Transfer Risk What it is How it Works Example

Contents

Transfer Risk: What it is, How it Works, Example

What Is Transfer Risk?

Transfer risk is the threat that a local currency cannot be converted into another nation’s due to changes in value or specific regulatory or exchange restrictions.

Transfer risk, also known as conversion risk, may arise when a currency is not widely traded and capital controls prevent an investor or business from freely moving currency in or out of a country.

Key Takeaways

- Companies may face hurdles when conducting business overseas.

- Transfer risk involves the threat of the inability to convert local currency into the currency of another nation.

- Timing issues associated with getting funds from a sale may prevent currency conversion.

- Some companies maintain an allocated transfer risk reserve to combat transfer risks.

- Companies that frequently do business with overseas companies are often better prepared to handle transfer risks.

How Transfer Risk Works

The transfer risk concept became prominent when businesses started making international trade a large part of their operations. The benefits of international trade include increasing the flow of goods and services across borders and helping keep prices low. However, there are risks involved in buying goods from a company on the other side of the globe.

For example, when a U.S. company buys goods from a company in Japan, the transaction is typically denominated in USD or Japanese Yen. These are frequently traded currencies, so it is relatively easy for the U.S.-based company to convert dollars into yen. Plus, both the U.S. and Japan have well-regulated and stable economies, allowing transactions without limitations. The choice of currency in an international transaction often depends on the needs and desires of each business.

In some cases, transactions are not easily conducted. A business may purchase goods from a company located in a foreign country where converting the currency is more difficult. Companies are subject to local laws, which may affect how business is conducted, bank transactions are processed, and products are delivered.

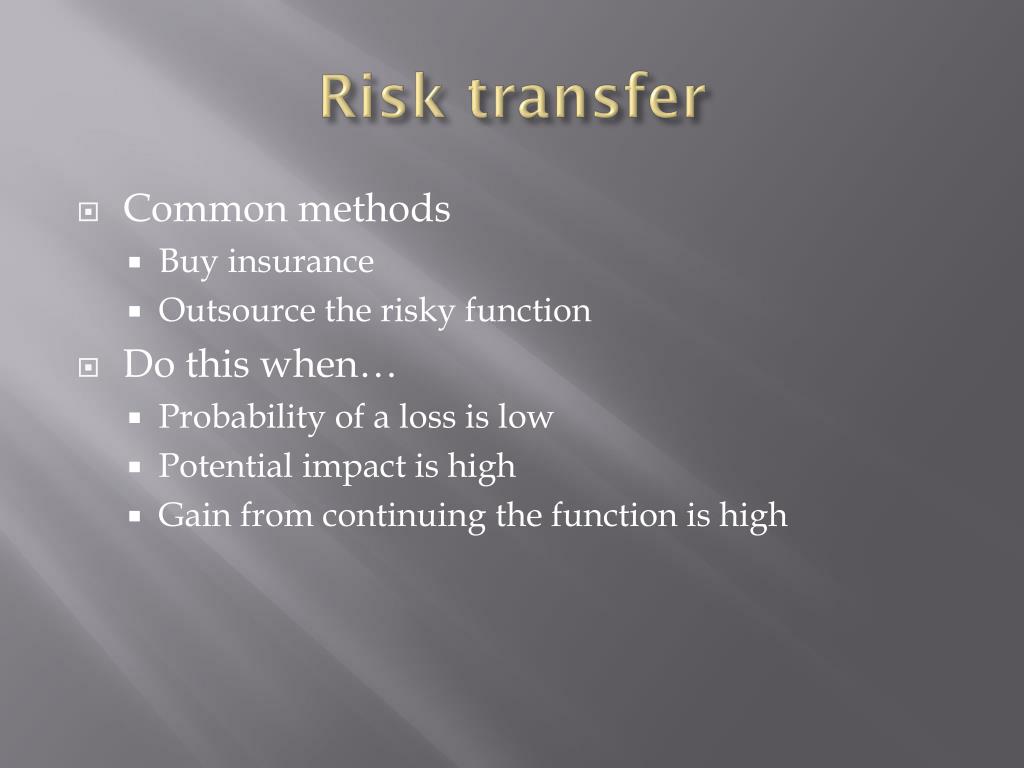

Companies should always consider transfer risk issues when doing business with foreign companies and take steps to minimize these risks.

Special Considerations

Transfer risk puts a business in a tumultuous situation. Measures can be taken to limit capital loss. Some firms keep a reserve of cash, known as an allocated transfer risk reserve, to manage these challenges. This reserve protects against country risks and inconvertible currencies.

Various types of companies maintain a transfer risk reserve, including large retail multinationals and banks with exposure in different countries. A banking institution may establish an allocated transfer risk reserve for specified international assets when required by the Board, according to the Federal Deposit Insurance Corporation (FDIC).

Example of Transfer Risk

Suppose banking regulations prevent a business from withdrawing funds in a foreign bank for several months after the sale is completed. While the funds are held, the foreign currency’s value decreases relative to the currency of the business’s country.

The end result is losing money on the overall transaction due to a timing issue that must be followed in accordance with the law. This is a transfer risk that some businesses face when engaging in commercial transactions with foreign companies.