Truncation What It Is How It Works Example

Contents

Truncation: What It Is, How It Works, Example

What Is Truncation?

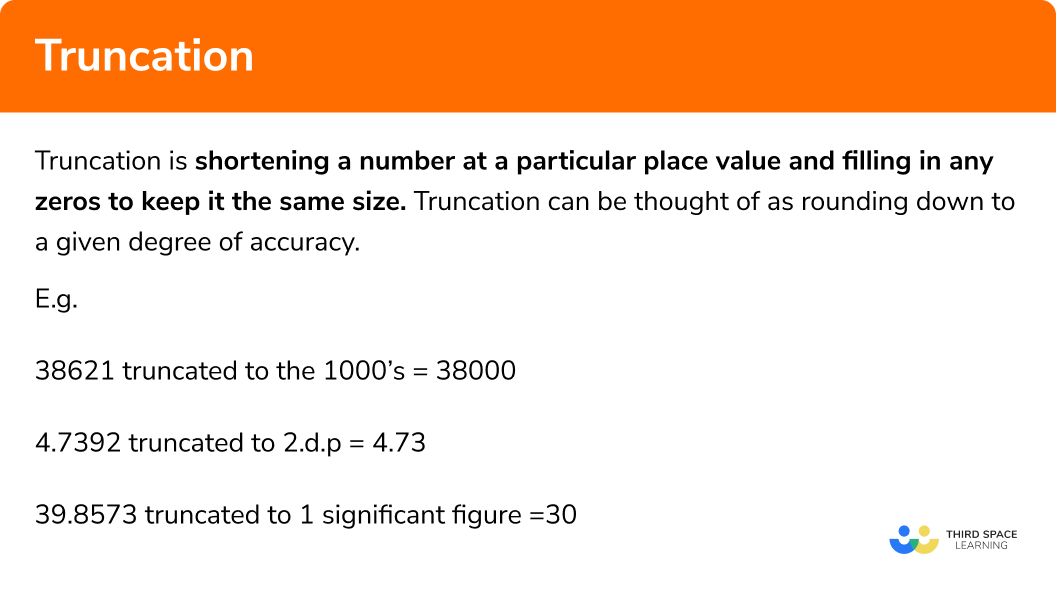

Truncation is the requirement mandated by the Federal Trade Commission (FTC) for merchants to shorten the personal account information printed on credit and debit card receipts.

Key Takeaways

- Truncation is the practice of shortening the credit and debit card information printed on receipts.

- This is a requirement mandated by the Federal Trade Commission (FTC) for all merchants.

- It is intended to make it more difficult for thieves to access card information from stolen transaction records.

- Truncation does not apply to digital transaction records retained by the merchant.

- Under FACTA, merchants can be liable for damages of up to $1,000 for each violation of the truncation requirement.

Understanding Truncation

Truncation requirements are specified in the Fair and Accurate Credit Transactions Act (FACTA) of 2003, a law that amended and expanded the Fair Credit Reporting Act of 1970. FACTA had a focus on preventing identity theft by protecting consumers’ personal data and sensitive financial information.

Under FACTA, businesses that accept credit or debit cards are prohibited from printing more than the last five digits of the card’s number on their receipts. This requirement, which came into effect on Dec. 1, 2006, is designed to help protect customers from credit card fraud and identity theft.

The requirement to truncate card numbers only applies to the receipts that are handed to customers at the point of sale. It does not apply to digital transaction records retained by the merchant. Generally speaking, merchants retain a separate copy of all receipts that contain the customer’s full credit card information. Merchants are permitted to collect and store this information under FACTA, although they must ensure that the records are securely stored and that the privacy of their customers is respected.

Under FACTA, merchants can be liable for damages of up to $1,000 for each violation of the truncation requirement. These damages can be incurred regardless of whether the incident in question actually harmed the customer, a fact which led to numerous individual and class action lawsuits against companies of all sizes for truncation violations in the years after the requirement went into effect. Some courts have ruled that there must be proof of actual harm resulting from the violation in order for the merchant to be penalized.

Example of Truncation

Unfortunately, theft of credit card information continues to be a major problem, affecting millions of consumers each year. According to a report by the FTC, there were more than 1.3 million cases of identity theft in 2020, more than triple the number in 2018. Thieves can use this stolen information in a variety of ways, such as making online purchases, opening new credit accounts, or selling it on the black market.

If not for truncation, thieves could steal most of the information they need for these crimes simply by stealing or finding discarded customer receipts. Truncation makes it much harder for criminals to obtain this information. It is worth noting, however, that the truncation requirement does not apply to manual imprinters or handwritten receipts, making it especially important to securely store or dispose of these types of records.

If not for truncation, thieves could steal most of the information they need for these crimes simply by stealing or finding discarded customer receipts. Truncation makes it much harder for criminals to obtain this information. It is worth noting, however, that the truncation requirement does not apply to manual imprinters or handwritten receipts, making it especially important to securely store or dispose of these types of records.