Western Account What It is How It Works Example

Contents

Western Account: What It is, How It Works, Example

What Is a Western Account?

A western account is a type of agreement among underwriters (AAU) where each underwriter shares responsibility for a specific portion of the new issuance. It is the opposite of an “eastern account,” where each underwriter shares responsibility for the entire issuance.

Western accounts are popular among underwriters because they reduce risk. These accounts lower liability if the new issuance proves more difficult than expected. However, they also limit the potential upside if the new issuance is successful.

Key Takeaways

- A western account is an agreement among underwriters where each party is responsible for their own allocation of the new securities issuance.

- The eastern account structure requires all parties to share liability for the entire issue.

- A western account lowers risk but also limits profit.

- In both types of accounts, underwriters profit from the spread between the price paid to the issuer and the price obtained from the investing public.

How Western Accounts Work

The western account is one way underwriters manage the risk of bringing new securities to the public, such as in an initial public offering (IPO). These transactions are inherently risky for underwriters because they must pay a certain amount of money to the issuer regardless of the sale price to the public. The underwriter’s profit is based on the spread between the price paid to the issuer and the price obtained from selling the securities.

To mitigate this risk, underwriters collaborate and form underwriting "consortiums."

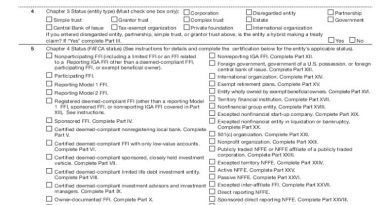

When underwriting firms come together, agreements among underwriters (AAUs) clearly define the rights and responsibilities of the parties involved. The western account is an example of an AAU structure. Each underwriter only takes on liability for the portion of the issuance in its inventory.

Example of a Western Account

XYZ Corporation is preparing for its IPO and hires a lead underwriter who forms a consortium of firms to carry out the IPO.

Under the terms of this transaction, XYZ is paid $25 per share by the underwriters. The underwriting consortium needs to sell the shares to other investors for more than $25 per share to make a profit.

The underwriters adopt an AAU modeled on the western account structure. Each underwriting firm only assumes responsibility for a specific portion of the newly issued shares, resulting in varying profits or losses.

What Is an Underwriter?

An underwriter is a person or organization that takes on another party’s financial risk through a mortgage, loan, insurance, or other financial transaction. Underwriters make money through interest payments and the difference between purchase and sale prices of investments or securities.

What Is an IPO?

An IPO is an initial public offering, where a large company sells shares to the public for the first time to raise money. The company’s shares can then be bought and sold on a public stock exchange.

Who Underwrites an IPO?

IPOs are usually underwritten by investment banks with IPO specialists working with the company to meet regulatory requirements.

The Bottom Line

When a new security, such as an IPO, is offered to the public, the risk is taken on by underwriters who may form an underwriting consortium. They may use a western account agreement, where each underwriter is responsible for a specific portion of the new shares.

This type of agreement lowers risk but also reduces potential profit once the shares are sold to the public.