Vasicek Interest Rate Model Definition Formula Other Models

Contents

Vasicek Interest Rate Model: Definition, Formula, and Other Models

What Is the Vasicek Interest Rate Model?

The Vasicek Interest Rate Model is a mathematical method for modeling the movement and evolution of interest rates. It is a single-factor short-rate model based on market risk. This model is commonly used in economics to predict future interest rate movements. By estimating where interest rates will move within a given time period, the Vasicek model helps analysts and investors make informed decisions about the economy and investments.

Key Takeaways

- The Vasicek Interest Rate Model predicts where interest rates will end up at the end of a given time period.

- It considers market risk, time, and equilibrium value in predicting the evolution of interest rates.

- This model is valuable in valuing interest rate futures and pricing hard-to-value bonds.

- The Vasicek Model uses a specific formula to calculate the instantaneous interest rate.

- It also accounts for negative interest rates.

How Does the Vasicek Interest Rate Model Work?

Predicting interest rate movements can be challenging. The Vasicek Interest Rate Model is one of the many models that help estimate future interest rate changes to assist investors and analysts in decision-making.

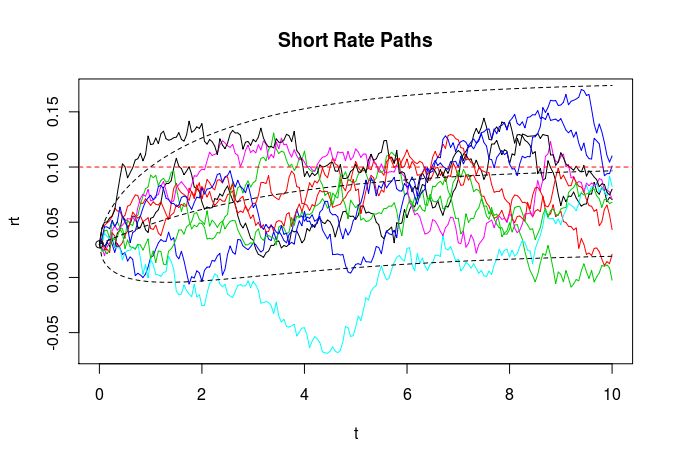

The Vasicek model is a stochastic model used in financial economics, outlining the movement of an interest rate based on market risk, time, and equilibrium value. Over time, the interest rate tends to revert towards the mean value of these factors. By considering current market volatility, the long-run mean interest rate value, and a given market risk factor, this model predicts where interest rates will be at a specific time.

The Vasicek interest rate model uses the following equation to value the instantaneous interest rate:

d r t = a ( b − r t ) d t + σ d W t

where:

W = Random market risk (represented by a Wiener process)

t = Time period

a ( b − r t ) = Expected change in the interest rate at time t (the drift factor)

a = Speed of the reversion to the mean

b = Long-term level of the mean

σ = Volatility at time t

This model states that the interest rate follows a stochastic differential equation, where "d" represents the derivative of the variable. When there are no market shocks (dWt = 0), the interest rate remains constant (rt = b). If rt < b, the drift factor becomes positive, indicating an increase towards equilibrium.

The Vasicek model is commonly used in valuing interest rate futures and pricing hard-to-value bonds.

Special Considerations

The Vasicek model is a single-factor short-rate model that accounts for market risk as the only factor affecting interest rate changes.

This model also accommodates negative interest rates. Although uncommon, negative rates can be used by central banks during economic uncertainties. Denmark’s central banks implemented negative interest rates in 2012, followed by European banks in 2014 and the Bank of Japan in 2016.

Vasicek Interest Rate Model vs. Other Models

While the Vasicek Interest Rate Model is a one-factor model, other models serve similar purposes:

- Merton’s Model: Determines a company’s credit risk and its ability to fulfill financial obligations.

- Cox-Ingersoll-Ross Model: Predicts interest rate movements based on volatility, mean rate, and spreads.

- Hull-While Model: Assesses low volatility when short-term interest rates approach zero, used in pricing interest rate derivatives.