What Is a Bank s Legal Lending Limit How Does It Work

What Is a Bank’s Legal Lending Limit, How Does It Work?

The legal lending limit is the maximum amount that a bank can lend to a borrower. This limit is a percentage of the bank’s capital and surplus, regulated by the Office of the Comptroller of the Currency (OCC).

Key Takeaways:

– A legal lending limit is the maximum a bank can lend to a single borrower.

– The limit for national banks is 15% of the bank’s capital.

– If the loan is secured by marketable securities, the limit is raised to 25%.

– Some loans, such as those secured by U.S. obligations or certain types of commercial paper, are not subject to limits.

– State-chartered banks usually have similar lending limits to the OCC standard.

How the Legal Lending Limit Works:

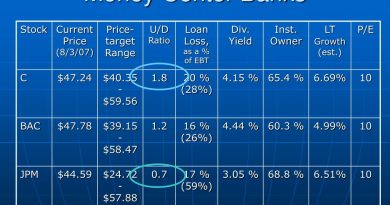

The legal lending limit for national banks is established under the United States Code (U.S.C.) and overseen by the OCC. The FDIC provides insurance for U.S. depositors, and both the FDIC and OCC are involved in the national bank chartering process. The lending limit applies to national banks and savings associations across the nation and states that they cannot issue a loan exceeding 15% of their capital and surplus. Banks can lend up to 25% if the loan is secured by marketable securities.

State-chartered banks may have their own lending limits, often similar to the OCC standard. For example, New York-chartered banks have a limit of 15% of their capital, surplus, and undivided profits (CUPS), and 25% for loans secured by collateral.

Special Considerations:

Some loans may qualify for special lending limits, such as those secured by bills of lading, installment consumer paper, or livestock. Certain loans, including commercial paper, loans secured by U.S. obligations, and loans affiliated with government agencies, may not be subject to lending limits.

Banks are required to hold significant capital, which typically applies only to institutional borrowers. Capital is divided into tiers based on liquidity, including tier 1 and tier 2 capital. Surplus at a bank may refer to profits, loss reserves, and convertible debt.