Variable Cost What It Is and How to Calculate It

Contents

- 1 Variable Cost: Understanding and Calculation

- 1.1 What Is a Variable Cost?

- 1.2 Understanding Variable Costs

- 1.3 Formula and Calculation of Variable Costs

- 1.4 Types of Variable Costs

- 1.5 Importance of Variable Cost Analysis

- 1.6 Variable Cost vs. Average Variable Cost

- 1.7 Variable Costs vs. Fixed Costs

- 1.8 Special Considerations

- 1.9 Example of a Variable Cost

- 1.10 What Are Some Examples of Variable Costs?

- 1.11 How Do Fixed Costs Differ From Variable Costs?

- 1.12 How Can Variable Costs Impact Growth and Profitability?

- 1.13 Is Marginal Cost the Same as Variable Cost?

- 1.14 What Is the Formula for Total Variable Cost?

- 1.15 The Bottom Line

Variable Cost: Understanding and Calculation

What Is a Variable Cost?

A variable cost is a corporate expense that changes based on production or sales. It increases with production and decreases when production decreases.

Examples of variable costs include raw materials, packaging, credit card fees, and shipping expenses. Variable costs contrast with fixed costs.

Key Takeaways

- A variable cost changes with production or sales.

- Variable costs are distinct from fixed costs.

- Variable costs affect a product’s contribution margin.

- Examples of variable costs include raw materials, labor, utilities, commission, and distribution costs.

Understanding Variable Costs

A business has variable and fixed costs. Variable costs depend on production and decrease as production decreases.

Examples of variable costs include sales commissions, direct labor, raw materials, and utilities.

Variable costs can be adjusted quickly to address cash flow issues.

Formula and Calculation of Variable Costs

The total variable cost is the quantity of output multiplied by the variable cost per unit.

The variable cost per unit varies across profits. It can be calculated as the sum of specific variable costs.

Types of Variable Costs

In the manufacturing process, certain items are usually variable costs, such as raw materials, direct labor, commissions, utilities, and shipping expenses.

Importance of Variable Cost Analysis

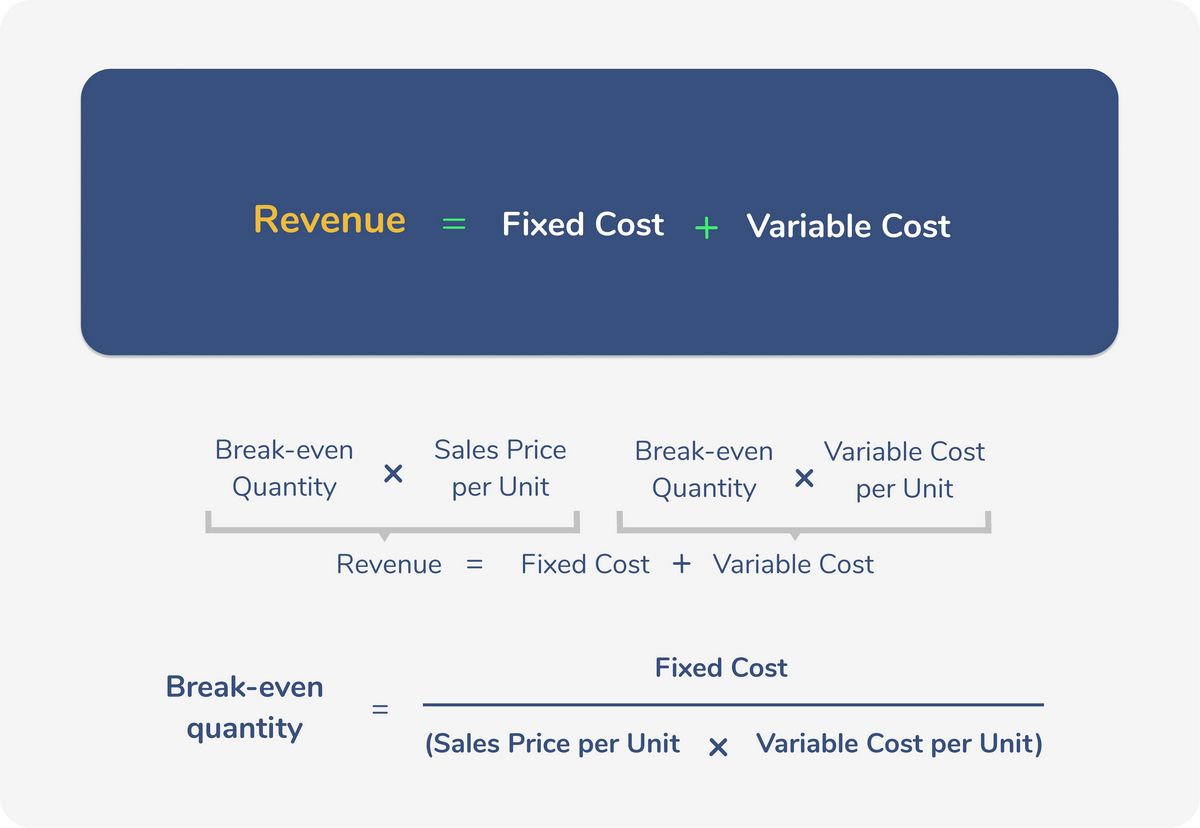

Variable cost analysis is important for determining pricing, budgeting, break-even points, profit margins, and expense structures.

Variable Cost vs. Average Variable Cost

Variable cost and average variable cost are different measures. Variable cost refers to the cost per unit, while average variable cost analyzes production over time and compares variable costs to output.

Variable Costs vs. Fixed Costs

Fixed costs remain constant regardless of production output, while variable costs change with production. Semi-variable costs fall in between fixed and variable costs.

Note

Companies with a higher proportion of variable costs are considered less volatile.

Special Considerations

Relevant Range

Relevant range applies to fixed costs. Variable costs may experience a relevant range, particularly for tangible products and labor costs.

Degree of Leverage

Variable and fixed costs affect a company’s degree of leverage. Fixed costs offer greater leverage and upside potential, while variable costs are safer.

Contribution Margin

Variable costs are used to calculate contribution margin and analyze profitability.

Example of a Variable Cost

A bakery’s variable costs increase as the number of cakes produced increases.

Total costs affect a company’s profits.

What Are Some Examples of Variable Costs?

Common examples of variable costs include costs of goods sold, raw materials, wages, commissions, and utilities.

How Do Fixed Costs Differ From Variable Costs?

Fixed costs are independent of production, while variable costs are directly related to production.

How Can Variable Costs Impact Growth and Profitability?

Increasing production increases variable costs. Understanding economies of scale is essential to determine the impact of variable costs on growth and profitability.

Is Marginal Cost the Same as Variable Cost?

No. Marginal cost considers both fixed and variable costs, while variable costs only analyze the cost of production.

What Is the Formula for Total Variable Cost?

Total variable cost is calculated by multiplying the total quantity of output by the unit variable cost.

The Bottom Line

Variable costs change based on production, while fixed costs remain constant. An effective cost structure can impact a company’s profitability and growth strategy.