Marginal Cost Meaning Formula and Examples

Marginal Cost: Meaning, Formula, and Examples

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is Marginal Cost?

In economics, marginal cost is the change in total production cost that comes from making or producing one additional unit. To calculate marginal cost, divide the change in production costs by the change in quantity. Analyzing marginal cost helps determine when an organization can achieve economies of scale and optimize production and overall operations. If the marginal cost of producing one additional unit is lower than the per-unit price, the producer can potentially gain a profit.

Key Takeaways

- Marginal cost is an important concept in managerial accounting, helping organizations optimize production through economies of scale.

- Companies can maximize profits by producing to the point where marginal cost (MC) equals marginal revenue (MR).

- Fixed costs are constant regardless of production levels, while variable costs change based on production levels.

- Companies must be aware of step costs that arise from increasing production, such as the need for additional machinery or storage space.

Marginal Cost Formula

Marginal cost is calculated as the total expenses required to manufacture one additional unit. Therefore, it can be measured by changes in expenses incurred for any given additional unit.

Marginal Cost = Change in Total Expenses / Change in Quantity of Units Produced

The change in total expenses is the difference between the cost of manufacturing at two different levels. For example, if the cost increases from $1,000,000 to $1,050,000, the change in total expenses is $50,000.

The change in quantity of units is the difference between the number of units produced at two varying levels of production. Marginal cost is based on a per-unit assumption, so the formula should be used when calculating the cost for a single unit. For example, if the company manufactured 24 pieces of heavy machinery for $1,000,000 and increased production to 25 total units, the change in quantity of units produced is one.

The formula above can be used when manufacturing more than one additional unit, but management must be aware that groups of production units may have materially varying levels of marginal cost.

Understanding Marginal Cost

Marginal cost is an economics and managerial accounting concept used by manufacturers to determine the most efficient level of production. At a certain level of production, producing one additional unit and generating revenue from that item reduces the overall cost of producing the product line. The key is to optimize manufacturing costs by identifying that point as quickly as possible.

Marginal costs include all costs that vary with the level of production. For example, if a company needs to build a new factory to produce more goods, the cost of building the factory is a marginal cost that varies based on the volume of goods being produced.

Maximizing profits involves producing up to the point where marginal cost (MC) equals marginal revenue (MR). Beyond that point, the cost of producing an additional unit exceeds the revenue generated.

Important

Economic factors that may impact marginal cost include information asymmetries, positive and negative externalities, transaction costs, and price discrimination.

Benefits of Marginal Cost

When a company knows its marginal cost and marginal revenue for different product lines, it can allocate resources to items that maximize returns. Instead of investing in minimally successful goods, the company can focus on producing units that generate maximum returns.

Marginal cost helps determine when it is no longer profitable to produce additional goods. If marginal cost exceeds marginal revenue, it is no longer financially profitable to manufacture that additional unit. With this information, a company can decide whether it is worth investing in additional capital assets.

Marginal cost also assists in evaluating additional or custom orders. By considering marginal cost, a company can determine if accepting an order at a special price is worth it.

Example of Marginal Cost

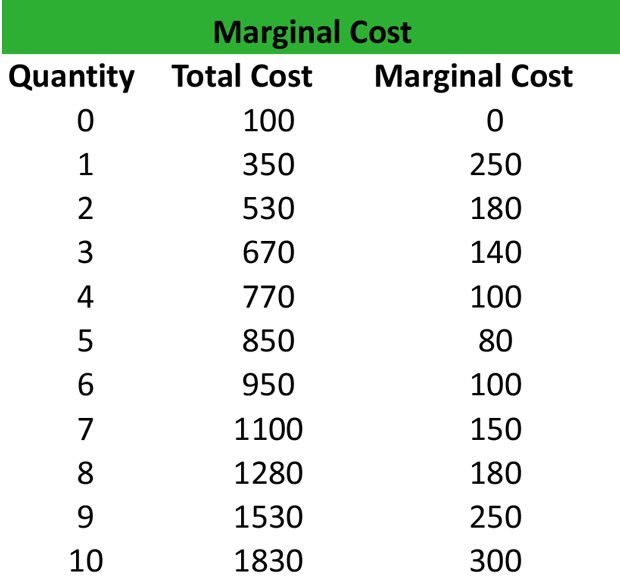

Production costs consist of fixed costs and variable costs. Fixed costs do not change with production levels, so the cost per unit decreases with increased production. Variable costs, on the other hand, increase as more units are produced.

For example, a company that makes hats incurs $0.75 of plastic and fabric costs for each hat produced. These costs are variable. The hat factory also incurs $1,000 in fixed costs per month.

If the company manufactures 500 hats per month, each hat incurs $2 of fixed costs. The total cost per hat would be $2.75.

If the company boosts production to 1,000 hats per month, each hat would incur $1 of fixed costs. The total cost per hat would then drop to $1.75. Increasing production volume reduces marginal costs.

If the hat factory cannot handle additional production units with its current machinery, the cost of adding another machine must be included in marginal cost. For example, if the machinery can only handle 1,499 units, the 1,500th unit would require purchasing an additional $500 machine. The cost of the new machine needs to be considered in the marginal cost calculation.

Marginal cost also affects average cost. If marginal cost is less than average cost, producing additional units decreases average cost. If marginal cost is more, producing more units increases average cost per unit.

Special Considerations

Marginal cost is often graphically depicted as the relationship between marginal revenue and average cost. Although the marginal cost slope varies across companies and products, it typically follows a "U" shape, initially decreasing and potentially exponentially increasing.

Internal vs. External Reporting

Marginal cost is strictly an internal reporting calculation and not required for external financial reporting. Public financial statements do not include marginal cost figures, as they are used internally for devising strategies.

Disclosing marginal cost may put a company at a disadvantage. Competitors would gain insight into the company’s cost structure, and the market could pressure the company by targeting its unprofitable manufacturing levels.

Relevant Range

Marginal cost highlights that an incremental unit is less expensive within the current relevant range. However, additional step costs or burdens beyond the relevant range result in significantly higher marginal costs that management must consider.

For example, consider a warehouse for a manufacturer of landscaping equipment with capacity for 100 extra-large riding lawnmowers. The marginal cost to manufacture the 98th, 99th, or 100th lawnmower may not vary widely. However, manufacturing the 101st lawnmower exceeds the warehouse’s storage capabilities. Storage space for the 101st lawnmower incurs an additional cost, which must be considered in the marginal cost calculation.

Pricing Strategy

Marginal cost significantly influences the marginal cost pricing doctrine, which proposes predicated prices on marginal costs for economic efficiency. The doctrine, originating from Alfred E. Kahn’s work, suggests that under pure competition, price is set equal to marginal cost. This approach maximizes consumer satisfaction and optimizes the use of limited resources.

The Bottom Line

Marginal cost helps optimize production levels to achieve efficiency in the manufacturing process. A company should continue producing goods as long as the marginal cost is less than the marginal revenue. By understanding marginal cost, companies can make informed decisions on production levels, profitability, and resource allocation.