Trial Balance Definition How It Works Purpose and Requirements

Contents

- 1 Trial Balance: Definition, How It Works, Purpose, and Requirements

- 1.1 What Is a Trial Balance?

- 1.2 How a Trial Balance Works

- 1.3 Requirements for a Trial Balance

- 1.4 Types of Trial Balance

- 1.5 Trial Balance vs. Balance Sheet

- 1.6 Special Considerations

- 1.7 What is a trial balance used for?

- 1.8 What are the three trial balances?

- 1.9 What is included in a trial balance?

- 1.10 The Bottom Line

Trial Balance: Definition, How It Works, Purpose, and Requirements

What Is a Trial Balance?

A trial balance is a bookkeeping worksheet where ledger balances are compiled into debit and credit totals that are equal. Companies prepare a trial balance periodically, usually at the end of each reporting period. The purpose of a trial balance is to ensure the accuracy of a company’s bookkeeping system.

A trial balance is a test of the fundamental aspect of a set of books, but is not a full audit. It is often the first step in an audit procedure, allowing auditors to identify mathematical errors in the bookkeeping system before further analysis.

Key Takeaways

- A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct.

- The debits and credits include all business transactions for a company over a certain period, such as assets, expenses, liabilities, and revenues.

- A trial balance does not guarantee the absence of errors in the accounting systems.

How a Trial Balance Works

Preparing a trial balance helps detect mathematical errors in the double entry accounting system. If the total debits equal the total credits, the trial balance is considered balanced. However, this does not eliminate the possibility of errors in a company’s accounting system. For example, transactions classified improperly or missing from the system may still include material accounting errors undetected by the trial balance.

Requirements for a Trial Balance

Companies record business transactions in bookkeeping accounts within the general ledger. Accounts in the ledgers may have been debited or credited during an accounting period, depending on the transactions. Some accounts may also record multiple business transactions. Therefore, the ending balance of each ledger account in the trial balance worksheet is the sum of all related debits and credits.

At the end of an accounting period, accounts of assets, expenses, or losses should have a debit balance, while accounts of liability, equity, revenue, or gain should have a credit balance. However, certain accounts may have different balances based on transactions that reduce their respective account balances. On a trial balance worksheet, debit balances are listed in the left column, and credit balances in the right column, with account titles on the far left.

Types of Trial Balance

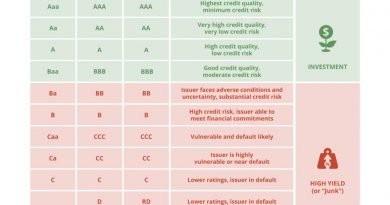

There are three main types of trial balance:

- The unadjusted trial balance

- The adjusted trial balance

- The post-closing trial balance

All three types have the same format but different uses. The unadjusted trial balance is prepared before adjusting journal entries. It is a record of day-to-day transactions and allows for balancing the ledger through adjusting entries.

Once the ledger is balanced, an adjusted trial balance is completed. This trial balance includes final balances for all accounts and is used to prepare financial statements. The post-closing trial balance shows balances after closing entries have been completed. It serves as the starting trial balance for the next year.

Trial Balance vs. Balance Sheet

The key difference between a trial balance and a balance sheet is scope. A balance sheet records closing balances of accounts and the assets, liabilities, and equity of a company. It is released publicly and requires an auditor’s signature for trustworthiness.

A trial balance is less formal. There are no specific conventions for preparing trial balances, and they can be completed as often as needed. A trial balance is often used to track a company’s finances throughout the year, while a balance sheet is a legal statement of the financial position at the end of a financial year.

Special Considerations

After listing ledger accounts and balances on a trial balance worksheet, add up debit and credit balances separately to prove equality. This ensures no unequal debits and credits were incorrectly entered. However, a trial balance cannot detect bookkeeping errors that are not simple mathematical mistakes. If equal debits and credits are entered into the wrong accounts, a transaction is unrecorded, or offsetting errors occur, the trial balance would still show a perfect balance between total debits and credits.

What is a trial balance used for?

A trial balance detects mathematical errors in a double entry accounting system. If the total debits equal the total credits, the trial balance is considered balanced, indicating no mathematical errors in the ledgers.

What are the three trial balances?

The three types of trial balance are the unadjusted trial balance, adjusted trial balance, and post-closing trial balance. Each is used at different stages in the accounting cycle.

What is included in a trial balance?

The content of a trial balance depends on the company’s needs throughout the financial year. It may contain major accounting items such as assets, liabilities, equity, revenues, expenses, gains, and losses.

The Bottom Line

A trial balance is a worksheet with two columns, one for debits and one for credits, ensuring a company’s bookkeeping is mathematically correct. It includes all business transactions for a certain period, such as assets, expenses, liabilities, and revenues. While a trial balance helps assess a company’s financial position, it does not guarantee the absence of errors in the accounting systems.