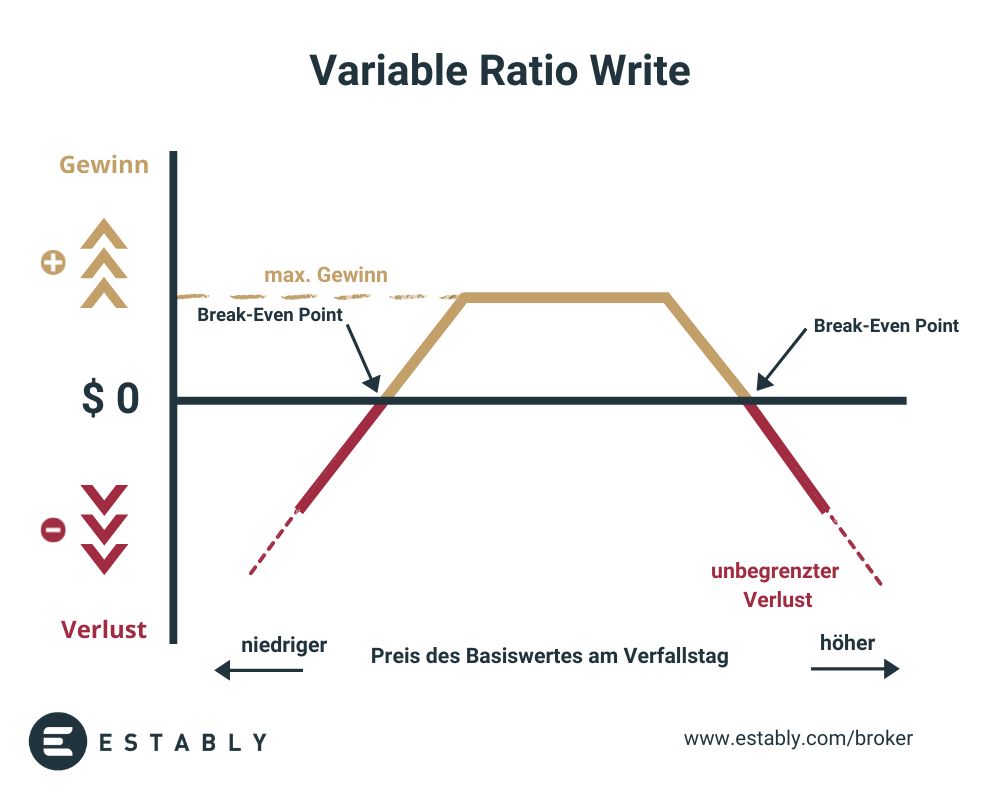

– The variable ratio write’s payoff is similar to that of a reverse strangle and has limited profit potential and unlimited risk.

When the Variable Ratio Write Is Used:

– Inexperienced options traders should avoid the variable ratio write due to its unlimited risk potential.

– The trader faces losses if the stock price moves strongly beyond the set upper and lower breakeven points.

– The variable ratio write provides flexibility and income, but it involves significant risks.

Breakeven Points:

– The variable ratio write has two breakeven points, which are calculated as follows:

– Upper Breakeven Point = SPH + PMP

– Lower Breakeven Point = SPL – PMP

(where SPH = strike price of higher strike short call, PMP = points of maximum profit, SPL = strike price of lower strike short call)

Real-World Example of a Variable Ratio Write:

– Suppose an investor owns 1,000 shares of XYZ, priced at $100 per share, and expects minimal price movement.

– The investor can earn a positive return by initiating a variable ratio write, selling 30 110 strike calls on XYZ expiring in two months.

– The premium for each call option is $0.25, allowing the investor to collect $750 in total.

– The investor will realize the full $750 profit if XYZ remains below $110 after two months.

– However, if the stock rises above the breakeven price of $110.25, gains on the long stock position will be outweighed by losses on the short calls, which represent 3,000 shares of XYZ.