Understanding Liquidity Risk in Banks and Business With Examples

Liquidity risk refers to the potential difficulty an entity may face in meeting short-term financial obligations due to an inability to convert assets into cash without incurring a substantial loss. This risk is present in financial institutions and corporations, significantly impacting their operational and financial stability.

Liquidity risk is characterized by two main aspects: market liquidity risk and funding liquidity risk. Market liquidity risk is associated with an entity’s inability to execute transactions at prevailing market prices due to insufficient market depth or disruptions. Funding liquidity risk pertains to the inability to obtain sufficient funding to meet financial obligations.

Liquidity risk is not confined to any particular sector. Banks, financial institutions, corporations, and individual investors all need to manage liquidity risk. Regulatory frameworks mandate liquidity standards for banks and financial institutions to ensure financial stability and protect depositor interests. Corporations also need to manage liquidity risk to meet their operational and financial commitments.

To manage liquidity risk, entities must maintain a portfolio of liquid assets, forecast cash flow rigorously, and diversify funding sources. Unmanaged or poorly managed liquidity risk can lead to operational disruptions, financial losses, and reputational damage. It can even drive an entity towards insolvency or bankruptcy.

In the banking sector, liquidity risk arises from the maturity mismatch between long-term loans and short-term liabilities. Basel III provides stringent liquidity standards for banks to enhance their ability to absorb shocks. Liquidity risk and market liquidity risk can exacerbate each other, creating additional financial challenges for banks.

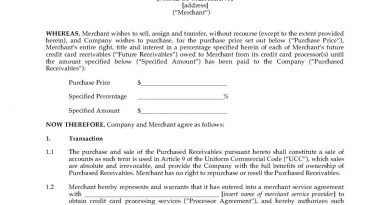

Corporations also face liquidity risk when funding long-term assets with short-term liabilities. They employ strategies such as establishing credit facilities, maintaining cash reserves, and effective cash flow management to mitigate this risk.

Individuals can manage liquidity risk by maintaining a reasonable budget, having emergency savings, diversifying investments, and ensuring access to liquid assets or credit facilities.

Liquidity risk, market risk, and credit risk are distinct but interrelated. Liquidity risk can exacerbate market risk and credit risk, causing further financial challenges.

Liquidity risk can have ripple effects on the broader economy. It can lead to credit crunches, job losses, reduced consumer spending, and a decline in investor confidence.

The measurement of liquidity risk commonly relies on ratios such as the quick ratio and the common ratio, which assess an entity’s ability to meet short-term obligations.

Overall, proactive management of liquidity risk is crucial to ensure financial stability and operational continuity. The adoption of digital technologies and regulatory frameworks like Basel III have enhanced the landscape of liquidity risk management.