Marginal Propensity to Save MPS Definition and Calculation

Marginal Propensity to Save (MPS): Definition and Calculation

What Is Marginal Propensity to Save (MPS)?

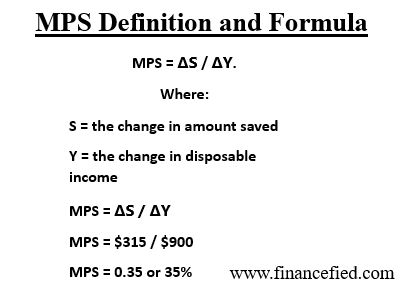

In Keynesian economics, marginal propensity to save (MPS) refers to the proportion of additional income that a consumer saves rather than spends on goods and services. MPS is a component of Keynesian macroeconomics and is calculated as the change in savings divided by the change in income.

MPS = Change in Saving ÷ Change in Income

MPS is depicted by a savings line: a sloped line showing change in savings on the y-axis and change in income on the x-axis.

Key Takeaways

– MPS is the proportion of income increase that gets saved instead of spent.

– MPS varies by income level and is typically higher at higher incomes.

– MPS helps determine the Keynesian multiplier, which describes the effect of increased investment or government spending as an economic stimulus.

Example of Marginal Propensity to Save (MPS)

Suppose you receive a $500 bonus with your paycheck. You suddenly have $500 more in income than before. If you spend $400 of this increase on a new suit and save the remaining $100, your marginal propensity to save is 0.2 ($100 change in saving divided by $500 change in income).

Understanding Marginal Propensity to Save (MPS)

Economists can calculate households’ MPS by income level using data on household income and saving. This calculation is important because MPS can vary by income level. Generally, as income increases, so does MPS. However, a consumer’s savings and consumption habits may change with a pay increase.

With a higher salary, it becomes easier to cover household expenses and save. A higher salary also provides access to goods and services that require greater expenditures, like luxury vehicles or new residences.

Knowing consumers’ MPS enables economists to determine how government spending or investment will affect saving. MPS is used to calculate the expenditures multiplier, which shows how changes in consumers’ MPS influence the economy.

Marginal Propensity to Consume (MPC)

MPC, the complement to MPS, shows how a change in income affects spending levels.

MPC = Change in Spending ÷ Change in Income

Using the previous example, where you spent $400 of your $500 bonus, the MPC is 0.8 ($400 divided by $500).

MPC and MPS always add up to one.

What does MPS describe?

MPS refers to the amount of income raise that a person saves rather than spends.

What is MPC?

MPC refers to the amount of income raise that a person spends rather than saves. It complements MPS, and together they always equal one.

What is the purpose of determining MPS?

MPS helps understand how government spending and investment influence saving and the economic impact they have.

The Bottom Line

MPS is an economic theory that calculates how much of a raise a person would save. It varies at different income levels and helps economists theorize about the impact of individual incomes on the broader economy.