Freedom Shares What They are How They Work

Cierra Murry is an experienced banking consultant, loan signing agent, and arbitrator specializing in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management with over 15 years of experience in the field.

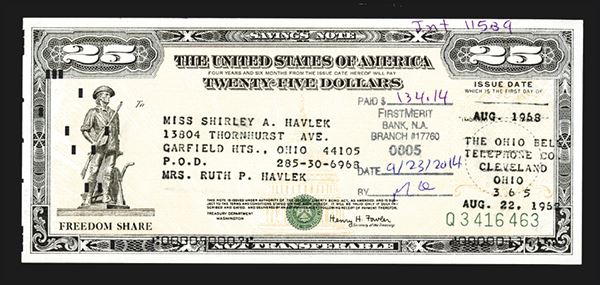

Freedom shares, also known as savings notes, were original issue discount bonds issued by the U.S. Treasury between May 1967 and October 1970 with a 30-year maturity.

Key Takeaways:

-The U.S. Treasury sold Freedom shares from May 1967 to October 1970.

-Freedom shares were issued at 81% of face value and sold in denominations of $25, $50, $75, and $100 with a 30-year maturity.

-Freedom shares were only available for purchase through a payroll savings plan or a "bond-a-month" plan offered by a bank.

-Buyers could only purchase Freedom shares in combination with Series E Bonds.

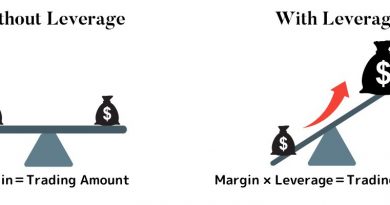

Freedom shares were sold in denominations of $25, $50, $75, and $100, at a discount basis of 81% of face value. For instance, a $100 face value bond would be bought for $81. These shares reached final maturity 30 years after the issue date.

In 1967, Freedom shares were introduced and sold exclusively through payroll savings plans or "bond-a-month" plans provided by banks. They couldn’t be bought in a lump sum over the counter. Additionally, Freedom shares could only be purchased together with Series E Bonds, and buyers were limited to a maximum purchase of $1,350 in maturity value each year. Freedom shares offered a higher interest rate compared to Series E Bonds, as treasury officials aimed to avoid diverting funds from other government savings programs.

The original maturity term was four and a half years, with optional extensions for two 10-year periods and an additional five-and-a-half-year period, resulting in a total interest-earning life span of 30 years.

Interest from savings notes is reportable for federal income tax purposes when the note is redeemed, reaches final maturity, or is disposed of, whichever occurs first. The note owner has the option to report interest annually as it accrues. However, this election must apply to all of the owner’s accrual-type securities. Freedom shares can be redeemed at any Federal Reserve Bank or branch, or at any financial institution designated as a paying agent of government savings bonds.

The U.S. Treasury sold Series E Bonds between 1941 and 1980, as defense expenditures and national debt grew in preparation for U.S. involvement in World War II. These bonds were sold through a national volunteer program that enlisted the help of financial institutions, community leaders, volunteer committees, advertising, and communications media. Prominent figures such as bankers, business executives, newspaper publishers, and Hollywood entertainers also promoted the bonds.

Similar to the Series E Bond, Freedom shares were linked to U.S. war efforts. The program was announced by President Lyndon B. Johnson during the U.S. escalation of the war in Vietnam.

From 1963 to 2003, the U.S. Savings Bonds Volunteer Committee, which included many Fortune 500 company executives, promoted the purchase of savings bonds through payroll deductions.

The U.S. Treasury department claims that the Series E bond became the most widely held security in the world. It was initially sold as a "defense bond" in 1941, a "war bond" during U.S. participation in World War II, and later as a regular U.S. savings bond. In 1980, Series E Bonds were replaced by Series EE Savings Bonds.