Variable Cost Ratio

Variable Cost Ratio

The variable cost ratio is a calculation of the costs of increasing production compared to the resulting greater revenues. Estimating the variable cost ratio helps a company find the optimal balance between increased revenues and increased production costs.

Key Takeaways:

– The variable cost ratio shows the additional costs for increasing production.

– A high ratio suggests a company is more likely to make a profit on low sales due to a high contribution margin for fixed costs.

– A low ratio suggests a company is less likely to make a profit on low sales due to a low contribution margin for fixed costs.

The production of goods involves both fixed and variable costs:

– Increasing production is an efficient use of fixed costs, like building leases. If producing 1,000 things costs the same fixed costs as producing 100 things, the fixed cost per thing decreases with increased production.

– Variable costs, such as raw materials, increase with production. It is not possible to make 1,000 gold-plated things for the same cost as 100 gold-plated things. The variable cost ratio indicates when the costs of increasing production outweigh the benefits.

Understanding Variable Cost Ratio

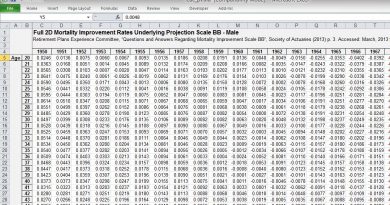

The Formula for the Variable Cost Ratio Is:

Variable Cost Ratio = Variable Costs / Net Sales

As an alternative, the ratio can be calculated as 1 – contribution margin.

The result determines if a company is achieving or maintaining a desirable balance where revenues exceed expenses.

The variable cost ratio quantifies the relationship between a company’s sales and the specific costs of production. It serves as an evaluation metric for management to determine break-even or minimum profit margins, make profit projections, and identify optimal sales prices.

High Fixed Costs Mean a Lower Ratio

Companies with high fixed costs need significant revenue to cover the costs and stay in business. These companies benefit from a low variable cost ratio. On the other hand, companies with low fixed costs don’t require substantial revenue to cover expenses and can operate with a higher variable cost ratio.

Variable cost calculation can be done per unit or over a given time period. For example, a $10 variable cost per unit with a $100 sales price gives a variable cost ratio of 0.1 or 10%. Total monthly variable costs of $1,000 with total monthly revenues of $10,000 also result in a variable cost ratio of 0.1 or 10%.

Variable Costs and Fixed Costs

The variable cost ratio and its usefulness are easily understood when considering the concepts of variable costs, fixed expenses, and their relationship to revenues and profitability.

Variable costs fluctuate depending on production levels. Examples include costs of raw materials, packaging, and shipping. These costs increase with production and decrease when production declines.

Fixed expenses remain relatively unchanged regardless of production levels. Examples include facility rental or mortgage costs and executive salaries. Fixed expenses only significantly change through management decisions.

The contribution margin is the percentage difference between total sales revenue and total variable costs.

The contribution margin reveals how much revenue is available to contribute towards fixed costs and potential profit.