Mass Index Overview and Examples in Technical Analysis

Contents

Mass Index: Overview and Examples in Technical Analysis

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is Mass Index?

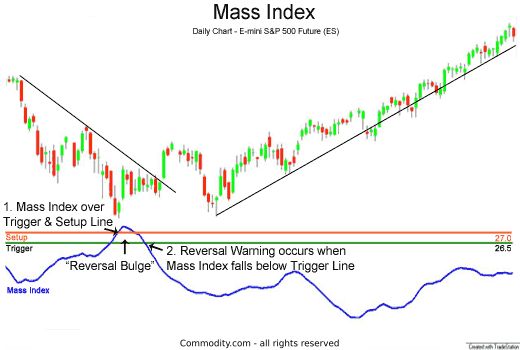

Mass index is a form of technical analysis that examines the range between high and low stock prices over a period of time. Developed by Donald Dorsey in the early 1990s, mass index suggests that a reversal of the current trend will likely occur when the range widens beyond a certain point and then contracts.

Breaking Down Mass Index

By analyzing the narrowing and widening of trading ranges, mass index identifies potential reversals based on market patterns that aren’t often considered by technical analysts focused on singular price and volume movements. However, since the patterns do not provide insight into the direction of the reversals, technical analysts should combine the indicator’s readings with directional indicators, like the A/D line, that specialize in predicting those types of things.

To determine the mass index, calculate the nine-day exponential moving average (EMA) of the range between the high and low prices for a period of time—typically 25 days. Then divide this figure by the nine-day exponential moving average of the moving average in the numerator. The equation looks like this:

∑ 1 25 9 − Day EMA of (High − Low ) 9 − Day EMA of a 9 − Day EMA of (High − Low )

Dorsey hypothesized that when the figure jumps above 27—creating a "bulge"—and then drops below 26.5, the stock is ready to change course. An index of 27 represents a volatile stock, so traders may set a lower baseline when determining the presence of a price bulge.

While you can use other technical indicators, such as standard deviation, to measure volatility, the reversal bulge function of the mass index provides a unique perspective on market conditions. Mass index can also be used to trade trend continuations.

The mass index indicator can be a useful tool for short-term trading if a trader adjusts the sensitivity or periods based on the historical volatility of the particular stock being studied.

Hypothetical Illustration of Mass Index

To understand mass index, imagine driving a car with the mass index calculator as your speedometer. The speedometer only shows how fast or slow you are going, so you need a compass to determine if you are driving north or south—the compass being another technical indicator for direction. In other words, if you don’t know your direction, it doesn’t matter how fast you’re going.