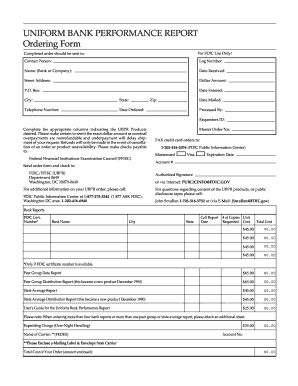

Uniform Bank Performance Report UBPR What It Is How It Works

The Uniform Bank Performance Report (UBPR) is an analytical tool created by the Federal Financial Institutions Examination Council (FFIEC) to supervise and examine financial institutions. It analyzes the impact of management and economic conditions on a bank’s balance sheet, including liquidity, capital adequacy, earnings, and other factors that could harm the bank’s stability.

Key Takeaways:

– The UBPR summarizes the financial position, performance, and risk exposures of American banks.

– It includes key ratios for the current quarter, previous quarter, year-ago quarter, and year-to-date information.

– The UBPR is filed with a Call Report, which contains additional items such as financial statements, loans & deposits, investments held, and changes in the bank’s capital.

Understanding the UBPR:

The UBPR summarizes the effect of economic conditions and management decisions on a bank’s performance and balance sheet composition. It helps evaluate the bank’s profitability, liquid assets, growth, and liabilities. It is a valuable tool for bankers and bank examiners to understand a bank’s financial condition and maintain or restore its fitness.

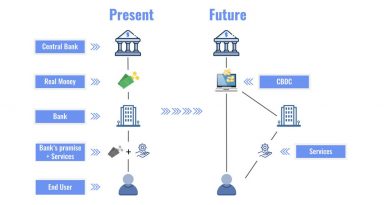

Banks heavily rely on short-term deposits to fund long-term loans, making them vulnerable to problems if conditions worsen or there is a sudden mass withdrawal of deposits. The FFIEC uses the UBPR to monitor banks’ stability.

UBPR Delivery Schedule:

A bank’s UBPR is usually published within 24 hours of filing the associated Call Report. However, if there are errors in the Call Report, the UBPR will be published once the errors are rectified.

UBPR Recalculation Schedule:

A bank’s UBPR data is continuously updated. The current quarter’s data is recalculated and published each morning. Data for the current quarter and the four previous quarters is recalculated every Friday night and published the next Saturday morning. Recalculation is also done once per quarter, two weeks before banks submit their new Call Reports. The recalculated data is published within three days.

Once most banks file their Call Reports and UBPR data is calculated, peer group average data is published. Peer group averages for all groups except 1 and 2 are published 30 days after the Call Report is filed or on the due date. Peer group average data for groups 1 and 2 is published 35 days after the Call Report is filed or on the due date.