Mortality Table Definition Types and Uses

Contents

Mortality Table: Definition, Types, and Uses

What Is a Mortality Table?

A mortality table, also known as a life table or actuarial table, shows the rate of deaths in a population during a selected time interval, or survival rates from birth to death. It typically shows the probability of a person’s death before their next birthday, based on their current age. These tables inform insurance policies and liability management.

Key Takeaways

- Mortality tables show death rates in a population.

- Mortality tables predict the likelihood of death in an individual within the current year.

- Mortality tables are used by insurance companies and the U.S. Social Security Administration.

- Mortality tables are split into “period” life tables and “cohort” life tables.

- “Cohort” tables are commonly used by actuaries.

How a Mortality Table Works

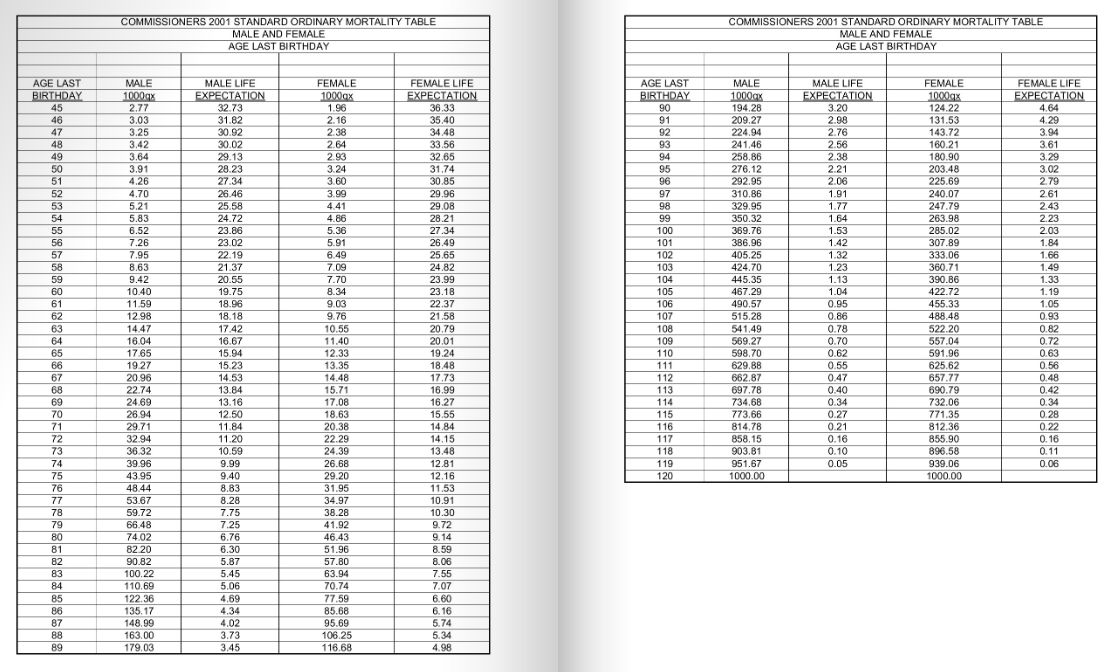

Mortality tables are complex grids of numbers showing the probability of death for a given population within a defined period, based on numerous variables. Tables differ by gender and can include characteristics like smoking status and occupation.

The life insurance industry and the U.S. Social Security Administration rely on mortality tables to establish coverage policies based on individuals.

Mortality tables were first introduced by Raymond Pearl in 1921 for ecological studies.

Types of Mortality Tables

There are two types of mortality tables. The period life table determines mortality rates for a specific time period and population. The cohort life table represents overall mortality rates for a population’s entire lifetime. The cohort life table is most commonly used by actuaries.

Requirements for Mortality Tables

Mortality tables are based on gender and age. They give probabilities based on deaths per thousand, or the number of people expected to die in a given year. Life insurance companies use mortality tables to determine premiums and remain solvent.

Mortality tables cover from birth through age 100, in one-year increments. They provide the probability of death for any age, with the likelihood increasing with age.

To use mortality tables, you need the age of an individual to compare their chances of dying with the rest of the group. For a newborn male, the chance of death is less than one half of one-10,000th of a percent, giving a life expectancy of around 75. However, according to the 2005 mortality table used by the Social Security Administration, a 119-year-old man has over a 90 percent chance of dying, with a life expectancy of just over six months.

To use mortality tables, you need the age of an individual to compare their chances of dying with the rest of the group. For a newborn male, the chance of death is less than one half of one-10,000th of a percent, giving a life expectancy of around 75. However, according to the 2005 mortality table used by the Social Security Administration, a 119-year-old man has over a 90 percent chance of dying, with a life expectancy of just over six months.