Monte Carlo Simulation History How it Works and 4 Key Steps

Contents

- 1 Monte Carlo Simulation: History, How it Works, and 4 Key Steps

- 1.1 What Is a Monte Carlo Simulation?

- 1.2 How Does the Monte Carlo Simulation Assess Risk?

- 1.3 What Is the History of the Monte Carlo Simulation?

- 1.4 How Does the Monte Carlo Simulation Method Work?

- 1.5 The 4 Steps in a Monte Carlo Simulation

- 1.6 Monte Carlo Simulation Results Explained

- 1.7 Advantages and Disadvantages of a Monte Carlo Simulation

- 1.8 How Is the Monte Carlo Simulation Used in Finance Applications?

- 1.9 What Professions Use the Monte Carlo Simulation?

- 1.10 What Factors Are Evaluated in a Monte Carlo Simulation?

- 1.11 The Bottom Line

Monte Carlo Simulation: History, How it Works, and 4 Key Steps

What Is a Monte Carlo Simulation?

A Monte Carlo simulation models the probability of outcomes in a process affected by random variables. It helps understand the impact of risk and uncertainty.

Monte Carlo simulations are used in various fields, including investing, business, physics, and engineering. They are also known as multiple probability simulations.

Key Takeaways

- A Monte Carlo simulation predicts the probability of outcomes in the presence of random variables.

- It explains the impact of risk and uncertainty in prediction and forecasting models.

- To perform a Monte Carlo simulation, multiple values are assigned to an uncertain variable and the results are averaged for an estimate.

- Monte Carlo simulations assume efficient markets.

How Does the Monte Carlo Simulation Assess Risk?

When faced with uncertainty, instead of using a single average number, the Monte Carlo Simulation uses multiple values and averages the results.

Monte Carlo simulations are used in various fields, such as business and investing, to estimate cost overruns in projects and predict asset price movements.

They are also used by telecoms to assess network performance, financial analysts to evaluate default risk, and by insurers and oil well drillers to measure risk.

Monte Carlo simulations have applications in meteorology, astronomy, and particle physics as well.

What Is the History of the Monte Carlo Simulation?

The Monte Carlo simulation was named after the gambling destination in Monaco, as chance and random outcomes are central to this technique, much like in games like roulette, dice, and slot machines.

The technique was initially developed by Stanislaw Ulam, a mathematician who worked on the Manhattan Project, and refined in collaboration with John Von Neumann.

How Does the Monte Carlo Simulation Method Work?

The Monte Carlo method addresses the issue of uncertainty by repeatedly running random samples.

In a Monte Carlo simulation, an uncertain variable is assigned a random value, and the model is run to obtain a result. This process is repeated with different values for the variable. The results are averaged to arrive at an estimate.

The 4 Steps in a Monte Carlo Simulation

To perform a Monte Carlo simulation, follow these four steps using a program like Microsoft Excel:

Step 1: Use historical price data to generate periodic daily returns using the natural logarithm.

Step 2: Calculate the average daily return, standard deviation, and variance using the resulting series.

Step 3: Obtain a random value using the standard deviation.

Step 4: Use the calculated values to simulate the asset’s future price movements.

Monte Carlo Simulation Results Explained

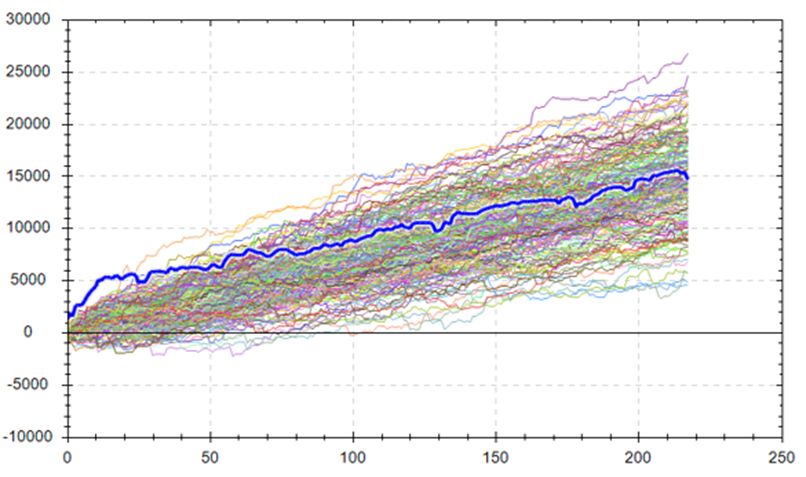

The outcomes generated by Monte Carlo simulations form a normal distribution, or a bell curve. The most likely return is in the middle of the curve, with equal chances of being higher or lower.

The probabilities within one, two, and three standard deviations from the most probable rate are 68%, 95%, and 99.7%, respectively.

However, there is no guarantee that the most expected outcome will occur or that actual movements won’t exceed projections.

A Monte Carlo simulation assumes a perfectly efficient market and ignores factors like macro trends, leadership, market hype, and cyclical factors.

Advantages and Disadvantages of a Monte Carlo Simulation

The Monte Carlo method helps estimate the likelihood of a gain or loss on an investment. It aims to provide a sounder estimate than other methods.

It uses historical price data, introduces random variables, and averages the results to estimate the risk of real-life disruptions.

How Is the Monte Carlo Simulation Used in Finance Applications?

The Monte Carlo simulation is used to estimate the probability of certain incomes. It is commonly used in pricing stock options, portfolio valuation, and fixed income investments.

What Professions Use the Monte Carlo Simulation?

The Monte Carlo simulation is used in various professions that need to measure and prepare for risks. For example, telecoms use it to assess network performance under different scenarios.

What Factors Are Evaluated in a Monte Carlo Simulation?

A Monte Carlo simulation in investing is based on historical price data and evaluates factors like drift, standard deviation, variance, and average price movement.

The Bottom Line

The Monte Carlo simulation shows the spectrum of probable outcomes for an uncertain scenario. By assigning multiple values to uncertain variables and averaging the results, it provides estimates of risk.

From investing to engineering, the Monte Carlo method is used to measure risk and estimate the likelihood of gains or losses.