Unbanked What It Means Statistics Solutions

Unbanked: What It Means, Statistics, Solutions

What Is Unbanked?

Unbanked refers to adults who do not use or have access to traditional financial services, including savings accounts, credit cards, or personal checks. This term is often used to describe adults in the developing world but can also apply to pockets of unbanked adults in developed countries like the United States.

Key Takeaways

– The unbanked are adults who do not use or have access to traditional financial services.

– They are often concentrated in less developed countries or poorer regions of developed countries.

– Lack of money, trust, and privacy concerns are the main reasons people in the U.S. are unbanked.

– Governments and organizations have initiated programs to help the unbanked, such as the Federal Deposit Insurance Corp.’s (FDIC’s) Money Smart program.

Understanding the Unbanked

Unbanked individuals primarily use cash, money orders, or prepaid debit cards for transactions. They usually do not have insurance, pensions, or other professional money-related services. If available, they may use alternative financial services like check cashing and payday lending.

Unbanked vs. Underbanked

Underbanked refers to families with checking or savings accounts who still rely on alternative financial services, such as money orders, check cashing, and payday loans, to manage their finances.

Unbanked Households in the United States

A Federal Deposit Insurance Corp. (FDIC) study found that in 2021, 5.9 million or 4.5% of American households were unbanked, the lowest recorded since 2009. The 2019 study estimated that 7.1 million or 5.4% of households were unbanked. Unbanked rates tend to be higher among households with low, volatile, or no income. Education also plays a role, as individuals without a high school diploma are more likely to be unbanked.

Black and Latinx households are overrepresented among the unbanked. While they make up 32% of the U.S. population, they represent 64% of unbanked households.

The rate of unbanked households varies across states. The highest rate remains in the South at 4.9%. In other regions, the rates are 4.2% in the Midwest, 4.2% in the West, and 4.1% in the Northeast. Mississippi has the highest rate at 11.1%, while Utah has the lowest at 1.2%.

According to the Federal Reserve, 6% of U.S. households were unbanked in 2022.

Why People Become Unbanked

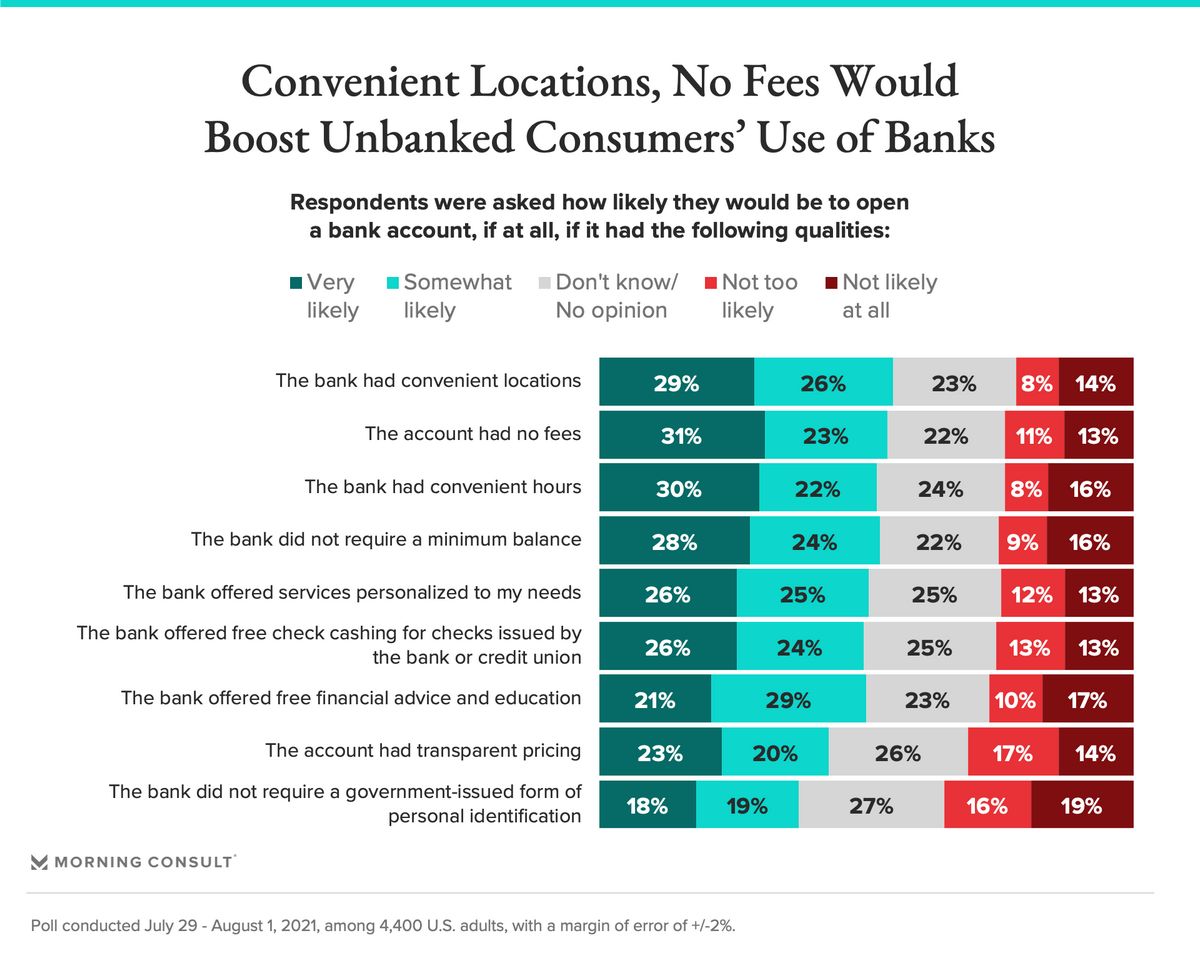

The main reason for being unbanked is cost. Traditional banks often have minimum balance requirements that unbanked individuals cannot meet. They also don’t provide the necessary financial services and products for this population. Alternative financial services are more accessible and convenient in areas with limited banking options.

Distrust in banking institutions is another factor, particularly among marginalized communities who have experienced lending discrimination. Lack of trust may also stem from banking crises in immigrants’ home countries.

Being unbanked is not solely due to financial illiteracy. Half of unbanked individuals have previously held a bank account.

Initiatives to Help the Unbanked

Several state and federal initiatives aim to help the unbanked access banking services and improve financial literacy. Examples include former California Gov. Arnold Schwarzenegger’s Bank on California Initiative and the FDIC’s Money Smart program. The U.S. Treasury Department’s Section 326 regulations enable banks and credit unions to accept identification issued by foreign governments, assisting undocumented immigrants in becoming banked.

Why Is Being Unbanked a Problem?

Being unbanked can lead to higher costs for alternative financial services like cash-checking and payday loans. It also hinders the establishment of creditworthiness, limiting access to emergency funds and worsening financial struggles for individuals and families.

How Many People Are Unbanked?

According to the Federal Reserve, 6% of U.S. adults did not have a bank account in 2022. The FDIC estimated that 5.9 million or 4.5% of American households were unbanked in 2021.

Who Are the Unbanked?

The FDIC identifies lower-income households, less-educated households, Black households, Hispanic households, American Indian or Alaska Native households, working-age disabled households, and single-mother households as having higher unbanked rates.