Upstream Capital Costs Index UCCI What It is How It Works

Contents

- 1 Upstream Capital Costs Index (UCCI): What It is and How It Works

- 1.1 What Is the Upstream Capital Costs Index (UCCI)?

- 1.2 Understanding the Upstream Capital Costs Index (UCCI)

- 1.3 Components of the UCCI

- 1.4 History of the UCCI

- 1.5 Meaning of "Upstream" in the Oil and Gas Industry

- 1.6 Meaning of "Downstream"

- 1.7 Meaning of "Midstream" in the Oil and Gas Industry

- 1.8 The Bottom Line

Upstream Capital Costs Index (UCCI): What It is and How It Works

What Is the Upstream Capital Costs Index (UCCI)?

The Upstream Capital Costs Index (UCCI) tracks the composite capital cost of materials, facilities, equipment, and personnel for oil and natural gas producing projects. Cambridge Energy Research Associates (CERA), now owned by S&P Global, manages the index.

Key Takeaways

- The Upstream Capital Costs Index (UCCI) tracks the capital cost of materials, facilities, equipment, and personnel for oil and natural gas producing projects.

- S&P Global, formerly IHS Markit, owns and manages the UCCI.

- The index serves as a benchmarking tool for analysts, traders, and others interested in the oil and gas industry.

Understanding the Upstream Capital Costs Index (UCCI)

S&P Global’s Upstream Capital Costs Index (UCCI) offers a benchmarking tool for analysts, traders, and others interested in the oil and gas industry. It helps track and forecast the performance of oil and gas properties.

The UCCI is one of the indexes published by S&P Global, a global data and advisory firm. Other indexes include:

- Upstream Operating Costs Index (UOCI), tracking costs for oil and gas field operations

- Downstream Capital Costs Index (DCCI), tracking capital expenses for petroleum projects

- North American Cost Index (NACI), investigating the cost of producing oil and natural gas in North America

- Upstream Innovation Index (UII), tracking the cost of efficiency and design changes on projects

Components of the UCCI

The UCCI includes a diversified portfolio of liquified natural gas (LNG), pipeline, onshore, and offshore projects in various locations. It examines changes to operating and capital costs over specific time frames.

Oil and gas production encompasses upstream, midstream, and downstream stages. The upstream segment involves exploration and production (E&P) of oil and natural gas. Many integrated oil companies combine upstream activities with midstream and downstream operations.

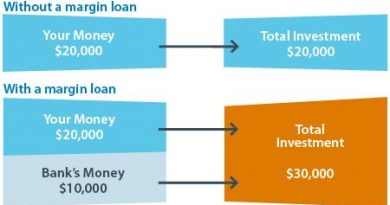

The composite cost of capital is a company’s cost to finance its projects, known as the weighted average cost of capital (WACC). A high composite cost of capital indicates high borrowing costs.

History of the UCCI

Cambridge Energy Research Associates (CERA), established in 1983, focuses on energy research and consulting for the energy industry. It is a leading authority on energy markets and related trends and statistics.

CERA serves as an advisory source for government departments and private companies. IHS Energy acquired CERA in 2004. In 2009, the joint organization adopted the name IHS CERA, Inc. IHS CERA merged with S&P Global in February 2022.

Meaning of "Upstream" in the Oil and Gas Industry

In extractive industries, "upstream" refers to the initial stages of operation, such as exploration, drilling, and mining. "Upstream costs" are the costs of drilling and pumping mineral resources before shipping them to the next stage of production.

Meaning of "Downstream"

In extractive industries, "downstream" refers to the final stages of operation before products are sold to consumers. In petrochemical industries, it can include refining and transportation to the final destination.

Meaning of "Midstream" in the Oil and Gas Industry

In extractive industries, "midstream" refers to intermediate operations between extraction and delivering final products to consumers. This includes piping and transportation operations between extraction points and refineries, as well as plants that remove sulfur from raw natural gas and produce natural gas liquids.

The Bottom Line

The Upstream Capital Costs Index (UCCI) measures the capital costs for businesses that extract oil and natural gas. It is part of a larger family of indexes published by S&P Global to evaluate costs for companies in those industries.