Trust Preferred Securities TruPS What it is How it Works

Trust Preferred Securities (TruPS): What it is, How it Works

What Were Trust Preferred Securities (TruPS)?

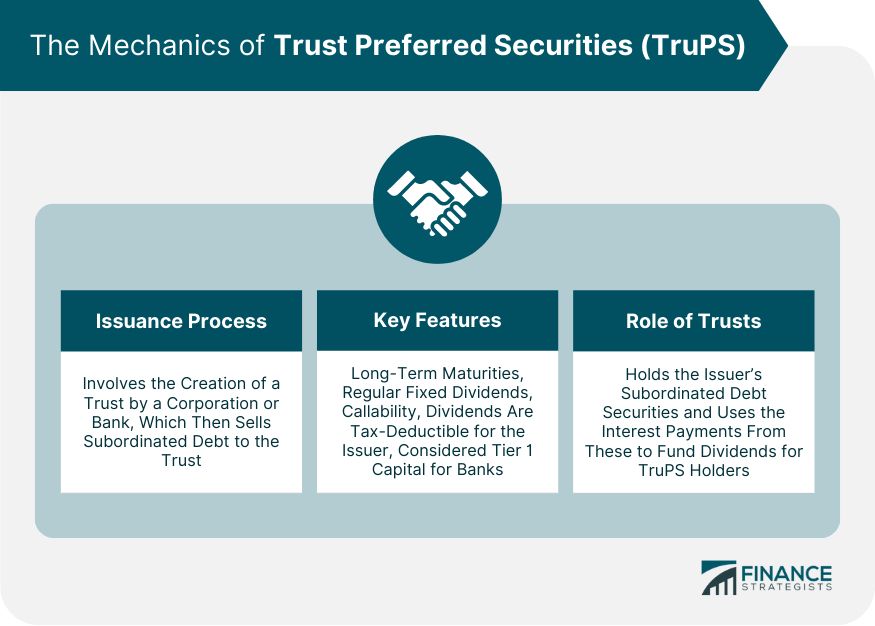

Trust preferred securities (TruPS) were hybrid securities issued by banks and bank holding companies (BHCs) included in regulatory tier 1 capital. The dividend payments for the issuer were tax deductible.

The bank would open a trust funded with debt, then carve up shares of the trust and sell them to investors as preferred stock, creating a trust preferred security or TruPS.

First issued in 1996, TruPS faced increased regulatory scrutiny after the 2008-09 financial crisis. The majority of TruPS were phased out by the Dodd-Frank reforms and the Volcker Rule by the end of 2015.

Key Takeaways

– TruPS were bank-issued securities with characteristics of both debt and stock.

– Most TruPS were phased out following the 2008-09 financial crisis.

– TruPS were issued by banks or bank holding companies through debt issuance, representing preferred stock of a trust.

– TruPS usually had higher periodic payments than preferred stock and could have up to a 30-year maturity.

– A disadvantage for issuers is the cost, as investors demand higher returns for investments with provisions like deferral of interest payments or early redemption.

Understanding Trust Preferred Securities (TruPS)

Trust preferred securities have characteristics of both stock and debt. While the trust is funded with debt, the issued shares are considered preferred stock and pay dividends like preferred stock. However, the payments investors receive are considered interest payments and are taxed as such by the IRS.

TruPS usually offer higher periodic payments than preferred stock and can have a maturity of up to 30 years due to the long maturity timeline of the debt used to fund the trust. The payments can be on a fixed schedule or variable, with some provisions allowing for the deferral of interest payments for up to five years. The TruPS matures at face value at the end of the term, but early redemption is possible.

Companies create trust preferred securities for their favorable accounting treatments and flexibility. These securities are taxed like debt obligations by the IRS but appear as equities in a company’s accounting statements according to GAAP procedures. The issuing bank pays tax-deductible interest payments into the trust, which are distributed to the trust’s shareholders.

It is important to note that buying a trust preferred security means buying a portion of the trust and its underlying holdings, not a share of ownership in the bank itself.

Special Considerations

The Dodd-Frank financial reform act, passed in 2010, called for the phase-out of the Tier 1 capital treatment of trust preferred securities issued by institutions with over $15 billion in assets by 2013. This increased funding requirements for banks, reduced incentives for banks to issue TruPS, and proposed the elimination of trust preferred securities as Tier 1 regulatory capital altogether through the "Collins Amendment."

One of the disadvantages for companies issuing TruPS is the cost. Trusts may have features like deferral of interest payments and early redemption of shares, making them less attractive to investors. As a result, the rates on trust preferred securities are typically higher than those of other types of debt. Additionally, investment banking fees for underwriting the securities can be substantial.