Upstream Guarantee What it is How it Works

Contents

Upstream Guarantee: What it is, How it Works

What Is an Upstream Guarantee?

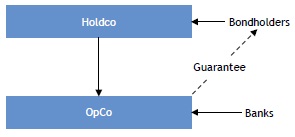

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company’s debt.

An upstream guarantee can be contrasted with a downstream guarantee, which is a pledge on behalf of the borrowing party by its parent company or stockholder.

Key Takeaways

- An upstream guarantee is when a parent company’s debt or obligation is backed by one or more of its subsidiaries.

- Such a guarantee may be required by a lender when the parent company’s primary asset base is its ownership in the subsidiary.

- Upstream guarantees are also utilized in leveraged buyouts when the parent company owns insufficient assets to back the buyout syndicate’s debt-financed purchase.

How Upstream Guarantees Work

Upstream guarantees enable a parent company to obtain debt financing on better terms by expanding the available collateral. They often occur in leveraged buy-outs, when the parent company does not have enough assets to pledge as collateral.

A payment guaranty obligates the guarantor to pay the debt should the borrower default, regardless of whether the lender makes a demand. Alternatively, a collection guaranty only obligates the guarantor if the lender cannot collect the amount owed after exhausting its remedies against the borrower. Guaranties can be absolute, limited or conditional.

Typically, a lender will insist on an upstream guaranty when it lends to a parent whose only asset is stock ownership of a subsidiary. In this case, the subsidiary owns substantially all the assets upon which the lender bases its credit decision.

The problem with upstream guarantees is that lenders are exposed to the risk of being sued for fraudulent conveyance when the guarantor is insolvent or without adequate capital at the time it executed the guarantee. If the issue of fraudulent conveyance is successfully proved in a bankruptcy court, the lender would become an unsecured creditor.

Since the subsidiary guaranteeing the debt payments owns no stock in the parent company borrowing the funds, the former does not directly receive any benefits from the loan proceeds and, hence, does not receive a reasonably equivalent value for the guarantee provided.

Upstream vs. Downstream Guarantees

An upstream guarantee, like a downstream guarantee in which the parent company guarantees the subsidiary company’s debt, does not have to be recorded as a liability on the balance sheet. However, it is disclosed as a contingent liability, including any provisions that might enable the guarantor to recover funds paid out in a guarantee.

A downstream guarantee can be undertaken to help a subsidiary company obtain debt financing it otherwise would be unable to obtain, or to obtain funds at lower interest rates.