Lost Decade in Japan History and Causes

Contents

Lost Decade in Japan: History and Causes

What Is the Lost Decade?

The Lost Decade refers to the economic stagnation in Japan during the 1990s, one of the longest-running economic crises in recorded history. Some definitions include later decades, extending the period from 1991-2011 (or even 1991-2021), known as Japan’s Lost Decades.

Key Takeaways

- The Lost Decade referred to a period of slow to negative economic growth in Japan’s economy during the 1990s.

- Stagnant growth in subsequent years led to the term Japan’s Lost Decades.

- Misguided government policies after a real estate bubble are considered the main culprits for the Lost Decade.

- The first decade of the 21st century, bookended by two stock market crashes, is often compared to Japan’s Lost Decade in the US economy.

Understanding the Lost Decade

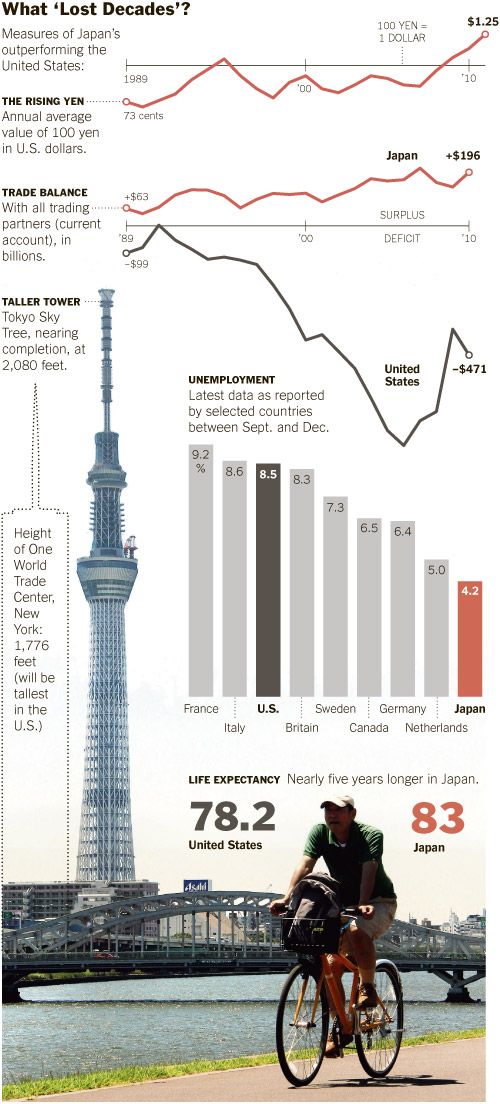

The Lost Decade refers to the decade-long economic crisis in Japan during the 1990s. Japan experienced rapid economic growth after World War II, becoming the world’s leader in per capita gross national product (GNP) in the 1980s. The country’s export-led growth and trade surplus with the U.S. attracted capital.

In 1985, Japan joined other major economies in the Plaza Agreement to address global trade imbalances. This led to a period of loose monetary policy in the late 1980s, resulting in increased speculation, a soaring stock market, and real estate valuations.

In the early 1990s, as the bubble was about to burst, the Japanese Financial Ministry raised interest rates, causing the stock market to crash and a debt crisis to begin. This halted economic growth and marked the start of the Lost Decade. Japan’s gross domestic product (GDP) averaged 1.3% during the 1990s, significantly lower than other G-7 countries. Despite increased household savings, deflation plagued the economy due to lacking demand.

The Lost Decades

In the following decade, Japan’s GDP growth averaged only 0.5% per year, continuing until the global financial crisis. From 1991 to 2010, the period is known as the Lost Score or the Lost 20 Years.

From 2011 to 2019, Japan’s GDP grew by under 1.0% per year, and the Covid-19 pandemic further impacted the global recession starting in 2020. The years from 1990 to the present are sometimes referred to as Japan’s Lost Decades.

According to research from the Federal Reserve Bank of St. Louis, Japan’s GDP is projected to double every 80 years, compared to the previous average of 14 years.

What Caused The Lost Decade?

The causes for Japan’s sustained economic woes during the Lost Decade are still debated. Demographic factors, like an aging population, and the rise of China and other East Asian competitors, may be underlying non-economic factors. Various papers propose reasons for the prolonged stagnation.

Keynesian economists suggest demand-side explanations. Paul Krugman argues that Japan was caught in a liquidity trap, with consumers holding onto their savings due to economic uncertainty. Research also highlights the role of decreasing household wealth in causing the crisis. The book Japan’s Lost Decade blames a "vertical investment-saving" curve.

Monetarist economists point to Japan’s restrictive monetary policy before and during the Lost Decade as hindering growth. Milton Friedman suggests that increasing the rate of monetary growth, without overdoing it, would facilitate financial and economic reforms.

Despite attempts at Keynesian and Monetarist solutions, Japan’s government’s repeated fiscal deficit spending and expansionary monetary policy have not resolved the economic malaise. This suggests that alternative explanations, such as those offered by Austrian economists, may be more insightful. Austrian economists argue that Japan’s economic policies focused on propping up existing firms and financial institutions, hindering creative destruction and entrepreneurship.