Unemployment Insurance UI How It Works Requirements and Funding

Unemployment Insurance (UI): How It Works, Requirements, and Funding

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional® and Certified Retirement Counselor designations for advance retirement planning.

Contents

- 1 What Is Unemployment Insurance (UI)?

- 2 Understanding Unemployment Insurance (UI)

- 3 Requirements for Unemployment Insurance

- 4 How Is Unemployment Insurance Funded?

- 5 Unemployment Insurance During the COVID-19 Pandemic

- 6 What Are the 4 Types of Unemployment?

- 7 How Is Unemployment Calculated?

- 8 Who Is Counted As Unemployed?

- 9 What Is the Meaning of UI?

- 10 The Bottom Line

What Is Unemployment Insurance (UI)?

Unemployment insurance (UI), also called unemployment benefits, is a type of state-provided insurance that pays money to individuals weekly when they lose their jobs and meet certain eligibility requirements.

Those who either voluntarily quit or were fired for a just cause are usually not eligible for UI. In other words, someone separated from their job due to a lack of available work and at no fault of their own usually qualifies for unemployment benefits.

Each state administers its own unemployment insurance program, despite it being federal law. Workers must meet their state’s work and wage requirements, including time worked. The benefits are primarily paid out by state governments and funded by specific payroll taxes collected for that purpose.

Key Takeaways

Understanding Unemployment Insurance (UI)

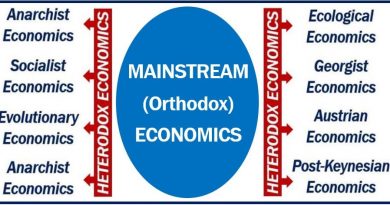

The unemployment initiative is a joint program between individual state governments and the federal government. Unemployment insurance provides cash stipends to unemployed workers who actively seek employment. Compensation to eligible, unemployed workers is made through the Federal Unemployment Tax Act (FUTA) along with state employment agencies.

Each state has an unemployment insurance program, but all states must follow specific guidelines outlined by federal law. Federal law makes unemployment benefits relatively ubiquitous across state lines. The U.S. Department of Labor oversees the program and ensures compliance within each state.

Workers who meet specific eligibility requirements may receive up to 26 weeks of benefits a year. The weekly cash stipend is designed to replace a percentage of the employee’s regular wage, on average.

States fund unemployment insurance using taxes levied on employers. The majority of employers will pay both federal and state unemployment FUTA tax. Companies that have 501(c)3 status do not pay FUTA tax.

Three states also require minimal employee contributions to the state unemployment fund. Reportable income includes freelance work or jobs for which unemployment insurance recipients were paid in cash.

Out-of-work persons who do not find employment after a 26-week period may be eligible for an extended benefits program. Extended benefits give unemployed workers an additional number of weeks of unemployment benefits. The availability of extended benefits will depend on a state’s overall unemployment situation.

The federal government established provisions designed to help unemployed Americans during the coronavirus pandemic. These additional benefits were put in place after former President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020.

Requirements for Unemployment Insurance

An unemployed person must meet two primary requirements to qualify for unemployment insurance benefits. An unemployed individual must meet state-mandated thresholds for either earned wages or time worked in a stated base period. The state must also determine that the eligible person is unemployed through no fault of their own. A person may file an unemployment insurance claim when fulfilling these two requirements.

Individuals file claims in the state where they worked. A participant may file claims by phone or on the state unemployment insurance agency’s website. After the first application, it generally takes two to three weeks for the processing and approval of a claim.

After approval of a claim, the participant must either file weekly or biweekly reports that test or confirm their employment situation. Reports must be submitted to remain eligible for benefit payments. An unemployed worker cannot refuse work during a week, and on each weekly or biweekly claim, they must report any income that they earned from freelance or consulting gigs.

How Is Unemployment Insurance Funded?

Unemployment insurance is funded by taxes on employers, such as the FUTA and various state taxes. FUTA charges 6% of the first $7,000 of each employee’s wages, although this is offset by a 5.4% credit for on-time tax payments.

Some states pay for unemployment benefits by debiting the former employer’s UI account or by raising the employer’s UI taxes in future years. Since employees are usually not eligible for UI if they quit voluntarily, some employers may pressure their employees to resign rather than fire them.

Unemployment Insurance During the COVID-19 Pandemic

On March 11, 2020, the World Health Organization declared COVID-19, the illness caused by a novel coronavirus, to be a pandemic. States and businesses across the U.S. closed down, causing massive unemployment.

Lawmakers agreed on the passage of the CARES Act, a landmark piece of legislation that, in part, expanded states’ ability to provide UI to millions of workers affected by COVID-19, including people who aren’t ordinarily eligible for unemployment benefits. The bill was passed and signed into law in March 2020.

Three specific programs were designed to help Americans who were out of work because of the coronavirus. A fourth program was established through an Aug. 8, 2020 memorandum issued by President Trump in response to the expiration of the Federal Pandemic Employment Compensation program.

While people who voluntarily quit their jobs do not normally qualify for UI, you may qualify for benefits if you quit due to unpaid wages, unsafe working conditions, a sudden decrease in your hours, or certain other factors. The legal term for this is constructive dismissal.

Federal Pandemic Unemployment Compensation (FPUC)

The Federal Pandemic Unemployment Compensation (FPUC) provided an extra weekly benefit on top of regular UI. The original benefit provided an additional $600 weekly under the CARES Act, but that benefit expired on July 31, 2020. The FPUC was modified and extended as part of the Consolidated Appropriations Act in December 2020.

Pandemic Unemployment Assistance (PUA)

Pandemic Emergency Unemployment Compensation (PEUC)

Lost Wages Assistance (LWA) Program

The Lost Wages Assistance (LWA) program was a federal-state unemployment benefit that provided $300 to $400 in weekly compensation to eligible claimants. LWA came into existence in response to the expiration of FPUC on July 31, 2020.

What Are the 4 Types of Unemployment?

The four types of unemployment are cyclical, frictional, institutional, and structural unemployment.

- Cyclical unemployment is caused by changes in the business cycle, such as recessions.

- Frictional unemployment occurs when workers leave their jobs and take some time to find a new employer.

- Institutional unemployment occurs as a result of policies that alter the features of the labor market, such as minimum wage laws and unemployment insurance.

- Structural employment is long-term unemployment caused by deep changes in the economy, such as new technologies or changing business needs.

How Is Unemployment Calculated?

In the United States, the unemployment rate is calculated by dividing the number of unemployed people who are actively looking for work by the total number of people who are employed or actively seeking employment. This does not include unemployed people who are unable to work or have given up seeking employment.

Who Is Counted As Unemployed?

The unemployed include anyone who doesn’t have a job, is available for work, and has been actively looking for work in the previous four weeks. Actively looking for work includes having job interviews or contacting employers.

What Is the Meaning of UI?

UI, or unemployment insurance, is a government benefit for those who lose their jobs through no fault of their own. UI provides a temporary safety net so that people can continue searching for jobs after they are fired or laid off. Notably, employees who voluntarily quit or are fired for absenteeism or insubordination do not normally qualify for UI, and those who leave due to intolerable working conditions may qualify even if they did quit.

The Bottom Line

Unemployment insurance is a form of state-provided insurance that provides weekly payments to people who have recently been fired or laid off. Although it only provides a fraction of a full paycheck, UI payments can help workers make ends meet as they search for a new job.