Maximum Leverage Meaning Overview and Examples

Contents

Maximum Leverage: Meaning, Overview, and Examples

What Is Maximum Leverage?

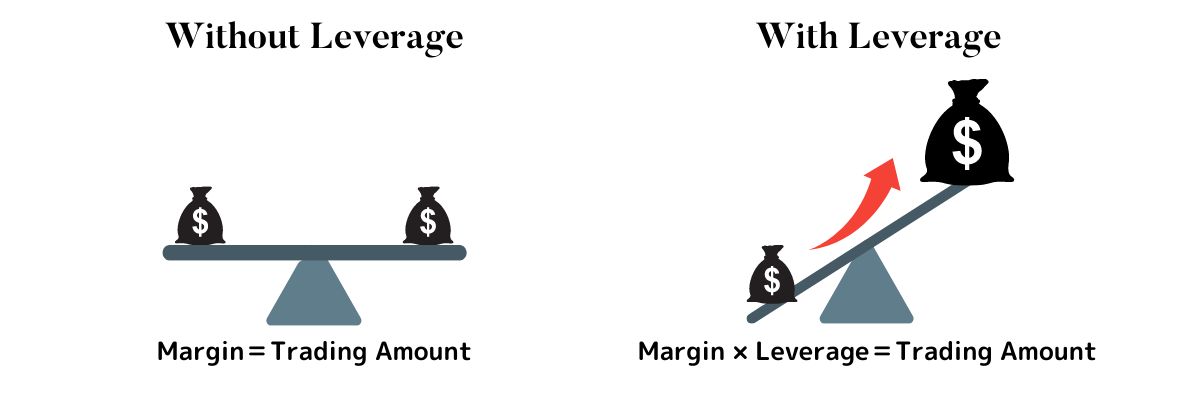

Maximum leverage is the largest allowable size of a trading position permitted through a leveraged account. Leverage involves using borrowed funds to purchase securities or investments. In brokerage accounts, leverage can be obtained through margin, a deposit with the broker to buy or sell a larger position than deposited.

Leverage can increase gains or losses on a trade, increasing the volatility and risk of a portfolio.

Key Takeaways

- Maximum leverage is the largest position size permitted in a leveraged account based on a customer’s margin requirements with their broker.

- Stock investors can borrow up to 50% of the value of a position under Reg T, but some brokerage firms may impose more stringent requirements.

- Maximum leverage in the currency (forex) markets can be quite high; some firms allow leverage of more than 100:1.

- Futures margin requirements and maximum leverage vary depending on the specific product being traded.

Understanding Maximum Leverage

Due to the risky nature of trading with borrowed funds, guidelines and regulations regarding the maximum allowable leverage for stock trading were established under Regulation T. This regulation sets minimum margin quantities that must be on hand for credit to be extended to clients. Brokerage firms may impose more stringent requirements to limit risk further.

Foreign exchange trading has more relaxed standards. Leverage on currency trades can range from 50 to 400 times. Approaching or exceeding the maximum leverage point can be untenable for forex traders, as a small price movement can quickly wipe out the entire equity in the trading account. In the futures market, maximum leverage is based on futures margin requirements, which are good faith deposits typically equal to 3% to 12% of the value of the futures contract.

Examples of Maximum Leverage

Brokerage firms can establish their own rules for the amount of leverage allowed and the required collateral. However, the Federal Reserve Board established Regulation T, which requires at least half of the purchase price of a stock position to be on deposit. For example, an investor cannot borrow more than $1,000 to buy $2,000 worth of stocks within a brokerage account.

Currency trading has its own rules. Typical leverage available on currency pair trades through forex trading institutions ranges from 50 to 400 times. With a leverage ratio of 50, for example, an individual with a margin deposit of $5,000 can initiate a maximum leverage trading position of up to $250,000.

When trading futures, specific margin amounts are set by the futures exchange and are often determined by the volatility of the futures contract. For example, if a crude oil futures contract represents 1,000 barrels and crude is trading at $55 per barrel, the size of the contract is $55,000 (1,000 x $55). If the margin is $4,350, or roughly 8% of the contract size, that amount is the maximum leverage when trading one oil futures contract.