Unit Linked Insurance Plan What It Is How It Works

Unit Linked Insurance Plan: What It Is, How It Works

What Is a Unit Linked Insurance Plan (ULIP)?

A unit linked insurance plan (ULIP) offers insurance coverage and investment exposure in equities or bonds. Policyholders make regular premium payments. Part of the premiums goes toward insurance coverage, while the remaining portion is invested in either equities, bonds, or a combination of both.

Key Takeaways

– A unit linked insurance plan offers a combination of insurance and investment payout.

– ULIP policyholders must make regular premium payments, which cover both insurance coverage and investment.

– ULIPs provide a range of payouts to beneficiaries following the insured individual’s death.

– ULIPs have a lock-in period, surrendering the plan incurs penalty fees and tax implications.

– The risk in ULIPs lies in the securities selected, and losses in investment capital can occur.

Understanding Unit Linked Insurance Plans (ULIPs)

A unit linked insurance plan can be used for various purposes, including life insurance, wealth building, retirement income, and education funding. Investors can open a ULIP to provide benefits to their descendants. Life insurance ULIPs provide payments to beneficiaries upon the owner’s death.

ULIPs structure investment options like mutual funds, pooling investments with those from other investors. ULIP assets are managed to achieve investment objectives. Investors can buy shares in a single strategy or diversify across multiple market-linked ULIP funds.

Investing in a Unit Linked Insurance Plan

Policyholders must make an initial lump-sum payment followed by regular premium payments. Premium payment obligations vary, but they are directed towards a designated investment mandate.

Regular premium payments help policyholders build up principal faster. Many ULIPs offer the option of topping up by adding lump sums to the balance.

Important

ULIPs expose investors to equities, raising investment risk.

ULIPs offer flexibility, allowing investors to adjust fund preferences. Investors can shuttle between stock funds, bond funds, and diversified funds based on their needs.

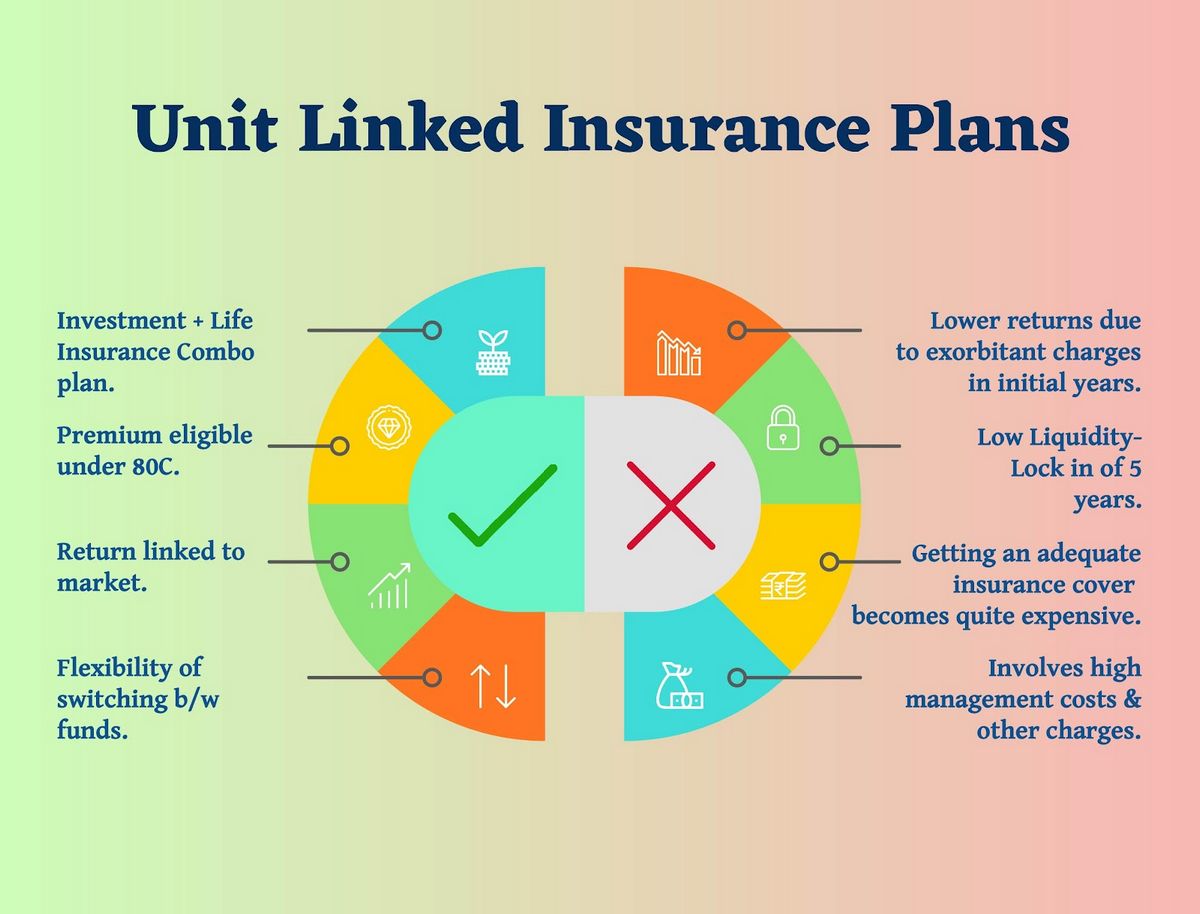

Advantages and Disadvantages of ULIPs

Pros of Unit Linked Insurance Plans

– Dual coverage (investment and insurance benefits)

– Flexibility in premium payments, investment options, and fund switching

– Long-term wealth creation potential

– Option for partial withdrawals

Cons of Unit Linked Insurance Plans

– High fees and administration charges

– Market exposure and investment risk

– Lock-in period with limited access to funds

– May not fulfill all insurance needs

ULIPs vs. Fixed Deposits

Investors choose between ULIPs and fixed deposits. ULIPs combine insurance with investing, while FDs are only investment vehicles.

The main difference lies in wealth creation. ULIP returns fluctuate based on the market, while FDs provide fixed returns.

ULIPs involve risk due to market fluctuations, while FDs offer lower-risk investments.

Partial withdrawals are possible after the lock-in period for ULIPs, while FDs often don’t allow them.

Is a ULIP Better Than a Mutual Fund?

For higher liquidity and potentially higher returns, a mutual fund may be preferable. ULIPs offer security with a long-term goal and the dual benefit of insurance and investment.

Are ULIPs High Risk?

ULIPs have an investment component that exposes them to the risk of loss. The underlying risk depends on the investments selected and market performance.

Can I Break a ULIP Before Maturity?

ULIPs can be broken before maturity, but there are penalty charges and tax implications.

What Happens to a ULIP After Maturity?

Once a ULIP matures, the policy is paid out to the policyholder, including the insured amount and invested funds. If the policyholder has passed away, a nominee can receive the distribution.

The Bottom Line

A ULIP combines investing options with life insurance coverage. Premiums cover life insurance and are invested in stocks, bonds, or mutual funds. ULIPs allow participation in financial markets with potential investment growth and life insurance coverage.