Marginal Propensity To Consume MPC in Economics With Formula

Marginal Propensity To Consume (MPC) in Economics:

David is experienced in financial and legal research and publishing. As a Dotdash fact checker since 2020, he has validated over 1,100 articles on financial and investment topics.

What Is Marginal Propensity To Consume (MPC)?

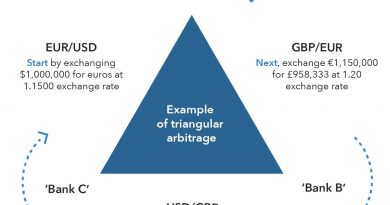

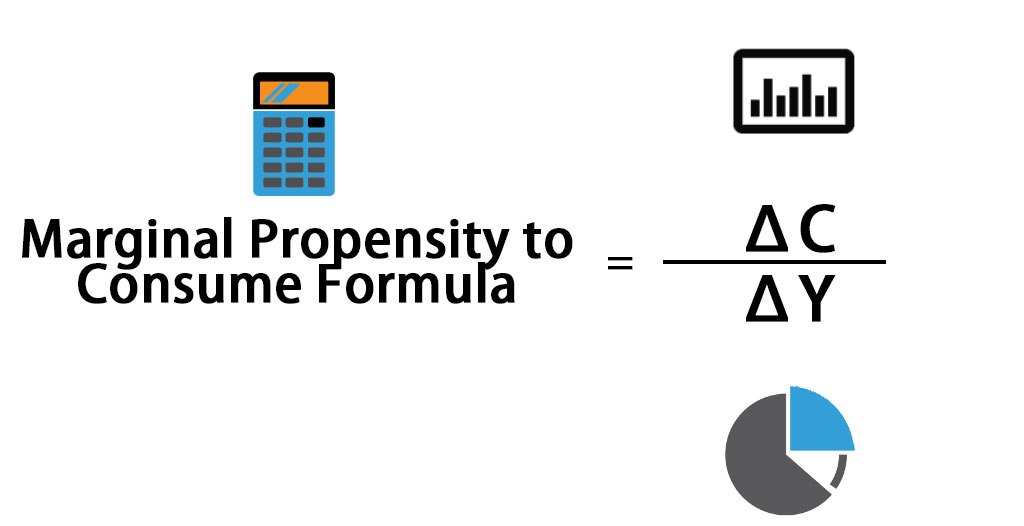

In economics, the marginal propensity to consume (MPC) is the proportion of an aggregate increase in pay that a consumer spends on goods and services, as opposed to saving. MPC is a component of Keynesian macroeconomic theory and is calculated as the change in consumption divided by the change in income.

MPC is depicted by a consumption line, which plots the change in consumption on the vertical "y" axis and the change in income on the horizontal "x" axis.

Key Takeaways:

– Marginal propensity to consume is the proportion of an increase in income that gets spent on consumption.

– MPC varies by income level, typically lower at higher incomes.

– MPC is the key determinant of the Keynesian multiplier, which describes the effect of increased investment or government spending as an economic stimulus.

Understanding Marginal Propensity To Consume (MPC):

The marginal propensity to consume is equal to ΔC / ΔY, where ΔC is the change in consumption and ΔY is the change in income. If consumption increases by 80 cents for each additional dollar of income, then MPC is equal to 0.8 / 1 = 0.8.

Suppose you receive a $500 bonus on top of your normal annual earnings. You suddenly have $500 more in income. If you decide to spend $400 of this increase on a new suit and save the remaining $100, your marginal propensity to consume will be 0.8 ($400 divided by $500).

The other side of the marginal propensity to consume is the marginal propensity to save, which shows how a change in income affects levels of saving. Marginal propensity to consume + marginal propensity to save = 1. In the suit example, your marginal propensity to save will be 0.2 ($100 divided by $500).

If you decide to save the entire $500, your marginal propensity to consume will be 0 ($0 divided by 500), and your marginal propensity to save will be 1 ($500 divided by 500).

MPC and Economic Policy:

Given data on household income and spending, economists can calculate households’ MPC by income level. This calculation is important because MPC varies by income level. Typically, higher incomes result in lower MPC as more wants and needs are satisfied, leading to increased savings. At low-income levels, MPC tends to be much higher as most or all income must be used for subsistence consumption.

According to Keynesian theory, an increase in investment or government spending increases consumers’ income, leading to increased spending. By estimating the MPC, economists can calculate the total impact of a prospective increase in incomes and the resulting increase in consumption. This process is known as the Keynesian multiplier.

What Is Marginal Propensity To Consume in Simple Terms?

The marginal propensity to consume measures the degree to which a consumer will spend or save in relation to an increase in pay. Higher incomes tend to have lower levels of marginal propensity to consume due to already satisfied consumption needs and higher savings. In contrast, lower-income levels experience a higher marginal propensity to consume as a higher percentage of income is directed towards daily living expenses.

How Do You Calculate Marginal Propensity To Consume?

To calculate the marginal propensity to consume, divide the change in consumption by the change in income. For example, if spending increases by 90 cents for each new dollar of earnings, the MPC would be 0.9/1 = 0.9. Alternatively, if someone receives a $1,000 bonus and spends $100 while saving $900, the marginal propensity to consume would be $100/$1,000 or 0.1.

What Role Does the Marginal Propensity To Consume Have in Economics?

In Keynesian macroeconomic theory, the marginal propensity to consume is a key variable that demonstrates the multiplier effect of economic stimulus spending. An increase in government spending leads to increased consumer income, which in turn increases consumer spending. This increase in investment stimulates higher aggregate demand.