Unbundled Life Insurance Policy What It Is How It Works

Contents

Unbundled Life Insurance Policy: What It Is, How It Works

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling and both the Retirement Income Certified Professional®, and Certified Retirement Counselor designations for advance retirement planning.

What Is an Unbundled Life Insurance Policy?

An unbundled life insurance policy provides cash to beneficiaries upon a policyholder’s death. It contains a savings and investment component that the policyholder can use during their lifetime.

The policy does not have an expiration date, and the policyholder can adjust the amount and timing of premium payments tied to the death benefit while the policy is in force. Unbundled life insurance is also called universal life insurance.

Key Takeaways

- Unbundled life insurance has a cash value component, in which a portion of each premium payment can be saved and invested on the policyholder’s behalf.

- One of the most noteworthy features of an unbundled life insurance policy is its flexible premiums; the flexibility in premiums is tied to both the option for an adjustable death benefit and the cash value element.

- Unbundled life insurance policies include the option for a savings component; the savings component usually has a stated interest-earning rate.

- Most unbundled life insurance policies come with a policy loan option; the borrowing amount is usually based on the cash value.

Understanding Unbundled Life Insurance Policy

Universal/unbundled life insurance is one of several types of permanent life insurance. It has a cash value component, in which a portion of each premium payment can be saved and invested on the policyholder’s behalf. The other portion of the premium goes toward the death benefit and administrative expenses.

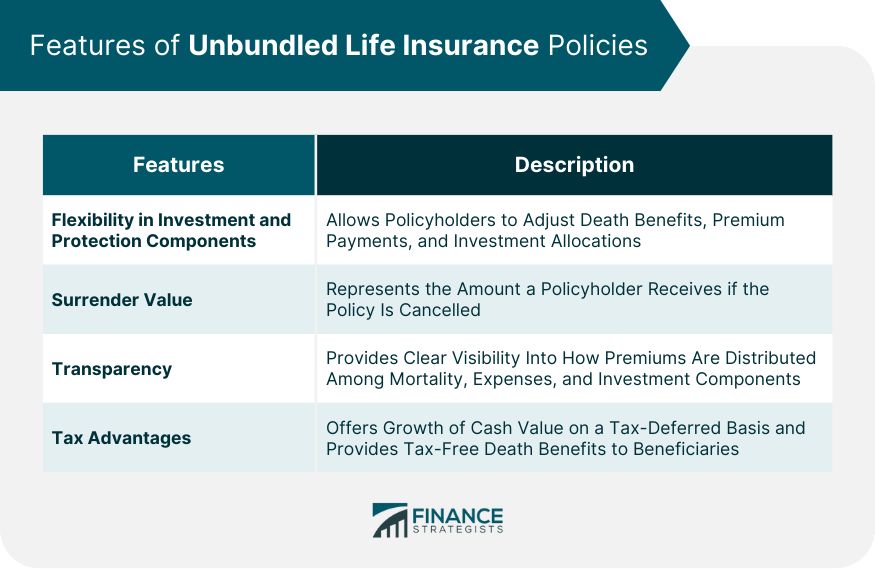

With universal/unbundled life insurance, the premiums and death benefit can be changed during the life of the policy, which is a desirable feature if the policyholder’s needs change. The universal/unbundled policy also clearly discloses the policy’s administrative fees—also called underwriting and sales expense charges—to the policyholder, unlike other types of permanent life insurance policies.

Within the permanent life insurance category, individuals can choose from whole life, universal/unbundled life, variable life, and variable universal life options. Some benefits of the unbundled life insurance policy include its flexibility and transparency in premium payments.

Elements of Unbundled Life Insurance

Every life insurance policy comes with its own provisions, which can vary by company and type. Some basic elements of an unbundled life insurance policy include the following.

Flexible Premiums

One of the most noteworthy features of an unbundled life insurance policy is its flexible premiums. The premiums are based on the coverage amount and policyholder risks. Unbundled life insurance policies allow the policyholder to adjust their death benefit and premium. Premiums can decrease or increase with changes in death benefit coverage.

Cash Value

Unbundled life insurance policies include the option for a savings component with a stated interest-earning rate. Individuals can contribute to the cash value at any time or with payments in excess of their premium. Payments can also come directly from the cash value for added payment flexibility.

Loan Option

Most unbundled life insurance policies come with a policy loan option based on the cash value. This allows the policyholder to obtain tax-free payouts but requires regular payments at a specified interest rate. The loan serves as collateral for missed payments and defaults.

Surrender Options

A surrender option allows the policyholder to terminate the policy and withdraw their cash value. The cash value is subject to surrender charges that vary depending on the year of termination. Cash values can be withdrawn directly by the policyholder. Other alternatives may also exist, such as a paid-in-full life insurance policy death benefit.

A surrender option allows the policyholder to terminate the policy and withdraw their cash value. The cash value is subject to surrender charges that vary depending on the year of termination. Cash values can be withdrawn directly by the policyholder. Other alternatives may also exist, such as a paid-in-full life insurance policy death benefit.