Uptick Volume

Maya Dollarhide is a financial journalist with over 10 years of experience helping people understand challenging financial topics, such as managing student loans, buying a home, and saving for retirement.

Uptick volume refers to the volume of shares traded while a stock price rises. It is one of many indicators used by investors to make buy and sell decisions.

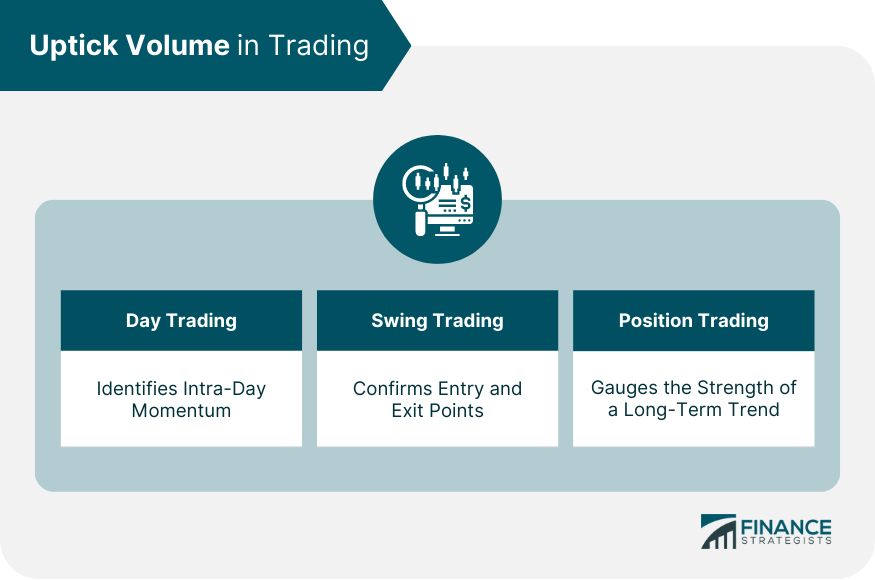

Traders who engage in technical analysis commonly use uptick volume to determine a stock’s net volume—the measurement of its momentum—by subtracting the uptick volume from the downtick volume.

Key Takeaways:

– Uptick volume is the volume of shares traded while a stock price is on the rise.

– Traders who engage in technical analysis commonly use uptick volume in their trading strategies.

– Investors look for uptick volume as evidence of a stock’s early stages of a significant move upwards.

– Stock prices typically find resistance when both upward and downward momentum is thwarted, making no clear trend evident.

– Trading volume can show market volatility.

Uptick volume is used in trading strategies by investors focused on chart trends rather than company fundamentals. It measures the volume of shares traded while the stock price rises.

Investors look for uptick volume as evidence of a stock’s early stages of a significant move upwards. Breaking upward from the resistance zone is referred to as uptick volume.

Investors use the uptick/downtick indicator to determine whether to buy, sell, or short a particular stock. They compare the data to see whether the money flow trend is positive or negative.

Investors can use a stock’s net value to determine whether there’s a bullish or bearish trend in the market.

Uptick volume indicates a stock will trend upward, while downtick volume outlines when a stock price will reverse and drop. Used together, they calculate a stock’s net volume.

Uptick volume is a subset of technical analysis, which uses charts to see movements and patterns in stock prices and volumes over time.

Fundamental analysis is important for long-term investors, while technical analysis is used by day traders and others who rely on stock movements for quick profits.

Other trading indicators, such as the Accumulation Area and the Joseph Effect, help determine stock price and volume momentum. Seasoned investors use multiple models to avoid false signals.