Treasury Note Definition Maturities How To Buy

Treasury Note: Definition, Maturities, How To Buy

What Is a Treasury Note?

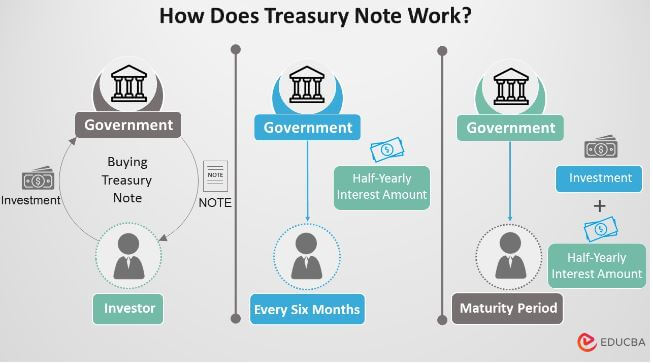

A Treasury note (T-note) is a marketable U.S. government debt security with a fixed interest rate and a maturity between two and 10 years.

Treasury notes are available from the government through competitive or noncompetitive bids. With a competitive bid, investors specify the desired yield, while a noncompetitive bid involves accepting whatever yield is determined at auction.

Key Takeaways

– A Treasury note is a U.S. government debt security with a fixed interest rate and maturity between two and 10 years.

– Treasury notes are available through competitive or noncompetitive bids, allowing investors to specify or accept the determined yield.

– A Treasury note is similar to a Treasury bond but with different maturities—T-bonds have lifespans of 20 to 30 years.

Understanding Treasury Notes

Issued in maturities of two, three, five, seven, and 10 years, Treasury notes are popular investments with a large secondary market, enhancing their liquidity.

Interest payments on the notes occur every six months until maturity. The income from interest payments is not taxable at the municipal or state level but is federally taxed, like a Treasury bond or a Treasury bill.

Treasury notes, bonds, and bills are all types of U.S. Treasury debt investments, differing in their length of maturity. Treasury bonds have maturities exceeding 10 years, making them the longest-dated sovereign fixed-income security.

Treasury Notes and Interest Rate Risk

The longer the maturity, the higher a T-note’s exposure to interest rate risks. In addition to credit strength, a note or bond’s value is determined by its sensitivity to changes in interest rates, which occur either at the absolute level controlled by a central bank or through the yield curve’s shape.

These fixed-income instruments also possess varying levels of sensitivity to rate changes, resulting in price declines of different magnitudes. Duration, measured in years, quantifies this sensitivity and is calculated using factors such as coupon, yield, present value, final maturity, and call features.

An example of an absolute shift in interest rates occurred in December 2015 when the Federal Reserve (the Fed) raised the federal funds rate by 25 basis points. This increase, from a range of 0% to 0.25% to 0.25% to 0.50%, decreased the prices of all U.S. Treasury notes and bonds.

Special Considerations

Apart from the benchmark interest rate, shifts in investor expectations can lead to changes in the yield curve, known as yield curve risk. This risk is associated with the steepening or flattening of the curve, which occurs when yields among bonds of different maturities change.

For example, a steepening yield curve widens the spread between short- and long-term interest rates, with long-term rates increasing more than short-term rates. An inverted yield curve arises when short-term rates surpass any longer-term rates.

As a result, the prices of long-term notes decrease relative to short-term notes. The opposite happens with a flattening yield curve, where the spread narrows and the prices of short-term notes decrease relative to long-term notes.