What Is a Central Bank Digital Currency CBDC

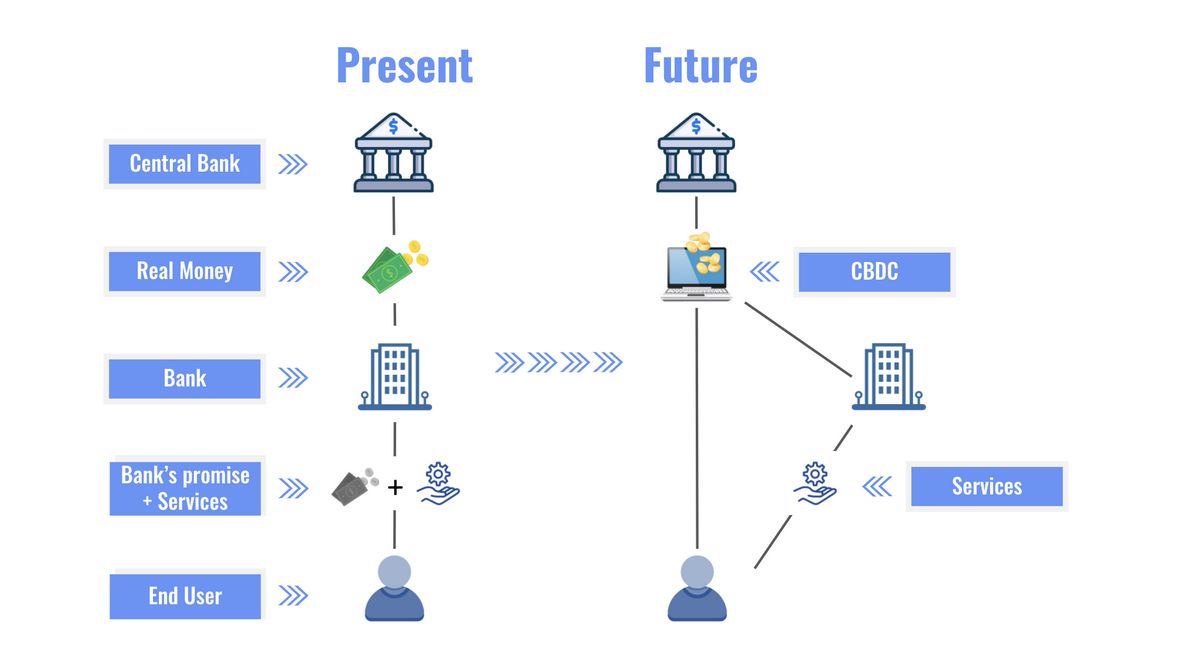

Central bank digital currencies (CBDCs) are digital currency issued by a country’s central bank. They are similar to cryptocurrencies, but their value is fixed by the central bank and equivalent to the country’s fiat currency.

Countries are developing and implementing CBDCs, so it’s important to understand what they are and their impact on society.

Key Takeaways:

-A CBDC is the digital form of a country’s fiat currency.

-A nation’s central bank issues a CBDC, promoting financial inclusion and simplifying monetary and fiscal policy implementation.

-Countries are exploring how CBDCs affect economies, financial networks, and stability.

Understanding CBDCs:

-Fiat money is government-issued currency without backing from physical commodities like gold or silver. It can be used as legal tender for goods and services. Fiat money can be physical or digital.

-During the pandemic, physical currency usage decreased.

-Countries are exploring government-backed digital currencies, similar to fiat money, but with the backing and faith of the issuing government.

-The introduction of cryptocurrencies and blockchain technology has increased interest in cashless societies and digital currencies.

Goals of CBDCs:

-CBDCs aim to provide privacy, transferability, convenience, accessibility, and financial security to businesses and consumers.

-CBDCs can reduce maintenance costs of complex financial systems, lower cross-border transaction costs, and offer lower-cost options to users of alternative money-transfer methods.

-CBDCs mitigate risks associated with current volatile cryptocurrencies and provide a secure means of exchange.

-CBDCs allow central banks to implement monetary policies for stability, control growth, and influence inflation.

Types of CBDCs:

-Wholesale CBDCs are used by financial institutions for reserves and interbank transfers.

-Retail CBDCs are government-backed digital currencies for consumers and businesses.

-Token-based retail CBDCs allow anonymous transactions through private or public keys.

-Account-based retail CBDCs require digital identification to access an account.

Issues CBDCs Address and Create:

-CBDCs eliminate third-party risk, lower cross-border transaction costs, and support the international role of a country’s currency.

-CBDCs lower the cost of implementing financial structures, provide direct consumer-central bank connections, and expand financial access.

-CBDCs bring about changes in financial structures, affect financial system stability, monetary policy influence, privacy and protection, and require robust cybersecurity measures.

CBDCs vs Cryptocurrencies:

-Cryptocurrencies offer an alternative currency system with less regulation and more security through consensus mechanisms. However, they lack stability.

-CBDCs are designed for stability and safety, mirroring fiat currency, and may not require blockchain technology or consensus mechanisms.

Central Bank Digital Currencies at a Glance:

-Many countries have pilot programs and research projects for CBDCs, with examples of implemented CBDCs in 11 countries.

-A CBDC provides access to financial services, decreases maintenance costs, reduces cross-border transaction costs, and offers lower-cost options to alternative money-transfer methods.

Is CBDC a Cryptocurrency?

-CBDCs are not cryptocurrencies. Central banks control CBDCs, while cryptocurrencies are decentralized.

Does the U.S. Have a CBDC?

-The U.S. is researching CBDCs but does not have one. The development of a national strategy on digital currencies has been ordered.

Is a CBDC Based on a Blockchain?

-A CBDC can be based on a blockchain but doesn’t need to be. Efficiency and scalability concerns have been raised about blockchain-based CBDCs.

The Bottom Line:

-CBDCs aim to provide privacy, transferability, convenience, accessibility, and financial security to businesses and consumers.

-CBDCs decrease maintenance costs, cross-border transaction costs, and offer lower-cost options for alternative money-transfer methods.