Mineral Rights What it is How it Works Special Considerations

Contents

Mineral Rights: What it is, How it Works, Special Considerations

What Are Mineral Rights?

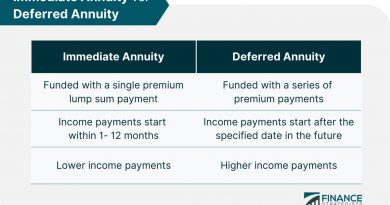

Mineral rights are ownership rights to underground resources such as fossil fuels (oil, natural gas, coal, etc.), metals and ores, and mineable rocks like limestone and salt. In the United States, mineral rights are legally separate from surface rights. Surface rights grant the owner the use of the land’s surface for various purposes, while mineral rights allow the owner to exploit any natural resources beneath the land.

Key Takeaways

- Mineral rights are ownership claims against natural resources located beneath a plot of land.

- In the United States, mineral rights are separate from surface rights.

- Mineral rights are often "severed" from surface rights in states like Texas, Oklahoma, Pennsylvania, Louisiana, Colorado, and New Mexico.

How Mineral Rights Work

In the United States, private individuals can purchase land and have the right to develop and exploit it, including any natural resources beneath its surface. However, in many other countries, land ownership rights only extend to the surface, with any resources below owned by the nation and controlled by the government. For example, in the United Kingdom, the state owns mineral rights for oil, gas, coal, gold, and silver, while other commodities’ mineral rights are privately held.

Since mineral rights can be privately owned in the United States, homeowners with rights to valuable resources on their property can sell those rights to private corporations, sometimes receiving substantial up-front or ongoing royalty payments. This often occurs with properties located on oil reserves, which attract purchase offers from oil extraction companies.

The value of these mineral rights and the royalties landowners can obtain from them depend heavily on oil prices. When oil prices are high, unconventional methods of extraction become more economical, increasing the value of mineral rights.

Special Considerations

Mineral rights are an important consideration when purchasing real estate, especially in states like Texas, Oklahoma, Pennsylvania, Louisiana, Colorado, and New Mexico, where they are often separate from surface rights. In North Carolina, property sellers must disclose to buyers whether mineral rights are included. However, some states lack similar disclosure laws, which can leave homeowners aware of valuable resources beneath their land but unable to benefit from them.

To mitigate this risk, homebuyers should carefully study their property’s land title records to verify whether the surface rights and mineral rights are included in their purchase. These records are generally available through the local property appraisal authority or the county clerk’s office.

Real-World Example of Mineral Rights

The development of technologies like horizontal oil drilling has made it increasingly common for resource-extraction companies to purchase mineral rights without acquiring surface rights. This approach is widely used in the Texas Permian shale basin and New Mexico to extract oil and gas.

Large investment firms like Texas-based EnCap Investments have also entered this sector, investing in upstream companies focused on the Permian Basin and Marcellus Shale. Black Stone Minerals (BSM), another Texas-based firm, has concentrated its mineral rights investments in the Permian, Haynesville, and Bakken shale oil fields.