Uncovered Interest Rate Parity UIP Definition and Calculation

Uncovered Interest Rate Parity (UIP): Definition and Calculation

What Is Uncovered Interest Rate Parity (UIP)?

Uncovered interest rate parity (UIP) theory states that the difference in interest rates between two countries will equal the relative change in currency exchange rates over the same period. It is one form of interest rate parity (IRP) used alongside covered interest rate parity. If the uncovered interest rate parity relationship does not hold, then there is an opportunity to make a risk-free profit using currency arbitrage or forex arbitrage.

Key Takeaways

– UIP is a fundamental equation in economics that governs the relationship between foreign and domestic interest rates and currency exchange rates.

– The basic premise of interest rate parity is that, in a global economy, the price of goods should be the same everywhere (the law of one price) once interest rates and currency exchange rates are factored in.

– UIP can be contrasted with covered interest rate parity, which involves using forward contracts to hedge exchange rates for forex traders.

Uncovered Interest Rate Parity

The Formula for Uncovered Interest Rate Parity Is:

F0 = S01 + ic1 + ib

where:

F0 = Forward rate

S0 = Spot rate

ic = Interest rate in country c

ib = Interest rate in country b

How to Calculate Interest Rate Parity

Uncovered interest rate parity is based on the theory that countries with high interest rates tend to have currencies that often depreciate. This is calculated through the formula above, which takes the spot exchange rate between the two currencies and multiplies this by the interest rate in one country, divided by the interest rate in the second country.

In theory, the expected spot exchange rate will be equal to the gap between the two countries’ interest rates.

However, if this does not materialize, investors can make a profit through taking a loan in a low interest rate currency and using it to purchase a high interest rate currency.

A currency with a lower interest rate will trade at a forward premium in relation to a currency with a higher interest rate. For example, the U.S. dollar typically trades at a forward premium against the Canadian dollar; conversely, the Canadian dollar trades at a forward discount versus the U.S. dollar.

What Does Uncovered Interest Rate Parity Tell You?

Uncovered interest rate parity conditions consist of two return streams: one from the foreign money market interest rate on the investment and one from the change in the foreign currency spot rate. Uncovered interest rate parity assumes foreign exchange equilibrium, thus implying that the expected return of a domestic asset will equal the expected return of a foreign asset after adjusting for the change in foreign currency exchange spot rates.

When uncovered interest rate parity holds, there can be no excess return earned from simultaneously going long a higher-yielding currency investment and shorting a different lower-yielding currency or interest rate spread. Uncovered interest rate parity assumes that the country with the higher interest rate or risk-free money market yield will experience depreciation in its domestic currency relative to the foreign currency.

UIP is related to the "law of one price," which states that the price of an identical security, commodity, or product traded anywhere in the world should have the same price regardless of location when currency exchange rates are taken into consideration.

The difference between Covered Interest Rate Parity and Uncovered Interest Rate Parity

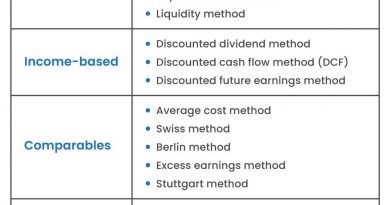

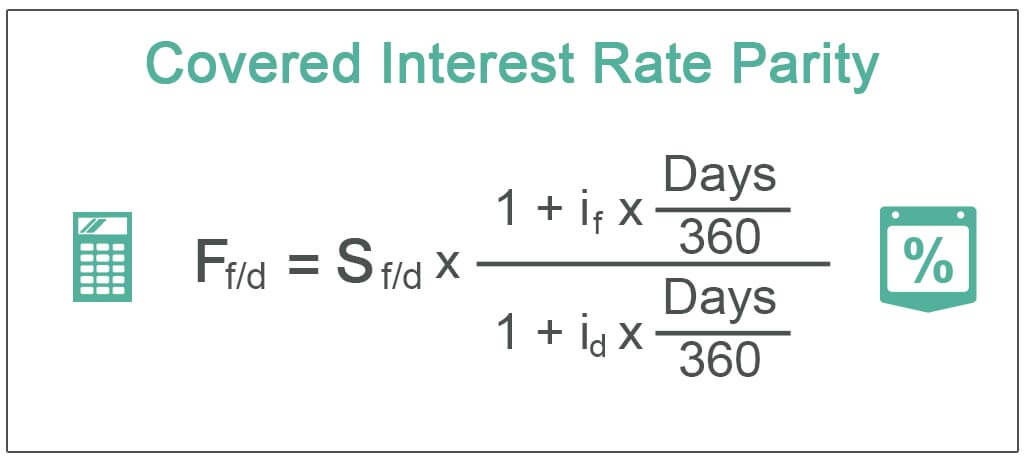

Covered interest parity (CIP) involves using forward or futures contracts to cover exchange rates, thus hedging in the market. Meanwhile, uncovered interest rate parity (UIP) involves forecasting rates and not covering exposure to foreign exchange risk – there are no forward rate contracts, and it uses only the expected spot rate.

There is no theoretical difference between covered and uncovered interest rate parity when the forward and expected spot rates are the same.

Limitations of Uncovered Interest Parity

There is limited evidence to support UIP, but economists, academics, and analysts still use it as a theoretical and conceptual framework to represent rational expectation models. UIP requires the assumption that capital markets are efficient.

Empirical evidence has shown that over the short and medium-term periods, the level of depreciation of the higher-yielding currency is less than the implications of uncovered interest rate parity. Many times, the higher-yielding currency has strengthened instead of weakened.

What Is Interest Rate Parity in Simple Terms?

Interest rate parity looks at two core components: the currency exchange between two countries and each currency’s interest rate. Interest rate parity is a theory that suggests that the difference between these two countries is equal to the changes in the foreign exchange rate over a given time period.

What Are the Two Types of Interest Rate Parity?

The two main types of interest rate parity are covered and uncovered. Covered includes the use of forward or futures contracts that are intended to cover exchange rates and serve as a hedge. Uncovered does not involve these forward contracts to cover foreign exchange risk, instead using expected spot rates.

What Would an Uncovered Interest Arbitrage Imply?

Uncovered interest arbitrage implies that foreign exchange investors can turn a profit through taking out a loan in a currency that has a low interest rate and buying a foreign currency with a high interest rate.

The Bottom Line

Uncovered interest rate parity is based on the theory that foreign exchange rates smooth out the differentials between the interest rates of two different countries. However, this theory may not always hold. Macroeconomic factors, such as monetary policy, distortions in foreign exchange markets, and time horizons can affect the validity of this theory.

For this reason, investors may use this as an opportunity to earn money through taking a loan in a domestic currency with low interest rates and buying a foreign currency with higher rates as market imperfections and other factors affect the movement of currencies.